We’re living in the digital world, but the pace of technology adoption is slower than the development of technology itself. Given that, it’s quite natural that a significant number of financial institutions still use traditional techniques in their business processes. The domain of KYC (or Know Your Customer) and AML (aka Anti-Money Laundering) is no exception. Technology can change that for good.

The idea of KYC appeared in official documents in the United States four years ago. The FinCEN Treasury Department for Financial Crimes introduced the formal requirements of KYC, although private companies employed this abbreviation earlier. AML is a concept with a long history. It was coined back in 1989 following the creation of the Group for the Development of Financial Measures against Money Laundering (the FATF) in Paris.

The Definition

Before plunging into more specific details, let’s observe these two acronyms first.

KYC. This is the principle of activity applied to banks, lenders, investment, and mutual funds that oblige these institutions to identify a counterparty before conducting a financial transaction. Such a policy helps to better understand clients, monitor financial transactions, reduce customer risks, and consequently prevent bribery and corruption.

AML. AML is a set of measures that ensures that companies are able to detect and prevent money laundering, and, accordingly, protect themselves and the financial systems in which they operate.

The Difference

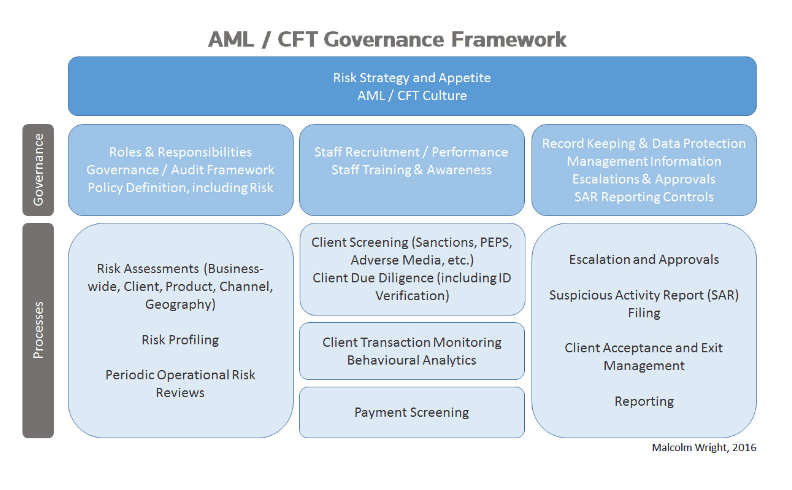

To put it briefly, KYC is a part of the AML. If you want an analogy, AML is a river while KYC is its inflow. It’s fair to define KYC as a set of procedures and tools within the framework of the general AML / CFT policy.

The Problem

According to the report by Fenergo, violations in KYC and AML compliance resulted in a whopping $ 10 billion worth fines in 2019 globally. Financial institutions consider the following business actions as triggers for initiating checks based on AML principles:

- running a business on the basis of cash payments

- making investments in securities via 3rd parties, especially affiliated with the company

- transferring funds abroad

- the use of different accounts in several banks.

How Automation Improves Compliance in Lending

Even if the volume of fines may come as a shock, KYC and AML aren’t something to be afraid of. The solution to proper compliance lies in a modern lending platform that automates all stages of loan origination and makes sure that any fraudulent behavior is detected at an early stage. Again, the KYC procedure (client verification) is just a part of the business process of loan origination along with credit underwriting, scoring and risks assessment.

Here’s how HES FinTech can assist its clients in terms of KYC compliance:

- The automation of the KYC business process. Authority-matrix based operations. Configurable workflows for different clients. Maker-checker decision-making process. Keeping registries of disallowed individuals/companies (blacklists).

- Consult the client. If a client has little experience in the domain of compliance, our specialists can outline the best approaches in setting up the basics of the KYC process. Depending on a country, we can help to address particular legislation constraints.

- Perform integrations with 3rd parties. Data is a vital part of the KYC/AML procedure. HES FinTech helps businesses to do integrations with 3rd parties (AML lists, terrorist lists, PEP checks, Ministry of Interior data cross-checks, banks and credit bureau data cross-checks).

- Suggest partners. Companies such as Experian or Equifax provide data for KYC and operate globally. Since many of them are our partners, we can suggest the best provider to work with for each particular client’s case.

- HES FinTech regards data protection as an integral part of the KYC process. We follow generally accepted standards for data protection and assist in meeting the variety of local legislative requirements (like storing data in the country of operation).

- The tools for loan portfolio performance tracking. These statistics and key metrics serve to gradually improve/adjust compliance processes with the time going.

Final Thoughts

Slowly, but steadily, the use of automation for KYC/AML compliance is gaining popularity in both banking and lending. The report by Deloitte claims that 35% of participants already use automation while another 34% are actively experimenting with the technology. The most important benefit is associated with an increase in the speed of the analysis process. This approach effectively responds to the latest trends in improving methods of KYC/AML compliance. Companies report a reduction of “false alarms” in their systems and an increase in the ability to generate preventive notifications that previously remained unnoticed. In all, enhanced analytical capabilities help to identify incoming threats and improve the whole level of security within an organization.

There’s no precise information on the total volume of laundered funds in the world. According to Deloitte’s report, the annual amount sits somewhere between 2 to 5% of the global GDP or, simply, over $ 600 billion. Naturally, money laundering has a significant negative effect on the distribution of domestic and international monetary resources and undermines macroeconomic stability. This way, AML/KYC compliance should be one of the most important strategic directions for each and every financial organization.

Many industry executives would agree that legacy systems represent the biggest hurdle on the way to embrace transformation. These systems are too complex (if not clumsy), and it takes a lot of effort and programmer wizardry to keep them up to date. Examples of such systems include network infrastructure, hardware, operating systems, ERP, and CRMs.

What’s more, employees are quite unenthusiastic to adopt a new platform because cumbersome or not, they got used to the current system. It’s just a basic human reaction to the unknown. One thing is certain — the limitations of legacy systems result in high costs associated with issues with cybersecurity, maintenance, low level of integration with modern cloud and other SaaS platforms. Switching to digital requires a lightweight system — most often a microservice system — that won’t replace, but supplement the current one. For lenders, it’s especially vital during the process of customer onboarding. When submitting a loan application, borrowers want a quick response, but old systems just can’t provide the level of convenience that customers expect.

Wrapping it Up

Just like any industry, banking has its ups and downs. However, there is no doubt that in the decades to come the biggest banks will evolve into technology companies in their own right. The success of such technology revolutionaries like Amazon and Apple serves as proof of what can be achieved if companies adopt the customer-centric approach. The digital bank of tomorrow will embed financial transparency at the core of its business, and that answers the question of why investments in digital transformation are so important today.

Source: https://hesfintech.com/blog/how-automation-improves-compliance-in-lending/