The COVID-19 pandemic announced by the World Health Organization in March this year changed the way the global financial system has been operating for years. Along with other business domains, the lending market has entered the mode of adaptation and (sometimes) uncertainty. However, the incomes of both citizens and companies will most likely decrease, despite the efforts of European governments or the CARES Act in the US. What this basically means is that the demand for credit will be higher than ever. Crisis or not, businesses still need funds to operate, and people still resort to loans. In light of the pandemic, the work of the collection sector will also change — there’s a strong probability that borrowers will expect difficulties in returning funds than they did, say, three months ago. Therefore, lenders must rearrange their processes to avoid possible defaults and further complications with debtors.

In its abundance in the market, automated debt collection solutions minimize sometimes inevitable losses. Widely used in various industries, automation offers tools that significantly improve the collection process leaving no room for human error. Ideally, a digital collection center represents a kind of an online portal that sends emails and makes calls in a fully automated mode.

What is a Proper Debt Collection System?

If you want a quick answer, well, it’s the one that solves the goals of debt collection automation. Let’s dive in detail, shall we? When talking about technology-driven debt collection, automation improves two major areas within the debt collection industry. The first one is the automation of processes that takes the productivity of a company to a whole new level and frees up human resources. The second aspect is the process of algorithms-powered decision-making that offers a specific kind of settlement to a debtor depending on various factors.

However, to maximize the effect of automation, the system that a collector uses must contain integrations with external systems. In particular, it’s advisable to integrate with:

- banking systems — to automatically receive information about payments made by the debtor, changes in financial indicators, the period of delay, and other important data;

- SMS and automatic mailing service providers;

- automatic mailing systems in instant messengers — Whatsapp, Skype, Facebook Messenger, and other similar programs;

- telephony systems used for auto redial;

- external service providers — for example, providing mail sending services.

The Benefits of Automation

As said earlier, the most important benefit of an automated solution is that it fights repetitiveness. Debt collection is a process that requires dozens of clerical actions to repeat over and over again. These tasks are time-consuming (blame good old spreadsheets for it), prone to human error, and ask for manual work in the Age of Tech. The outcome? One can easily damage relationships with clients. You could ask anyone in the industry, and they will tell you: the proper customer relationship is the cornerstone of the collection business.

The second best benefit of automation collection programs is the data and various types of information in a single format. I couldn’t emphasize more the importance of its availability within the system. How much effort does it take to load debtor data? Are there mechanisms in place to quickly reconfigure the system if the bank changes the format or when a new client appears? Automation puts the data at employees’ very fingertips, so they are fully equipped when calling debtors.

In a nutshell, automation allows collectors to:

- optimize communication strategies and collection of overdue debts;

- increase customer satisfaction and loyalty;

- reduce costs through improved automation of the decision-making process and analyze KPI’s.

- go on with steady communication and provide fast follow-ups;

- increase profitability and reduce the collection of overdue debts;

- manage problem debts more effectively and sending invoices quickly;

- control risks and increase compliance with corporate policies.

General Requirements for the Functionality of a Debt Collection System

When choosing software, here at HES FinTech, we advise you to stick to the following features. A decent collection system should contain:

1. Tools that provide the opportunity to get analytical information on the effectiveness of work with debt in particular and the overall performance of the company as a whole (scoring, reporting system, etc.).

2. A convenient work environment for users (workstations, user-friendly interfaces and search tools, etc.).

3. Tools for the implementation of management activities (for example, a system for distributing debt obligations by employees).

4. Means of exchanging data with the outside world.

In case new changes or tools are needed, the cloud makes it possible to introduce quick adjustments in no time. However, many organizations adhere to the on-premise model to keep infrastructure in-house. One way or another, if an automation debt collection software vendor can keep up with these basic requirements, then chances are the software will be easily integrated into a collector’s business system resulting in quick payback.

Conclusion

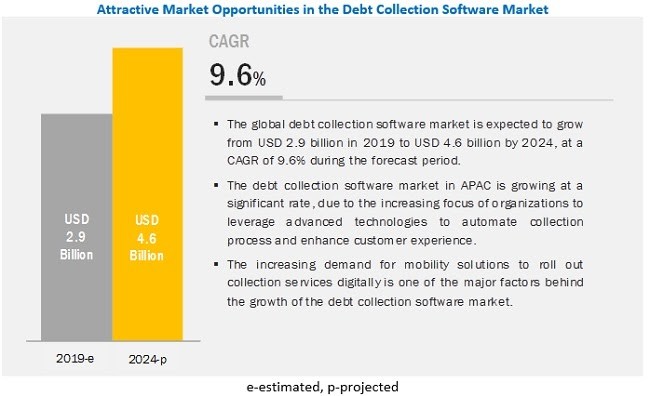

The report by Reports and Data claims that the debt collection software market is forecasted to hit 4,49 billion dollars by 2026. This is part of the global wave of digitalization in banking and finance.

Due to the pandemic, it takes time to assess the depth of the changes to adapt to and outline new trends in the collection. Don’t get me wrong: automated collection software doesn’t contain a magic wand effect inside, and it won’t certainly make human debt collectors obsolete in the near future. The collection industry still relies on human touch and judgments, and it’s only natural in regard to the essence of the business. However, technology is able to improve both performance and productivity.

The nature of a debt collection process asks for a very sensitive approach. BCFP Annual Report 2019 reports about 80,000 complaints related to debt collection in the USA back in 2018. This way, concerning all the scandals within the industry, collectors must become more customer-centric. Especially during hard times of today. With automation, the domain of collection can smooth the process of debt recovery and make it more humanistic.

Source: https://hesfintech.com/blog/how-automation-improves-debt-collection/