Need Predictive Analytics Training? Browse courses developed by industry thought leaders and Experfy in Harvard Innovation Lab.

Problem Description

Consumers today go through a complex decision making process before subscribing to any one of the numerous Telecom service options — Voice (Prepaid, Post-Paid), Data (DSL, 3G, 4G), Voice+Data, etc. Since the services provided by the Telecom vendors are not highly differentiated and number portability is commonplace, customer loyalty becomes an issue. Hence, it is becoming increasingly important for telecommunications companies to proactively identify customers that have a tendency to unsubscribe and take preventive measures to retain such customers.

The aim of this blog post is to introduce a predictive model to identify the set of customers who have a high probability of unsubscribing from the service now or in the near future using Personal Details, Demographic Information, Pricing and the Plans they have subscribed to. A secondary objective is to identify the features of the Independent Variables (also known as “X” or “Predictors”) which cause a great impact on the Dependent Variable (“Y” or “Outcome”) that causes a customer to unsubscribe.

Data Description

On the input data:

6 months of data with 3 million transactions

Predictors / Independent Variables (IV) considered:

- Customer Demographics (Age, Gender, Marital Status, Location, etc.)

- Call Statistics (Length of calls like Local, National & International, etc.)

- Billing Information (what the customer paid for)

- Voice and Data Product (Broadband services, Special Data Tariffs, etc.)

- Complaints and Disputes (customer satisfaction issues and the remedial steps taken)

- Credit History

On the output:

- Target / Response considered for the model:

- The value ‘1’ indicates UNSUBSCRIBED customers

- The value ‘0’ indicates ACTIVE customers

Note: For the sake of brevity, I am ignoring the steps taken to clean, transform, and impute the data.

Partitioning the Data

In any Predictive Model work, the data set has to be partitioned appropriately so as to avoid overfitting/underfitting issues amongst other things.

Prediction Accuracy & Model Selection:

Models built on TRAINING data set are validated using the VALIDATION data set. It is common to build multiple models including ensembles and compare their performance. The model that eventually gets deployed is the one that benefits the business the most, while keeping the error rate within acceptable limits.

Here are the 2 common error types in Churn Prediction:

Type I Error — False Negative: Failing to identify a customer who has a high propensity to unsubscribe.

From a business perspective, this is the least desirable error as the customer is very likely to quit/cancel/abandon the business, thus adversely affecting its revenue.

Type II Error — False Positive: Classifying a good, satisfied customer as one likely to Churn.

From a business perspective, this is acceptable as it does not impact revenue.

Any Predictive Algorithm going into Production will have to be the one with the least Type I error.

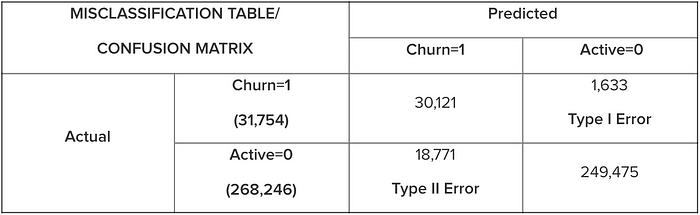

In our case, we used multiple algorithms on a Test data set of 300K transactions to predict Churn. Shown below are the results from the top 2 performing algorithms:

Algorithm 1: Decision Tree

Overall Error of Decision Tree Model = (1535+20685) / (31754+268246) = .074 = 7.4%

Prediction Accuracy for DT = 100–7.4 = 92.6%

Algorithm 2: Neural Networks

Overall Error of Neural Network Model = (1633+18771) / (31754+268246) = .068 = 6.8%

Prediction Accuracy for NN = 100–6.8 = 93.2%

Though the overall error rate of Neural Network was less than that of the Decision Tree algorithm, the Decision Tree model was chosen for deployment due the higher Type I error rate.

The model was chosen based on not only Prediction Accuracy, but also the impact of Type I Error.

Technology

R was used to build, validate, and test the models with the 3 miilion transaction data set.

It was re-implemented in Spark/MLLib/Scikit-Learn/HDFS to deal with larger datasets.

Results

Model predicts the likelihood of Customer Churn with high accuracy.

Key variables that were impacting Customer Churn or causing significant impact on the “Y” were:

- Age (ages 21–40)

- Salary (lower salaries)

- Data Usage (those who used more data services)