Don’t worry about the bear market. As an emerging technology, blockchain is on a typical journey to maturity and mainstream adoption.

Blockchain technology and cryptocurrency have been on a wild ride since 2008. Epic booms, busts, wild swings, scams and a lack of real-world implementation have led many to dismiss the technology as overhyped and valueless.

But a closer look at the last decade reveals blockchain has thus far had a typical journey for an emerging technology on the road to maturity and adoption. A journey that’s evident in the rise of many other innovative and game-changing technologies.

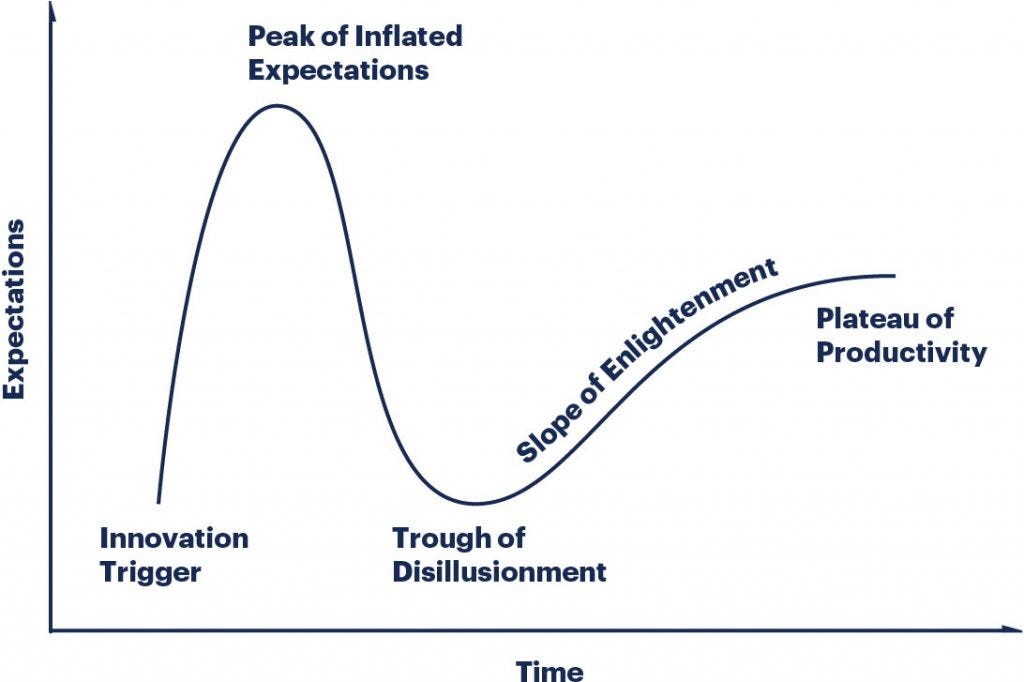

The Gartner Hype Cycle for Emerging Technologies was first published in 1995 and is somewhat of an institution in high tech. It proposed a standard adoption model and process for new technologies on their path to becoming a mature technology.

Here are descriptions of each stage direct from Gartner.

Innovation trigger — A potential technology breakthrough kicks things off. Early proof-of-concept stories and media interest trigger significant publicity. Often no usable products exist and commercial viability is unproven.

Peak of inflated expectations — Early publicity produces a number of success stories — often accompanied by scores of failures. Some companies take action; many do not.

Trough of disillusionment — Interest wanes as experiments and implementations fail to deliver. Producers of the technology shake out or fail. Investments continue only if the surviving providers improve their products to the satisfaction of early adopters.

Slope of enlightenment — More instances of how the technology can benefit the enterprise start to crystallize and become more widely understood. Second- and third-generation products appear from technology providers. More enterprises fund pilots; conservative companies remain cautious.

Plateu of productivity — Mainstream adoption starts to take off. Criteria for assessing provider viability are more clearly defined. The technology’s broad market applicability and relevance are clearly paying off.

Blockchain’s Innovation Trigger — The Bitcoin Whitepaper

Blockchain technology’s innovation trigger came in the form of a white paper written by a mysterious figure in 2008 named Satoshi Nakamoto. The white paper titled Bitcoin: A Peer-to-Peer Electronic Cash System shared the workings for a new digital currency system that didn’t rely on banks to facilitate transactions or governments to create and disseminate the currency. Although the proposed bitcoin payment system was exciting, it was the mechanics of how it worked that was truly revolutionary. As it turned out, the main technical innovation was not actually the digital currency itself but the technology that lay behind it, known today as blockchain.

In the following few years after the white paper is released, word begins to spread amongst technology insiders, businesses and at conferences. These years also witnessed the birth of altcoins such as Namecoin, Litecoin, OpenCoin (Ripple) and other more privacy-focused coins like DASH, Monero, and ZCash.

Peak of Inflated Expectations — ICOs, Lambos & FOMO

The peak of inflated expectations arguably started with the rise of Ethereum in 2014 but reached crazy levels in 2017 where market mania and speculation took over. Pure speculation led token and coin prices to go through the roof. The Bitcoin price hit just under USD 20,000 a rise of around 1900% from the beginning of 2017 while the price of Ethereum with all its technological constraints remaining unsolved rose 13,000%.

You may remember this guy.

It was the advent of Ethereum back in 2014 that ultimately enabled the explosion of new projects and coins and the subsequent mania. Developers had for the first time a platform to build and deploy other decentralized applications but Ethereum also gave birth to a new fundraising mechanism called an Initial Coin Offerings (ICO), which sent the cryptosphere to the peak of inflated heights.

Overall, the period of time from 2014–2017 saw expectations reach unprecedented levels with hundreds of startups and tokens being created, some seemingly overnight, and billions of dollars invested in projects with little promise. The vast majority of projects have since failed to gain traction and many have also been exposed as scams taking advantage of the euphoric and unrealistic expectations of the public.

Talk of the potentially revolutionary nature of blockchain technology hit its peak and expanded to a larger segment of the population and business community. Blockchain technology was idealized as a panacea to every known problem in the world and became the hot topic in the tech and business community. Some corporations, like the Long Island Iced Tea Corp., merely renamed themselves to include the word blockchain and witnessed their share price soar 289%.

Of course, during this time, a few success stories emerged as well and established multinational companies in banking, insurance, healthcare, and many others industries began to take legitimate steps to develop solutions. Enterprises started a more in-depth exploration of the technology through consortiums and R&D initiatives and some produced working prototypes and tested the technology in the real world.

Trough of disillusionment — 2018’s reality check

This is where blockchain and crypto are now. 2018 has been a dramatic year with general sentiment now one of skepticism and caution. Prices have dropped significantly, projects are failing at high rates and people are unsure whether the technical issues impacting adoption such as scalability and usability can be overcome. Real-world use cases are still being defined and publicly available blockchain solutions are relatively few in number when compared to the technology’s level of hype.

According to Gartner, blockchain technology is officially entering the trough of disillusionment. And there’s plenty of evidence to suggest this is correct.

Huge price drops

At the end of 2017, Bitcoin hit an all-time high of USD 19,783. At the time of writing, it sits at around USD 6300. Ethereum’s price has experienced a total decline of approximately 76% in 2018, according to data from CoinDesk. The same goes for most other altcoins. A large number of investors have lost a lot of money which has, in turn, dragged down disillusionment and spread negative sentiment even further.

Projects are failing, ICOs aren’t fashionable & funding has dried up

The failure rate of ICOs has skyrocketed in 2018, some research indicating that well over 50% of ICOs fail and do so rather quickly. It’s become much harder for projects to raise funding as there is now widespread skepticism around scams and the potential for meaningful ROIs on ICOs. Even blockchain startups that have managed to navigate the market downturn are struggling and have needed to go back to the drawing board.

The overall view, especially among the retail investor community toward ICOs and blockchain projects is now one of distrust. There is also a far greater acknowledgment of the speculative, risky and dangerous nature of these types of ventures.

Enterprises slow at delivering on blockchain initiatives

Due to a variety of technological, regulatory and cost-related reasons, only a small portion of enterprises have delivered real-world blockchain driven products and services. R&D initiatives and moving beyond PoC to the pilot stage is proving slow and difficult. Some enterprises have even shelved their blockchain related efforts sighting regulatory and market uncertainty as well as a knowledge gap.

What’s coming next — Promising signs of maturity

According to Gartner’s 2018 Hype Cycle, blockchain technology is entering the trough of disillusionment stage. Precisely how long this will last is unknown, however, the average length of the trough ranges for emerging technologies is from two to four years. Some rapidly moving innovations mature much faster, only suffering from a slump of six to twelve months.

Of course, there are no guarantees that emerging technologies will make it out of the trough of disillusionment stage of the Hype Cycle. There are many examples of technologies that have failed to catch fire like Ultrawideband and RSS Enterprise. Other emerging technologies like Speech Recognition have taken decades longer than expected to reach full maturity.

There are good signs that blockchain technology will not be added to this list. In fact, the technology could be further along the Hype Cycle than Gartner has concluded. Blockchain is showing signs that are usually associated with an emerging technology in the Slope of Enlightenment stage.

- Companies improving products on the basis of early feedback.

- More instances of how the technology can benefit enterprises start to crystallize and become more widely understood and used.

- More enterprises funding pilots.

- Second- and third-generation products appear from technology providers.

- The reputation of the technology rising again.

Banks and Wall Street are warming up

There are signs that banks will soon be more open to partnering with projects to help with their day to day operations. The Swiss Bankers Association has issued guidelines to banks that wish to do business with startups and The Monetary Authority of Singapore has said it is willing to help cryptocurrency companies secure banking services by bringing the banks and cryptocurrency startups together to reach an understanding.

Some of the biggest names on Wall Street are warming up to trading Bitcoin and cryptocurrencies as well. The parent company of the New York Stock Exchange has been working on an online trading platform that would allow large investors to buy and hold Bitcoin, Goldman Sachs has started registering clients for its new Bitcoin trading desk, and over 70 of the largest banks have joined in an unprecedented move to adopt blockchain based payments systems. The Australian Securities Exchange and the Vanguard Group are well on their way to implementing blockchain in 2018 after successful pilots. These are just a few examples.

More enterprises are funding pilots and moving into production

Blockchain has grabbed the attention of enterprises in a wide range of industries. After a long period of R&D, major enterprises are moving beyond pilots toward production. IBM alone is working with hundreds of enterprises on blockchain implementations. The latest tally is that there have been tens of thousands of blockchain pilots run within corporations, some of which are moving into full implementation.

Cypherium, developed by former software developers at Google, Amazon, Microsoft, and Tencent has released a beta version of its enterprise blockchain ready for use in the wild. There’s also the Mobility Open Blockchain Initiative (MOBI) made up of 30 members including Ford, Renault, BMW, GM, Bosch, IBM, Hyperledger and IOTA which is developing standards, pilot projects, and open source software tools. Most major Fortune 500 companies, from insurance and finance to retail and manufacturing are developing pilots and real-world services using blockchain technology.

Regulatory advancements

The regulatory landscape is shifting and advancing. Regulators in many countries are taking real steps to crack down on scams, and are also producing research papers, standards and introducing new regulations.

One of the first countries to begin building a regulatory framework for blockchain projects was Switzerland. The country has proposed an idea for minimizing regulations while still keeping companies in line with legislation through ‘sandboxes’ which allow startups to experiment and innovate within controlled conditions.

Britain and Singapore have been exploring their blockchain and crypto regulatory environment as well, providing a platform which enables companies to experiment under relaxed regulation and licensing requirements. The upper house of the UK Parliament has also published an inquiry on crypto-assets and the G20, EU, and many other bodies are all actively investigating the implementation of new regulations that will spur innovation in the blockchain sector. In the US, the New York Attorney General’s Office recently launched the most comprehensive study on exchanges.

A rise of enterprise custodial products and services

Custody solutions have begun to emerge which is expected to catalyze the entry of institutional capital into the industry. Coinbase has announced its Coinbase Custody product upon completion of their first successful deposit. The multinational investment bank, Citigroup, has announced that it will offer crypto custody solutions to institutional investors. Citigroup launched a product called Digital Asset Receipt, which is intended for institutional investors to securely invest in cryptocurrencies in a fully regulated and secure manner.

There’s also BitGo, a leader in cryptocurrency security. The BitGo Trust Company has been approved by the South Dakota Division of Banking as a public South Dakota Trust Company, making it the first qualified custodian purpose-built for storing digital assets.

Third-generation blockchains are emerging

Blockchain innovation is moving quickly. Bitcoin represented the first generation of blockchains, Ethereum the second and although it’s early days, there is now a new breed of 3rd generation blockchains actively working to solve some of the technological limitations of their predecessors. These platforms are tackling significant inhibitors of usability and mainstream adoption and have better scalability, interoperability, treasury systems, and on-chain governance. Ethereum is also pursuing and implementing major improvements and overhauls to their platform.

Universities have added blockchain to their curriculum

As demand for cryptocurrency and blockchain technology-related jobs increases, demand for education and courses in these areas is reaching new highs. As a result, universities and schools are starting to offer different specializations in blockchain and cryptocurrencies. According to new research conducted by Coinbase and research firm Qriously, 42% of the world’s top 50 universities now offer at least one course on crypto or blockchain.

What does this mean for enterprises and investors?

The Hype Cycle is a model developed by Gartner to understand how emerging technologies rise, behave and grow on the journey to maturity.

If you’re part of an enterprise thinking about utilizing blockchain to optimize and transform business operations or an investor seeking investment opportunities, the Hype Cycle can be quite useful.

It should not be interpreted as gospel, or solely relied on, but enterprises and investors can use it as a guide to help decide when to act (invest/develop) alongside other due diligence. It can also assist in analyzing risks and managing expectations.

For example, investors with a low-risk appetite might want to wait until an emerging technology is more proven and mature, toward the end stages of the cycle. An investor or enterprise with a high-risk appetite that is looking for big rewards could, for example, make investments right after a technology breakthrough has just been made, during the peak of inflated expectations or at the beginning of the trough of disillusionment. In the blockchain and crypto world, this would be the equivalent of making investments in the immediate years following the release of the Bitcoin whitepaper leading up to the peak in 2017 and arguably throughout 2018 as well.

Of course, investing too late or too early both come with risks. Too late and you risk being left behind competitors or even wholly disrupted. Too early, and there is a significant risk of losing money as immature technologies yield little results and markets are not ready.

At the end of the day, every organization and investor has their own risk appetite, but this should not completely dictate their actions. This is especially true for transformational technologies like blockchain.

“If an organization operates exclusively within its comfort zone, it will miss opportunities. It will always tend to adopt everything early, or late, in line with its enterprise personality. Organizations should recognize their risk comfort zones, but be prepared to step outside them depending on the strategic importance of an innovation.” — Gartner

As the blockchain ecosystem suffers through a downturn, it is also showing clear signs that it will overcome challenges and continue to mature. It’s arguably the best time for enterprises, and investors to act. This does not necessarily mean investing millions of dollars tomorrow morning. What’s important now is to at least invest in education so to understand:

- How potentially valuable blockchain technology is to you or your organization.

- How the technology is impacting your industry.

- Where the technology is currently positioned on the Hype Cycle and the associated pros and cons.

Final thoughts — Don’t throw the baby out with the bathwater

Nobody really knows precisely when blockchain technology and cryptocurrencies will mature and reach mainstream adoption. Some experts have said this will happen in 2020/2021, while others point to 2025 as a more realistic timeframe.

What is becoming clearer, however, is that blockchain technology is on track to become a transformative and disruptive force. Yes, market conditions and sentiment are bad, there are many average projects out there, and some critical technological shortcomings still need to be overcome. But there are good projects and initiatives too, building great products and services and actively solving these issues.

If you zoom out a bit, get some perspective and put the current market into context, you’ll realize that blockchain is on a rather typical journey to maturity and mainstream adoption.