Bottom Line: Manufacturers need to turn spare parts businesses into profit centers using intelligent pricing, protecting margins and creating a reliable source of revenue in these challenging times.

While this pandemic is impacting revenue across all manufacturers, it’s the automotive aftermarket manufacturers who paradoxically have among the best conditions to spin out a spare parts business to create a profit center. Consider the following factors that favor automotive aftermarket manufacturers turning spare parts businesses into profit centers today:

- McKinsey estimates the global automotive aftermarket to be worth $740B today, growing to $2.7T in 2030 due to rapid technology gains in vehicles.

- E-Commerce sales of automotive aftermarket products are flourishing today, projected to reach $28.4B in 2026, attaining a Compound Annual Growth Rate (CAGR) of 18.5% between 2020 and 2026.

- There are 300M lines in a typical high-end vehicle today, making software capabilities in the automotive aftermarket increasingly important, according to McKinsey.

- Safety measures are decreasing the use of public transportation, making the goal of extending a vehicle’s useful life more important than ever.

- There are approximately 309M Americans affected by the stay-at-home and social distancing orders across the country, giving many vehicle owners more time for Do-It-Yourself (DIY) car improvement projects than ever before.

- The pandemic has sent used car prices plunging, making vehicles more affordable for first-time buyers and those looking for an economical vehicle replacement.

Turn Spare Parts Businesses Into Profit Centers With Intelligent Pricing

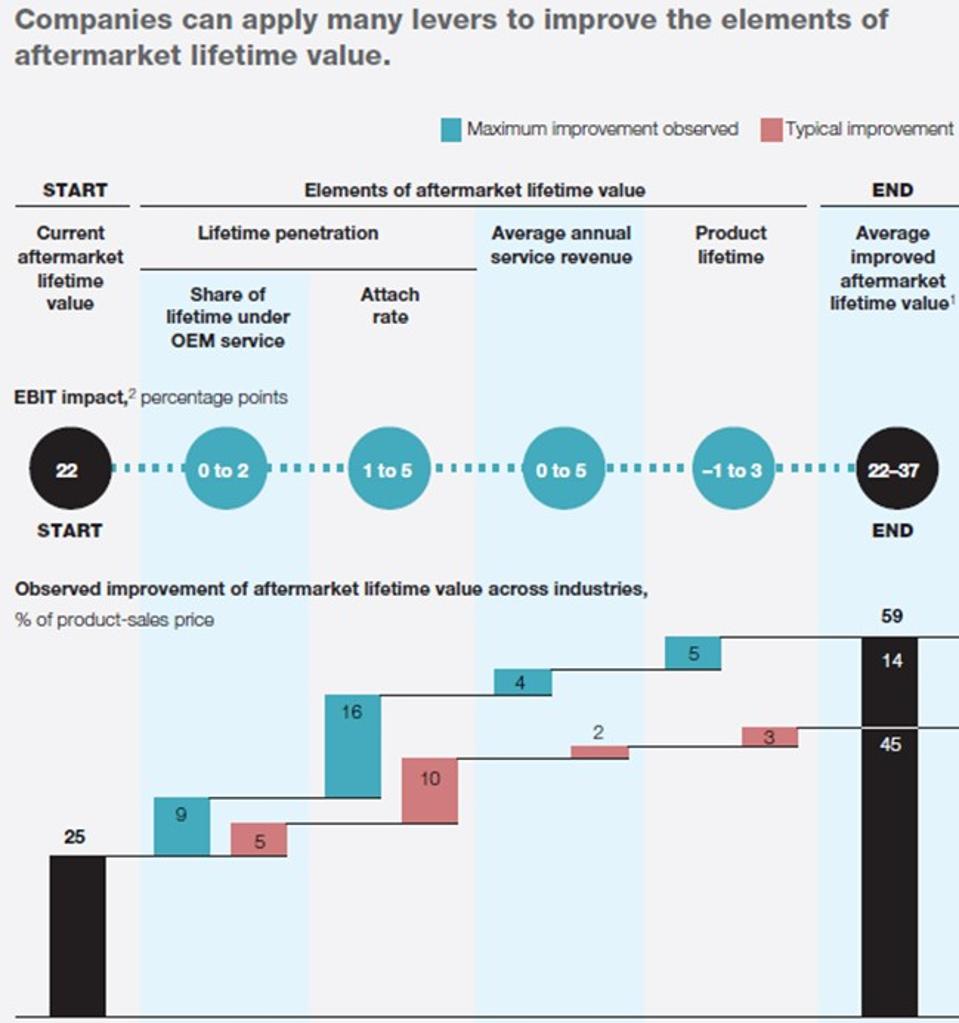

Getting Earnings before Interest and Taxes (EBIT) right is the cornerstone of transitioning a spare parts business into a profit center. To do that, manufacturers need to consider how an orchestrated approach to combining deal price, margin and profit can help grow EBIT and ensure the new profit center succeeds. Intelligent pricing is pivotal in making the transition to a profit center work as it can provide guard rails that guide which strategies or levers are going to deliver the most realizable EBIT gains. McKinsey’s study, Industrial aftermarket services: Growing the core, provides a framework that illustrates the importance of managing EBIT as the primary driver to turn a parts business into a profit center. The framework is shown in the following graphic:

PROMOTEDGoogle Cloud BRANDVOICE | Paid ProgramHow No-Code And The Democratization Of Application Development Are Helping BusinessesUNICEF USA BRANDVOICE | Paid ProgramWant World Peace And Prosperity? Invest In ChildrenCivic Nation BRANDVOICE | Paid Program6 Ways Voter Engagement Leaders Are Mobilizing College Students During COVID-19

Why Intelligent Pricing Is the Cornerstone Of Creating A Profit Center

Successfully transitioning an automotive aftermarket spare parts business to a profit center involves having greater pricing, margin and cost control over all sales channels, greater visibility into bundled services costs, contract costs and contract coverage. Using deal price guidance, deal management and risk alerts as guardrails to optimize and maintain parts pricing is essential for keeping a new profit center on track. Once the guardrails are in place for direct sales and service, automotive aftermarket manufacturers roll out deal price guidance, deal management and margin analysis across all their channels.

With an intelligent pricing platform in place, aftermarket manufacturers need to adopt the four strategies below to grow their new profit centers:

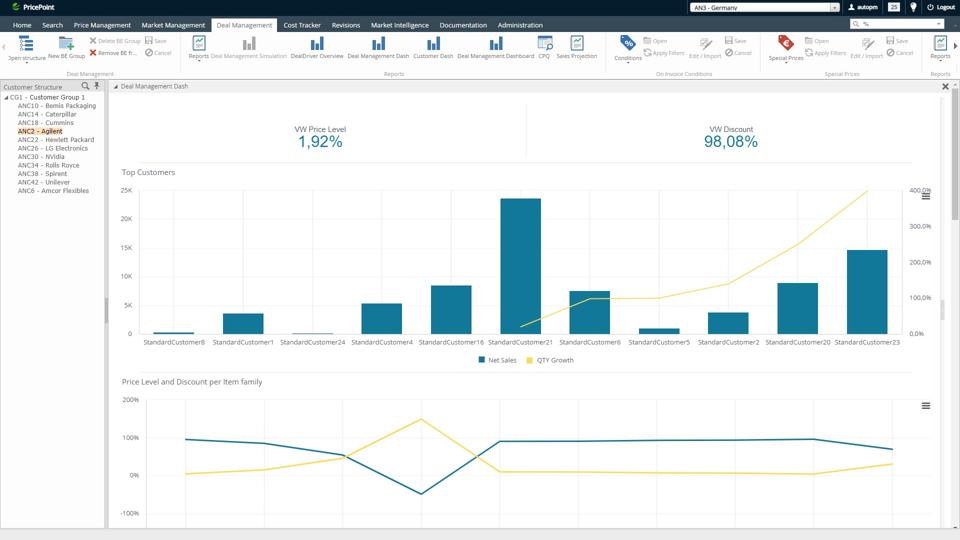

- Gain a greater share of aftermarket sales by launching deal price guidance as an integrated workflow in CRM, CPQ and price management systems. Getting pricing guard rails in place to protect margins, combined with deal intelligence is key to gaining a greater share of an existing aftermarket. By setting and optimizing target list prices for aftermarket products while taking into account local competitive, market and regional factors, it’s possible to improve quote-to-close rates. One of the most advanced software companies in this area is Vendavo, whose PricePoint application relies on machine learning to provide real-time insights on which pricing decision alternatives will most likely result in a sale, while also providing a customizable dashboard. PricePoint is capable of completing market-level simulations and builds on the decades of expertise Vendavo has in price optimization.

- Capitalize on customers’ previous purchasing and margin histories by channel, product and region to understand what’s driving current revenues and margins and by how much. To launch a profit center successfully, manufacturers need to know how price, volume and product mix are interrelated to each other and how changes in one impact the others. Instead of just relying on price moves as the single lever for explaining current revenues and margins, relying on data analysis models that can factor in a wide variety of data is needed. Automotive aftermarket manufacturers with worldwide operations spanning a wide variety of regions and product lines customize data models so they can optimize pricing for each unique market they compete in. Add in the need for being able to define revenue and margin bridge analysis visually clearly and the need for machine learning-based systems capable of price, volume and product mix becomes clear.

- Improving deal intelligence across all indirect channels, including Value-Added Resellers (VARs), dealers and distributors will make or break the success of a new profit center. Sales reps who sell for indirect channel partners are among the most important to a new profit center achieving its revenue and EBIT goals. They’re also the most in-demand across the 10 to 15 manufacturers a typical indirect channel partner is also reselling. Providing reseller sales reps with dealer intelligence apps is an effective way to gain mindshare across all the channels critical to a profit centers’ success. It’s also a great way to get them earning commissions on the highest margin products, using AI-based guided selling apps to help them choose the best possible products by customer for upsell or cross-sell. One of the most proven approaches to fast-tracking deal intelligence across all indirect channels is using a cloud-based CPQ platform immediately accessible to every sales rep. Having an excellent CPQ system that improves product configuration, guided selling, pricing automation and quoting is another proven way to gain more in-channel sales.

- Identify the resellers, sales cycles and pricing decisions that lead to price wars and cut them short to save valuable selling and sales operations time. Intelligent pricing can find which factors are contributing to price and margin erosion, helping profit center leaders alleviate costly problems in the future. Using deal intelligence and margin bridge analysis together, risk assessments can be created that are triggered by patterns of competing on price to win deals. Sales VPs and Chief Revenue officers (CROs) at aftermarket manufacturers are setting thresholds for pricing performance by reseller with Intelligent Pricing and they can coach the resellers needing the most work. Averting price wars in just a quarter can save a profit center from years of pain, making Intelligent Pricing invaluable in aftermarket sales.

Conclusion

Aftermarket services: The near-term growth opportunity in targeting the right customers, January 2019. McKinsey & Company.

Automotive Aftermarket Supplier’s Association

Beyond coronavirus: The road ahead for the automotive aftermarket, May 1, 2020. McKinsey & Company,

Covid-19 impact on the automotive sector, KPMG, March 20, 2020

Industrial aftermarket services: Growing the core, July 2017. McKinsey & Company

Ready for Inspection – The Automotive Aftermarket in 2030. June 2018. McKinsey & Company

Selling in the aftermarket: How to win the sales street fight, February 2019. McKinsey & Company

Winning in the Aftermarket by Morris A. Cohen, Narendra Agrawal, and Vipul Agrawal, May 2006. Harvard Business Review