Overall, the blockchain-powered space of Decentralized Finance (DeFi) is still nascent but offers a compelling value proposition whereby individuals and institutions make use of broader access to financial applications without the need for a trusted intermediary. Especially people previously without access to such financial services could benefit from this development. Even more so, DeFi promises a full-fledged capital market. At this point in time in a minuscule format thought. But it grows.

- DeFi favors network effects, the true innovation is created by uniquely combining the applications.

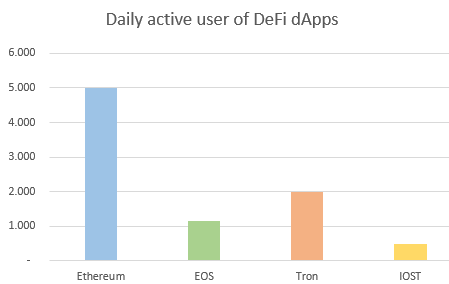

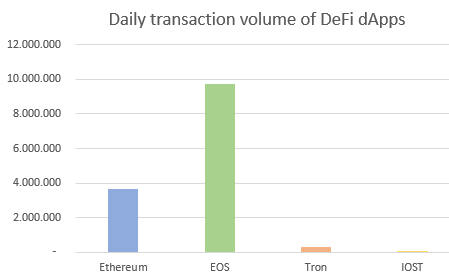

- While it may be difficult to determine which blockchain protocols and applications will get the most usage long-term, currently the advanced decentralization, programmatic flexibility and the truly enthusiastic developer base gives Ethereum the lead.

Note: All data and examples as of 30th November 2019.