Ready to learn Blockchain? Browse courses like Blockchain for Finance Professionals developed by industry thought leaders and Experfy in Harvard Innovation Lab.

I have covered more, about Bitcoins in some of my previous articles, but there are also other promising digital currency, which uses cryptography & the blockchain technology and catching up right there in terms of being cost effective, promising high return .

Please refer my links below to know all the basics of Bitcoin & Blockchain :

- All You Wanted To know About Bitcoins

- Blockchain Technology Part 1 : What and Why ?

- Smart Contract A Blockchain Innovation for Non-Techies

Types Of CryptoCurrency Existent In The Market :

source

Bitcoins : Refer this link to know more All You Wanted To know AboutBitcoins

We will today cover Ripple in detail, to help you understand its basics.

1. What Is Ripple?

As per ripple.com :

Ripple connects banks, payment providers, digital asset exchanges and corporate via RippleNet to provide one frictionless experience to send money globally.

Ripple is quite different from other cryptocurrencies as it doesn’t have its own public blockchain. Internally, the XRP Ledger network runs on an internal blockchain which they call an “Enterprise blockchain” ledger, it doesn’t use proof-of-work and little else is known about it.

Ripple functions like RTGS and is a digital currency exchange developed by Ripple company . Ripple was released officially in 2012 with an intent to enable instant & secure financial transactions of any size with no chargeback. It is currently a world third largest digital currency.

Is Ripple More Like a Bitcoin:

Ripple does share some technical similarities with bitcoin but it is quite different from it. Like many digital currencies it uses cryptography to secure transactions, but it doesn’t actually have a public blockchain like Bitcoin or Litecoin. And it came into existence to mainly transform the payment transfer system, for the purpose of sending instant and secure transactions across network participants and that what is more known for.

Ripple is more like payment system, remittance network, and currency exchange & now Ripple has built its network that includes its own cryptocurrency Ripple, or XRP.

RTXP:

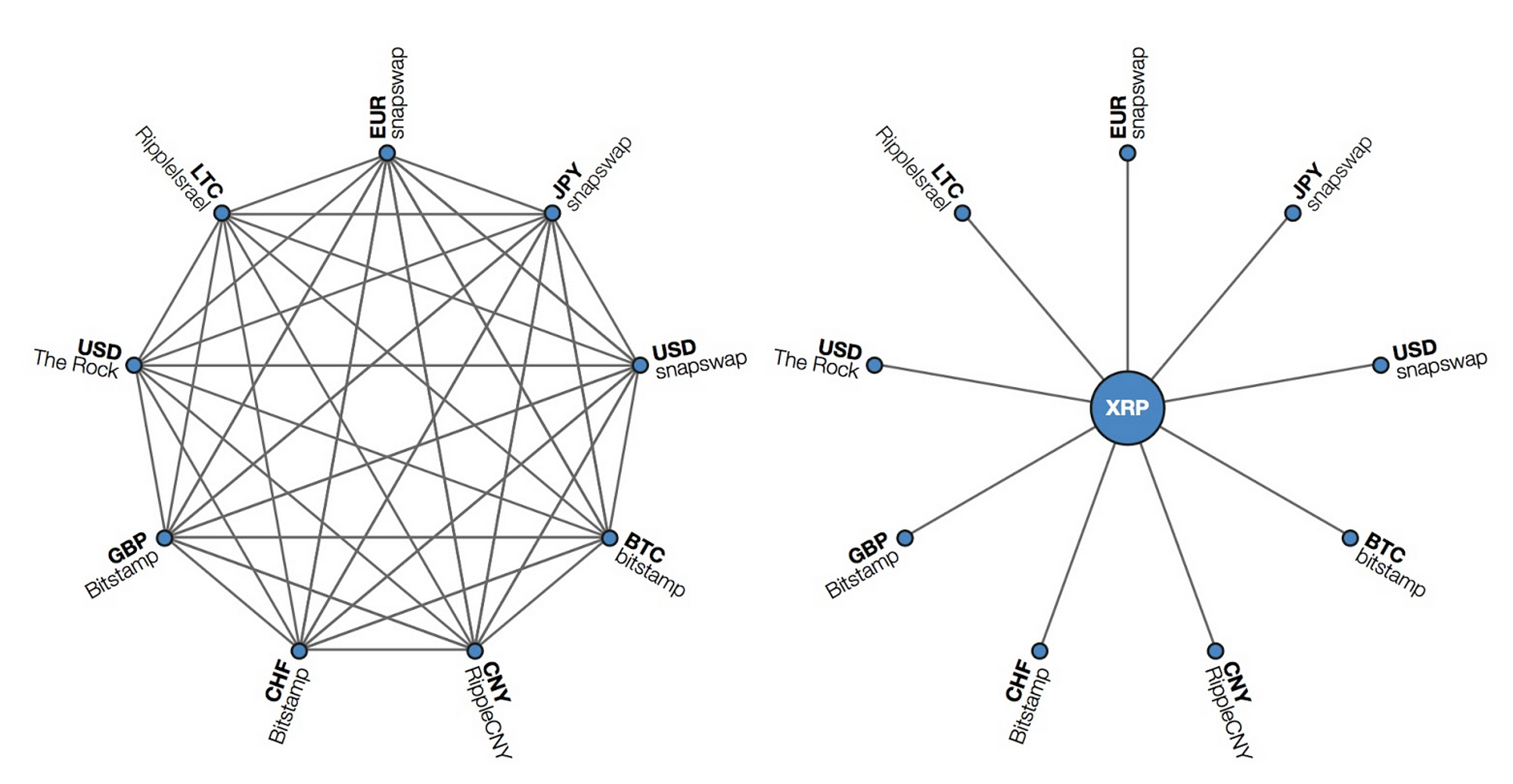

Ripple Transaction Protocol or simply we can call Ripple Payment Protocol uses distributed open source Internet Protocol, consensus ledger & native crypto called XRP(Ripples). Ripples circles around shared database or public ledger which uses a consensus mechanism to allow payments, exchanges and remittance in a distributed process.

The goal of the ripple system, according to its official web portal, is to enable people to break free of the “walled gardens” of financial networks — ie, credit cards, banks, PayPal and other institutions that restrict access with fees, charges for currency exchanges and processing delays.

How Ripple Works ?

source

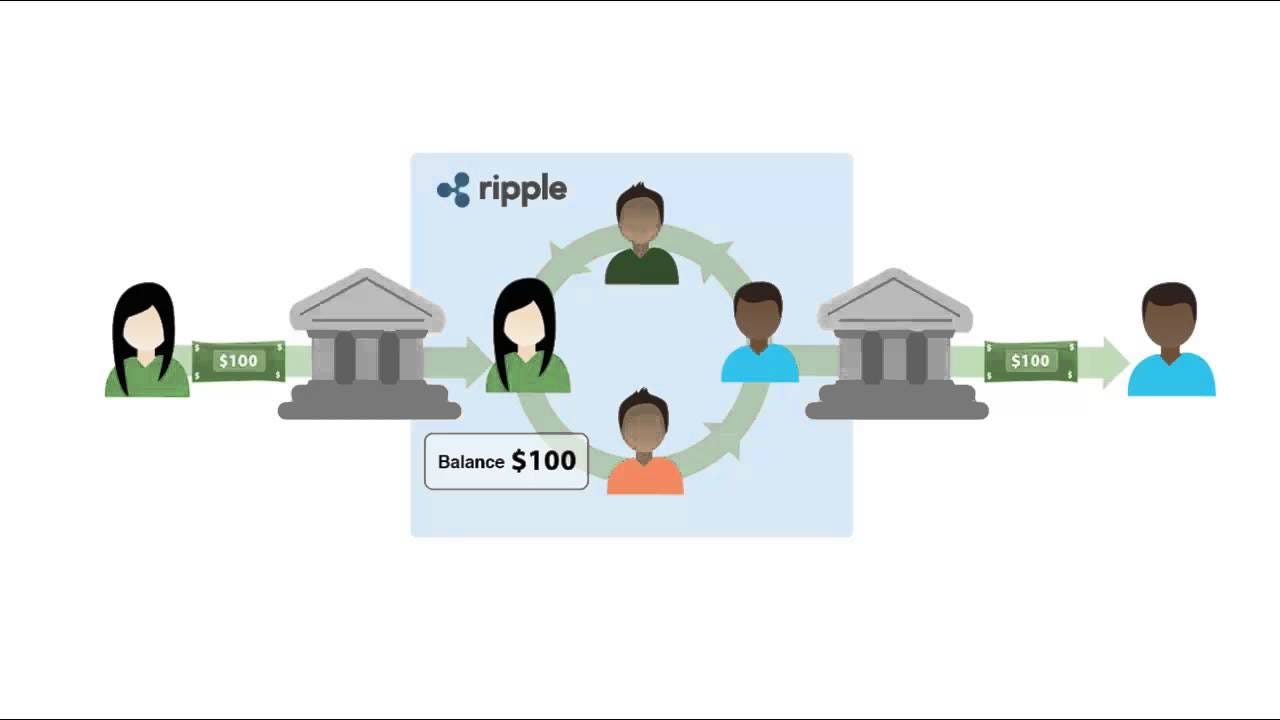

Let’s understand its working mechanism through simple example. Here Sender will send $=500 To the Receiver, Both parties involved in transaction lives in a different city.

Where,

Sender =Jim, Receiver = Rony , Senders Side Agent = Krish, Receiver Side Agent= Tim.

Jim gives Krish the money to send to Rony with a transaction password that Rony is required to answer correctly to receive the amount. Krish alerts Rony’s agent, Tim about the transaction details- of amount of funds to be transferred to Rony and the required password to be validated at Rony’s side by him. Here rony has to respond with the right password, then only Tim will release the fund from his side . Once Rony does so he gets the required amount. But here Krish owes $500 to Tim . Tim can record a journal of Krish’s Debt or IOUs which Krish would pay on the agreed date or can make immediate counter transactions to balance out the debt he owe to Tim.

This explanation would have given you some basic idea of how ripple transaction systems work. The key here is that there is a trust based mechanism working here between sender, receiver, and the local agents involved as security agents

What the original Ripple project sought to accomplish is effectively the democratization of this idea: everyone can be their own bank, issuing, accepting and acting as a conduit for loans all at the same time.

Ripples Use Case :

Let’s Discuss its Use Case Sector Wise :

1. Banking:

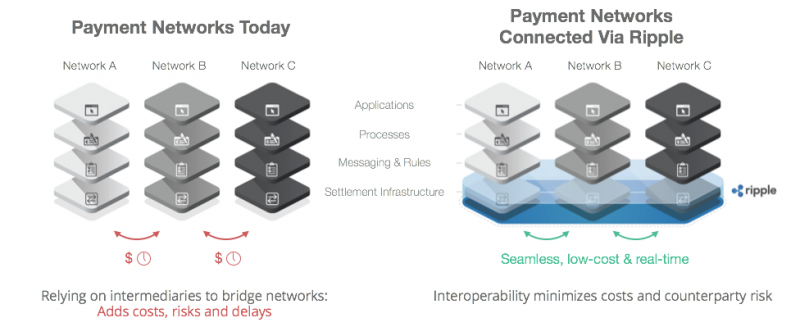

Ripple is going to revolutionize the way Banking system has been working. It will transform the cross border transactions, inter & intra transactions. Many global banks are joining Ripple’s RippleNet Product, to process cross-border payments in real time with end-to-end tracking and certainty. Banks can roll out payments offerings into new & emerging markets that are otherwise too difficult or expensive to reach quite easily through RippleNet Technology.

Benefit It Is Offering To The Banking Sector:

A. Increase Revenue & meet global customer demands –

Creating new revenue avenues to increase their customer base globally and cater to their financial transaction needs at cross-border level. Ripple allows banks to increase their global customer footprint at very low cost & at blazing speed.

B. Lower Expenses :

It helps banking institutions to reduce total transaction costs with fewer liquidity requirements

C: Amazing & Seamless Transaction Experience:

Ripple’s RippleNet allow banks to set protocols & governance practices which are state of art & is highly consistent, reliable & most importantly secure.

D. One Convergence Point

Plug in once to transact with any other RippleNet member bank

2. Payment Providers:

Ripple helps various payment lenders to attract the customers across the globe. It is faster and transparent & helps you cater in volumes to every nook & corner of the world.

Benefits It Provides :

A. Cater To Larger Customer Base:

Distribute Payments across borders in large volume, though its differentiated, real-time cross-border payment services.

B.One Integration For Greater Outreach

Integrate once to connect with all financial institutions across borders using its RippleNet technology.

C. Ripple Offers Transparent & Predictable Payments Solutions:

To help you get your payment access in real time with pure transparency of fees deducted, rate of transaction and seamless & hassle free payment settlement in quicktime.

3. For All Digital Exchanges :

Hey! Enterprises If you are looking to source liquidity in a more reliable & secure fashion turn to Ripple’s XRP protocol based solutions. It is apt for large banks & payment lenders to attract large payments as liquidity.

Why XRP(Ripples ) : Ripple Protocols For Payment Transactions :

1. It Is Stable :

Till date all the ledgers initiated has been successfully closed and no issues has been reported for 30 million of those transactions.

2. It Is Super Scalable :

Seeking to increase your payment lending business to large scale use XRP it handles 50,000 transactions per second.

3. Robust Digital Payment Infrastructure & Great Team:

Ripple proudly owns the superior payment technology, which is scalable to settle asset flawlessly. It has Open-source code base which is supported by ingenious and efficient full time team of engineers & architect . It makes their product line given below highly reliable & consistent to your financial transaction needs.

A. xCurrent : For Payment Processing

B. xRapid : For Liquid Sourcing

C. xVia : To Send Payment

4. It Is Decentralized:

Ripple currently boasts of 55 global payment validators and claims to be growing fast..

How To Buy Ripple Coins?

Well, there are many popular exchanges which can help you buy ripple coins. Like other cryptocurrencies, Ripple is available on several different exchanges. As per Ripple.com some of the authentic ripple coin provider exchanges are

A. Bitstamp: Deals in XRP/EUR, XRP/USD, and XRP/BTC trading pairs

B. Kraken: Deals in XRP/BTC, EUR, USD

C: GATEHUB :Deals in XRP/USD, JPY, CNY, EUR, BTC, ETH

D : btcXIndia : Deals XRP/INR(For Indians To Invest)

E. CoinOne : XRP/KRW, BTC

F. BITSO: XRP/MXN, BTC

G. CoinCheck : XRP/JPY, BTC

& Many More.

For Comprehensive Details Please Visit : https://ripple.com/xrp/buy-xrp/

Where you will get the entire exchange listing who are dealing in cryptocurrency selling & Buying. Follow their respective How To Invest Link based on your country and you will be able to get started in quick time. It should not be a daunting task for all you lovely readers & investors.

Which Banks Are Using It & Why:

As per McKinsey 2015 Global Payments Report number of global payments made in 2015 totaled $30.3 trillion and is expected to grow 6% per year over the next five years.

As per Ripple their technology is designed to lower total cost of payment settlement which can help banks to transact directly and with real-time certainty of settlement. By upgrading existing infrastructure, Ripple increases end-to-end processing efficiencies and can ultimately allow banks to make new business models economically viable through lower costs.

They claim 60% cost savings for an average payment size of $500. That can be the reasons most of the global banks are adopting their solution.

Some of them are:

- Santander

- Axis Bank

- Yes Bank

- Westpac

- Union Credit

- NBAD

- UBS

& Many More ..

Ripples Current Market Details: (Source Ripple.com)

Market Cap – $47.13 Billion USD

Current Price (As of 15 Dec 2017):

XRP /USD = 0.73314

Ledger Close Time – 3.33 Seconds

Network Transaction Fee — $0.0000561 USD

Transactions Per Seconds — 13.36 /1000+ TPS

Some of my other Technical Stuff which can be of your interest :

- NLP Fundamentals: Where Humans Team Up With Machines To Help It Speak

- Getting Started With Kotlin Language : A Beginners Guide

- Getting Started With Android & Kotlin : A Kickstarter Guide

- Getting Started With Node.js : A Beginners Guide

- All About Node.Js You Wanted To Know ?

- A Guide to MVP: Minimum Viable Product

References :