Ready to learn Blockchain? Browse courses like Blockchain for Finance Professionals developed by industry thought leaders and Experfy in Harvard Innovation Lab.

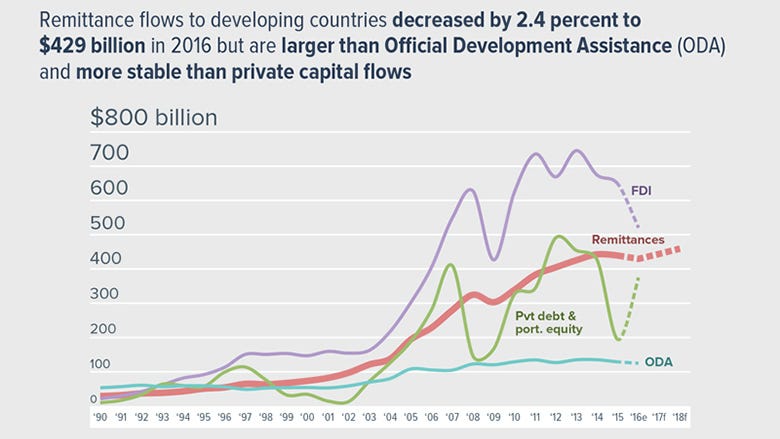

Those who are unfamiliar with the global remittance industry may be surprised to learn that it is a multi-billion dollar market. The world bank estimates that officially recorded remittances to developing countries amounted to $429 billion in 2016.

A remittance is a transfer of money by a foreign worker to an individual in his or her home country. These cross-border transfers are economically significant for many countries that receive them. Remittances often compete with foreign aid as the largest capital inflow for developing nations. It is safe to say that many economies rely on remittances to survive.

In many of these developing nations less than 20–30% of the citizenry have bank accounts. The other 70% of the population is without access to a bank or financial services and have been deemed “the unbanked”.

Workers sending home money home via Western Union, which can charge up to 15% of the transferred funds.

In order for the unbanked to receive funds they must use a money transfer operator (MTO). However, this presents several challenges because the system must have adequate geographical coverage of MTOs and these MTOs rely on a complex web of banks to transfer and re-balance funds.

The issue revolves around access to local currency and the network of banks needed to transact. An MTO sender may have a significant cash balance, whereas the receiving MTO may have a large digital balance.

Traditionally they would be forced to go through banks in order to re-balance. This is where cryptocurrency advocates see an opportunity to streamline the process by removing banks all together. This is made possible by the blockchain, the same technology that powers Bitcoin.

One project, Bitspark, is working to leverage blockchain technology to revolutionize the remittance industry. Bitspark is a remittance platform for money transfer businesses.

Bitspark is a remittance service using cryptocurrency to send and receive value.

In August, Bitspark announced they would be building their service on the BitShares blockchain. The BitShares platform itself is built to scale to 100,000 transactions per second with fees as low as fractions of cents and confirmation times sub 3 seconds.

Aside from providing a fast and efficient payment platform, BitShares allows for the creation of Market Pegged Assets (MPA). Market Pegged Assets are freely traded digital assets whose value is meant to track that of a conventional underlying asset such as CNY, gold or USD.

Bitspark is proposing the use of pegged cryptocurrency such as bitUSD to solve the re-balancing problem. A recent blog post showed an example of how this would function. “A Bitspark Sendy (mobile app) user has a digital balance of 100 bitUSD in their app and would like to make some money. They visit an MTO and offer to sell their digital 100 bitUSD to the MTO for $101 in Cash. The MTO accepts this offer and exchanges $101 in cash for 100 bitUSD. The MTO now has reduced their cash on hand and also received a digital balance to be used for future transactions.”

Bitspark created mobile app called “Sendy” to help with remittances.

In the current system, the MTO would need to take their cash to a bank and wait for the bank to credit it into their money transfer system providers account before sending transactions again. MPAs eliminate the need for a bank to provide liquidity allowing MTOs to operate without the need for a bank account.

Bitspark is removing the difficulty associated with accessing liquidity denominated in the local currency, with the goal of creating a pegged fiat cryptocurrency for every national currency in the world with zero counterparty risk and exchangeable for virtually no cost. The new payment method will be rolled out slowly for specific currency pairs so that Bitspark’s remittance users will have access to all of the world’s 180+ currencies over the coming months, bringing financial services to the unbanked.

It is estimated that there are 2 billion unbanked people, who use cash only, do not have any credit history or access to any financial services. Bitspark is not the only company looking to capitalize on this untapped market.

MicroMoney Credit Assessment and Micro-loan platform.

MicroMoney which is currently hosting its initial coin offering, claims to be the first blockchain credit bureau and social micro-finance service. MicroMoney has raised over six million dollars and counting, with a goal of thirty million dollars by the end of their ITO.

Without access to basic financial services, the unbanked have limited capacity to overcome poverty and to increase their living standards. No credit history means limited access to banking services, which means no loans or mortgages. MicroMoney hopes to change all of that with a simple app.

The next billion internet users will primarily be mobile. Many of the unbanked lack access to infrastructure including reliable electricity and internet, forcing them to rely heavily on smartphones. With this in mind, MicroMoney has put an emphasis on mobile app development. By analyzing an individual’s smartphone, the company can learn everything they need to know in order to accurately estimate their creditworthiness.

They have developed an app that gathers 10,000 different data parameters. They then analyze this data using AI Neural Network Scoring, determining a loan approval decision in just 15 seconds. The goal is to make borrowing money using their app as easy as ordering an Uber.

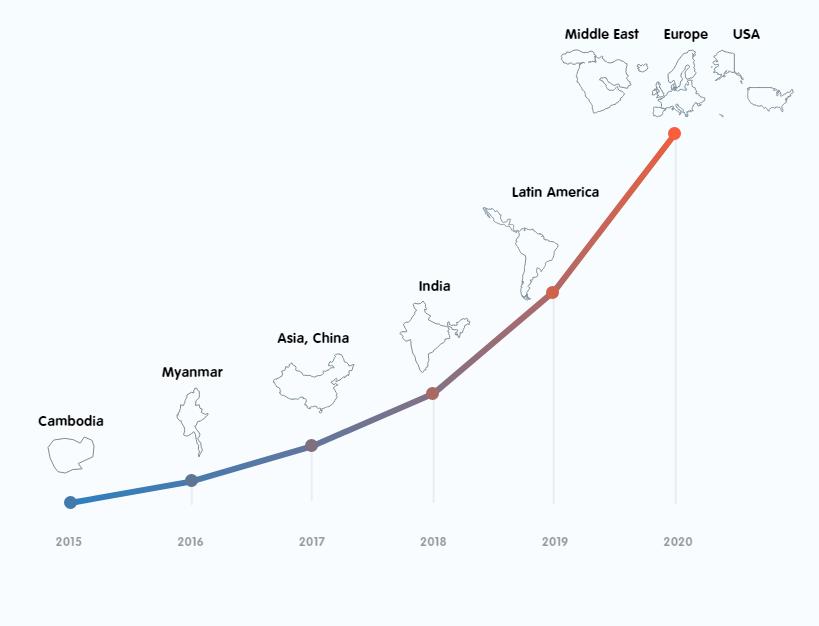

Simplicity and ease of access has led to 90% of MicroMoney customers taking their very first loan. Currently MicroMoney operates in Cambodia, Myanmar and Thailand with plans for aggressive expansion throughout Asia. In August 2017, MicroMoney signed a Memorandum of Understanding with Everex e-wallet. Everex is a crypto-based company operating in the remittance industry. Integration of Everex allows for customers to secure crypto-loans disbursed through global remittance.

MicroMoney currently operates in Cambodia, Myanmar, Indonesia, Sri Lanka, and Thailand.

Bringing financial services to the unbanked could have a major impact on developing nations and society as a whole. Regions that have experienced extreme poverty and limited growth for decades, will for the first time have access to banking, credit and loans. The expansion of the internet led to a boom in ideas and creativity. Bringing 2 billion unbanked into the global economy has the potential to create a massive economic boom on the scale of the industrial revolution.

Micromoney is already seeing success in the countries they currently operate within, with users of the micro-loan service posting stories on social media accounts and to the company. One of the micro-loan customers, Thet Zaw, wrote on Facebook about his experience using Micromoney service:

One day my son felt very ill, so I needed money urgently. I asked my friend for money but he couldn’t help me. Then I saw MicroMoney page on Facebook and applied for a loan. 2 days ago I got my first loan, which was not a lot of money but saved my son’s life.

Cryptocurrency may be exactly what the world needs to level the financial playing field. The new digital economy will provide global financial freedom and inclusion to billions.