Sales force concept. Businessman think about sales force team.GETTY

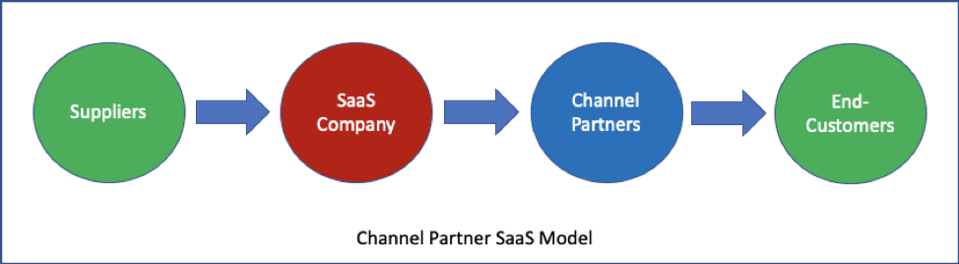

SaaS is a well-known and highly proven business model. It has expanded across industries and there are many types of SaaS business models. Some serve consumers directly while others use a channel partner to go to market. This model, however, allows these channel partners to “own” the customer relationship and data, one of the most valuable parts of any business. Many SaaS are now finding that they need to establish a direct branded relationship with the end-customers, which gives the firm greater control and optionality. Here’s what the original model looks like:

Common SaaS business Model AIMATTERS

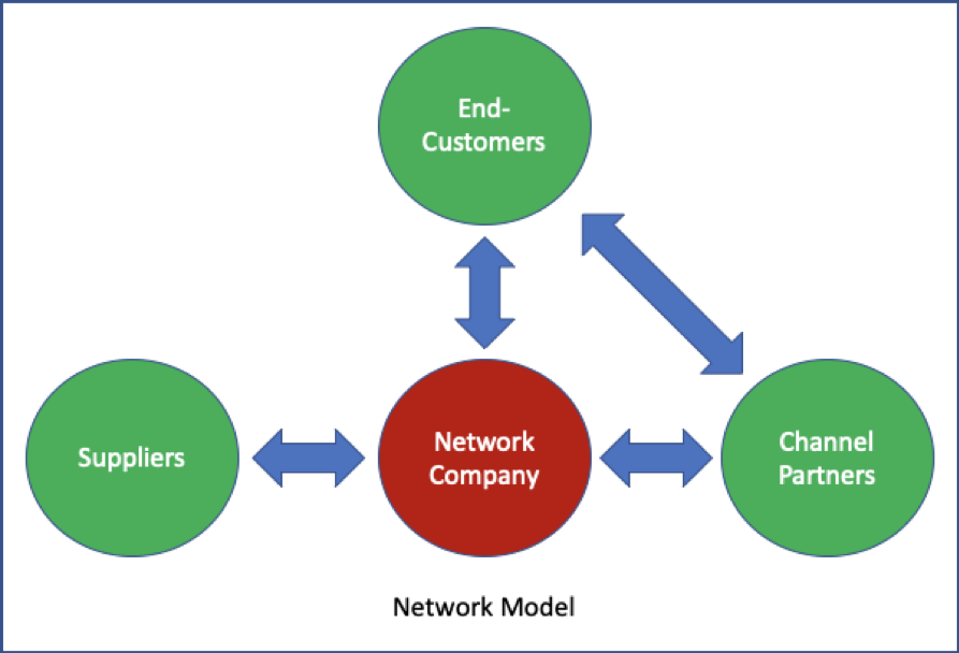

The new ecosystem diagram, demonstrating a modern business model, puts the SaaS player at the center of the network where they can establish brand and value with each of the other constituents. This shifts SaaS from a single directional digital software business, to a multi-sided platform business. The kind investors love. This requires SaaS companies reinterpret the relationships with each constituent and view them all as customers with needs that can be served through the network—both the channel partners they know well, and the end customers they have likely never thought about. Further, the SaaS company will have to balance the relationships—to build connections with end users without subverting the channel partners.

Network Model for SaaS Companies AIMATTERS

The transition to a multi-sided business model is difficult and rife with pitfalls. Over the last 20 years we have helped many companies with this transition, and we have found that there are some common challenges companies encounter as they seek to shift their business model. Because business model affects every part of the organization, companies need to shift broadly, including changes to:

- The expressed strategy of the leaders.

- The actions and capital allocations of the company.

- The skills of the people.

- The KPIs that the company uses to keep itself on course.

Often, a SaaS company that serves other businesses will want to transition to a platform business model that directly touches to the end-customers or consumers that have previously been served only by the channel partners. This is an important but risky shift, and there are several implications:

- It is likely that any sort of subscription fee paid by the channel partners will be reduced to zero over time to eliminate all friction so that the maximum number of these types of partners are encouraged to join the network, bring their customers while continuing to bring added value to the network.

- For end-customers or consumers, convenience and cost are likely the two most important drivers and so SaaS companies that reach directly to consumers need to make sure that these values are delivered to the end-customers as part of this process.

- Using Uber as an example, the network of vendors (and other businesses) will often become the SaaS’s companies’ most valuable assets and keeping them happy will be critical to their long-term survival. Established platforms are hard, but not impossible to topple.

Restructuring Relationships

Frequently, smaller SaaS companies have created a legacy of special agreements with either customers, resellers, or suppliers as they built their business. For example, it may be exclusivity or a “white label” relationship. And in almost all cases, the SaaS company is effectively invisible to the end user or consumer served by their channel partners.

To achieve today’s most valued status (the platform unicorn), SaaS companies need to begin to think about their business not just as B2B but also B2C. And the restructuring of relationships it the single largest challenge of the change. It will require specialized sales and marketing skills that tune the company’s offerings to meet the needs of each member of the network simultaneously. This requires artificial intelligence.

To be clear, this reorientation requires that a unique value or sales proposition must be created for each member that is attractive enough to encourage that member, normally a business, to allow the SaaS company to begin to serve the end-customer directly. This process of changing focus requires developing a complete understanding of every member of the ecosystem.

Each member business wants to grow, and the SaaS company must frame the value that they can deliver as one that can help the member business achieve that growth. In essence, the SaaS company must create a customized sales pitches for each member of the ecosystem. In addition, these members will often use an internal consensus process to make major purchase decisions, thus leading to the need for a separate sales pitch for each department within a member company, framing the value to be relevant to the department’s unique needs within the context of the member company’s strategy. Trial sales and validation are an essential part of the process.

To be successful, the SaaS company’s current go to market models with specific constituents needs to be modified so that it is clear to the current customers why they would be willing to turn over their customers to the new platform organizer. Transaction models need to be changed to be consistent with the broader goal of attracting a maximum number of the ecosystem members into the network. For example, replacement of subscription fees with transaction fees.

There are five actions that help with this transition.

- Reframe the conversation of the board and leaders which will help to reposition the company with the investment community to be seen as a modern business model.

- Inventory the entire ecosystem and the firm’s capabilities and needs to deeply understand the firm’s assets and the customers’ needs.

- Validate all the requirements and offers. Transitioning to a central network for an industry will increase the number of transactions by one or more orders of magnitude. Often the infrastructure of the SaaS provider will not be able to handle the additional load. The company will need to consider retooling their software with performance requirements in mind.

- Organize around the new capabilities: In most cases, the SaaS company has been able to grow by focusing on one type of customer, possibly a business (B2B) or a consumer (B2C). Serving a central network role in an industry will require development of new marketing and sales skills. Essentially, the company will be running multiple simultaneous marketing and sales programs, each tailored specifically to the category of company or consumer that is a member of the network. Each must be understood in detail, so that a compelling value can be offered, proper media channels can be used, and deals are structured in ways that are acceptable. This transition will imply the need for other new skills as well. If the transition is successful, one will require M&A capabilities for continued growth.

- Track new KPIs to reinforce the new business model: Many of the long-term benefits to the company and the values that it can deliver to ecosystem members of the network are rooted in the data that can be aggregated and analyzed. This implies the need to both collect and analyze large unstructured amounts of data that are often accumulated without a clear understanding of how it will be eventually used. Contemporary Artificial Intelligence (AI) methods, or machine learning, can be used to look for correlations and insights within data that become the eventual strength of the company in its newfound position.

Transitioning to a modern business model can be the only route to survival in an increasingly competitive environment driven by technology. First mover advantage can be critical to success. However, this is not a simple transition and there are difficult roadblocks. Understanding those barriers can help you prepare for the challenge ahead.

The steps above will assist you in gaining a better understanding of your current business model, and its limitations and then visualizing a long-term objective model that can be reached to create a better and more valuable version of your organization.

This article was coauthored by Bob Caspe