Authors: Robin Betz, Philipp Sandner

In order to deploy the full potential of a blockchain technology an internal unit could be beneficial, that consist of multiple roles and functionalities depending on the maturity of the project. In addition It is important especially for the C-level to understand the investment character of an emerging technology. By leveraging a blockchain technology, processes within a company can be enhanced, however the importance of investing into qualified manpower as well as a strategic foresight is going to be illustrated in the following article.

The hype around blockchain is partly caused by the media’s attention on the Bitcoin’s volatility and skyrocketing initial coin offerings (ICOs) — a blockchain-specific investment model. But potentially being more than a hype, multiple governments have published reports on the potential implications of blockchain technology. According to these reports the financial implications are remarkable: the global business value through cost savings and efficiencies is estimated at $2 trillion by 2030 [1]. Blockchain has not only caught interest of public but also private institutions and corporates invest heavily in the technology in order to have a stake in the developing blockchain ecosystem. Tech-savvy companies like Microsoft, Oracle, and Salesforce set up blockchain initiatives [2], as they believe in the technology’s business potential. Nevertheless, not only the big tech companies in the US, but also German companies like Festo, SAP, Datev, Telekom and BMW believe in blockchain and therefore scouted this field with pioneering projects. In doing so, these companies and their initiatives follow the challenging mission to build internal blockchain competency, optimize their processes and find the next big blockchain use case for their industry. Assuming that many core business processes will soon run on blockchain, companies need to start investing in the immature technology to interoperate with and within the future blockchain-based systems.

Many companies have already tried to get familiar with blockchain technology, but even more failed [3] and burnt a lot of money [4] due to sticking to traditional patterns of ownership and experimenting without strategic guidance. Despite the hype, blockchain is still an immature technology, and an easy success formula is hard to come by. Therefore a prevalent question is how to not waste resources but to successfully grow blockchain competency in corporate organizations and leverage the technology successfully.

In this blog post we outline how to set up an internal blockchain unit as a vehicle to structurally incorporate blockchain technology. Thereby we share our experience in successful corporate company building in combination with latest academic research results from Frankfurt School of Finance Blockchain Center. This article is a starting point to establish blockchain projects in corporates and does not claim to be comprehensive.

Full C-level buy-in

To successfully initiate and develop blockchain competency in corporates, clarity among top management about the strategic direction and the future role of blockchain technology in the organization is required. Same clarity is needed by setting up a blockchain unit, as top management buy-in is critical in order to stay in line with the overall organizational strategy. Further, C-levels must provide sufficient infrastructure and dedicated resources for a blockchain unit. Considering mindset, it is important for top management to be aware of the investment character of new technologies like the blockchain. Here the short-term goal is to establish basic infrastructure and get familiar with the topic and not to immediately earn big bucks.

Organizational integration

After the strategic direction is defined and full commitment is given, the blockchain unit needs to be properly incorporated. FSBC researchers found that blockchain projects in the financial industry are organized lately in a hybrid approach between centralization and decentralization [5]. The spectrum of organizational integration is shown below (Exhibit 1).

Exhibit 1: Blockchain project’s level of centralization in the financial industry. Source: own illustration based on Laufs (2019).

The advantage of a decentralized approach is the diffusion of blockchain competency throughout the entire company along with the danger of diluting the competency in the firm with limited impact. The upside of a centralized approach is a laser-sharp focus on blockchain topics along with the downside to potentially build isolated competency. Based on Bitrock’s company building experience, a centralized accelerator vehicle as a dedicated workspace to host the blockchain unit, is a valid way to bridge both approaches.

Joining industry forces with facilitation

Forming consortia or engaging in coopetition — the sharing of costs, distribution channels, innovation efforts and risks without officially cooperating — can help to mutually develop blockchain competency. Here a blockchain unit plays a central role in promoting the exchange between partners and develop the blockchain projects beyond corporate boundaries. In the financial industry both consortia and coopetition are common approaches according FSBC research and can be transferred to other industries. The GSBN — Global Shipping Business Network is a great example of nine leading ocean carriers and terminal operators to develop an open digital platform based on blockchain technology. Nevertheless, organizations have to carefully choose an appropriate setup and define who takes which role in the consortia.

Streamlined and dedicated processes

A blockchain unit needs to incorporate dedicated processes to ensure efficient operations and relevant competence build-up in the organization. Indispensable domains are i) a structured use case identification and ii) clear decision-making and reporting. A streamlined use case identification process has to be implemented, in order to systematically develop and re-evaluate the fit between the market and the blockchain technology. Considering decision-making and reporting, corporates must find the fine line between the degree of formalism required and the necessary development speed. Use cases that are closely located to the core business require alignment to the business line, without significantly impeding development speed.

Blockchain unit composition

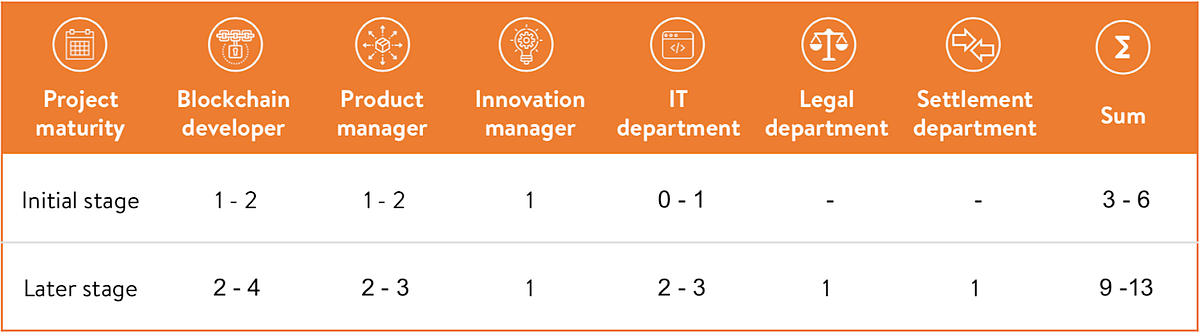

Lastly, composition of skills in the blockchain unit is of utmost importance. We propose an interdisciplinary team consisting of multiple roles and functionalities. In specific, the FSBC found the following skills to be inevitable in the financial industry: blockchain development, product management, IT competence, law expertise, innovation management and settlement competence [5]. The research supports that the interdisciplinary team should be consistently kept unaffected of the project’s maturity. The specific number of employees involved in blockchain-based projects found in the financial industry depends on the project’s maturity and are shown below (Exhibit 2). The distribution can be used as a guideline for setting up a blockchain unit in other industries. As a final remark, an interdisciplinary team is not a remedy itself, but it has to adapt an agile way of working with a steady customer orientation.

Exhibit 2: The blockchain project’s composition of skills in the financial industry. Source: own illustration based on Laufs (2019).

Key takeaways

- Blockchain technology has huge potential to transform corporate business operations and enable new business models — but potential is not exploited yet.

- To successfully develop corporate blockchain competency, a focused strategy in combination with resource investments is required. Here a blockchain unit can be a valid vehicle to contribute execution beyond current approaches.

- By setting up a blockchain unit corporates have to carefully pay attention to management buy-in, organizational integration, processes and skill composition.

In order to mutually overcome blockchain challenges in corporates, we strongly believe in pooling scientific knowledge with hands-on industry experience. In this manner, we founded a consortium consisting of blockchain experts from the Frankfurt School of Finance and venture building professionals from Bitrock Digital Partners.

Interested in how to incorporate blockchain technology with the help of a dedicated blockchain unit or simply want to get to know more? We look forward to hearing from you at hello@bitrock.partners.

What are next steps?

As a next step, to promote your knowledge of blockchain technologies or digitization in general, regardless whether it is directly for your company or your personal development, you should gather further information and deepen the understanding of how to incorporate blockchain competencies inside a corporation. And of course you are welcome to contact us. For more information regarding most current Blockchain research visit here. To get more information about company building and digitization visit here.

Literature

[1] Graham, Lee. Global Blockchain Business Value to Reach $2 Trillion by 2030. Marketwatch. https://www.marketwatch.com/press-release/global-blockchain-business-value-to-reach-2-trillion-by-2030-ihs-markit-says-2018-08-01. Accessed April 2019.

[2] Higgins, Stan. IBM Invests $200 Million in Blockchain-Powered IoT. Coindesk. https://www.coindesk.com/ibm-blockchain-iot-office. Accessed April 2019.

[3] Mizrahi, Avi. Research: Corporations Fail to Deliver on Blockchain Hype, Scalability a Top Concern. Bitcoin.com. https://news.bitcoin.com/research-corporations-fail-to-deliver-on-blockchain-hype-scalability-a-top-concern/. Accessed April 2019.

Hackett, Robert. Abra CEO: Enterprise Blockchains Will ‘Fail Miserably. Fortune.com. http://fortune.com/2019/02/25/blockchain-fail-abra-ceo/. Accessed April 2019.

[4] Armstrong, Paul. Is The Blockchain Failing Corporates?. Forbes.com. https://www.forbes.com/sites/paularmstrongtech/2018/08/19/is-the-blockchain-failing-corporates/#508159071ea0. Accessed April 2019.

Mizrahi, Avi. Mckinsey: Despite Billions of Dollars, Corporate Blockchains Have Achieved Little. Bitcoin.com. https://news.bitcoin.com/mckinsey-despite-billions-of-dollars-corporate-blockchains-have-achieved-little/. Accessed April 2019.

Chiriatti, Massimo. The reasons behind the failures of many blockchain projects. Cryptonomist.ch https://cryptonomist.ch/en/2019/01/13/reasons-failures-blockchain-projects/. Accessed April 2019.

[5] Laufs, Dominik (2019). Implementing Blockchain Projects in Banks: An Examination of Blockchain Projects and Organizational Structures. Bachelor’s Thesis. Frankfurt School of Finance — Blockchain Center.