Ready to learn more on IoT and Blockchain? Browse courses on IoT and Blockchain developed by industry thought leaders and Experfy in Harvard Innovation Lab.

As companies scale transaction volumes and integrate with more and more third party software, they get a growing inflow of data and services. This increases the risk of data breaches and cyber-attacks.

How to scale up without compromising security?

This is the final part of these on how technologies can solve key scalability bottlenecks in fintech. You can find the first part here, the second one here.

In this part we try to answer the following critical question:

As companies scale transaction volumes and integrate with more and more third party software, they get a growing inflow of data and services. On the downside, this subsequently increases the risk of data breaches and cyber-attacks.

According to Forbes, the overall global cost of cybercrime will amount to $2.1 trillion by 2019. That is a 400 per cent increase from 2015.

Primarily, that is a hot topic for financial services companies and fintechs in particular. According to the research findings, fintech companies are prime targets for cybercrime attacks with the growth of attacks outpacing transactional increase by 50 per cent. – Thinkadvisor

ThreatMetrix research showed 80 per cent increase in digital wallet transactions year-on-year as well as a 180 per cent increase in associated bot attacks that are used to mass test identity credentials.

In addition, fintechs currently suffer from the mismatch between innovations and regulations as the latter don’t keep up with the technological advancement in the financial industry. What’s more, early-stage startups usually don’t have adequate compliance teams. Such unstable regulatory environment creates additional security and compliance challenges for the financial market players.

Two key technologies will play a key role in cybersecurity.

According to the report, the AI in fintech market is expected to grow from USD 1,337.7 million in 2017 to USD 7,305.6 million by 2022, at a CAGR of 40.4 per cent,

There are four major areas in fintech software development where AI is making a game-changing effect:

● Detection and prevention of cyber-security attacks.

● Predictions and recommendations on the customers' credit-worthiness.

● Using capsule neural networks to identify customers and documents visually.

● Leveraging intelligent chat-bots.

To detect fraudulent financial behavior and prevent cyber-attacks, fintechs frequently use a generative adversarial network (GAN). GAN is a type of deep learning system that works as two competing neural networks: a generator and a discriminator.

The generator network creates fake data that looks identical to the real data. Whereas, the discriminator network analyses both synthetic data and the authentic dataset. Over time, both networks improve their results and learn from each other.

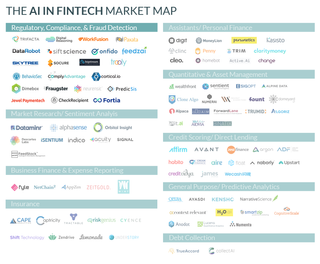

Many fintechs work in fraud detection and regulatory areas.

Source: AI Fintech Startup Market Cap

However, we can see that financial incumbents are taking many AI-related initiatives, and they don’t want to lag behind.

According to PWC report, more than 30 per cent of financial institutions are investing into AI.

Source: PWC report

According to a recent TCS study into AI across 13 sectors, 86 per cent of business leaders in the banking and financial services sector said they were already using this technology.

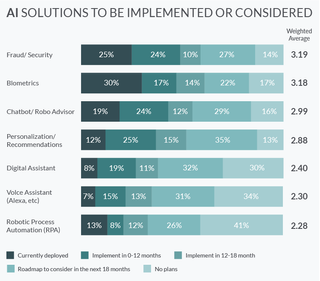

According to reports, banks are mainly focusing on using AI for security and biometrics.

Source: Competitive Survival in Banking Hinges on Artificial Intelligence

Shortage of AI talent

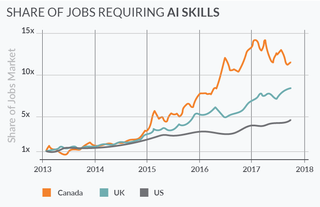

Consequently, we can see a growing trend for the share of jobs that require AI skills.

Source: 10 Charts That Will Change Your Perspective On Artificial Intelligence's Growth

Companies like Amazon, Google, and Facebook are alluring top AI talent with high salaries and high perks. Big banks also have more capital than fintechs to compete for it. As a result, the latter face a severe problem of AI talent shortage.

According to the analysis of glassdoor.com search results, we can see that the demand for AI and Machine learning specialists is great. Companies in the UK are looking for 4,525 AI specialists and 4,859 machine-learning engineers. In the US, the demand is even bigger – companies are looking to engage 33,607 AI specialists and 53,579 machine-learning experts.

To face the challenge, many fintechs are outsourcing their AI and machine learning development to Eastern Europe, and for a good reason. According to the LinkedIn search results, Eastern Europe has a talent pool of 15,254 AI specialists and 21,035 machine-learning engineers.

The blockchain is another hot topic in fintech. The technology will reinforce security of financial operations.

In Forbes' third edition of the “Fintech 50”, eleven companies use blockchain technology or are connected to the cryptocurrency industry.

According to KPMG's Pulse of Fintech, blockchain companies raised record high $512 million of venture capital investment in Q4’17.

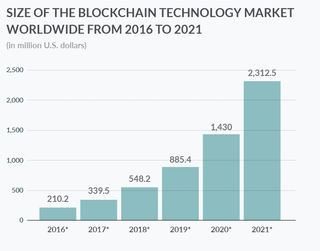

According to Statista, the size of global blockchain technology market is predicted to grow to 2.3 billion U.S. dollars by 2021.

Source: Statista

The distributed ledger technology doesn’t apply to all business cases. However, if its usage is well grounded, it offers multiple benefits, including security, transparency, improved digital identity, and traceability of transactions.

Its principal use cases in fintech are smart contracts, smart assets (especially in trade finance), clearing and settlement, payments, digital identity (KYC), and cryptocurrencies.

A PWC research of the financial services sector and fintech has shown that around 77 per cent of financial services industry leaders are looking to adopt blockchain in some way by 2020.

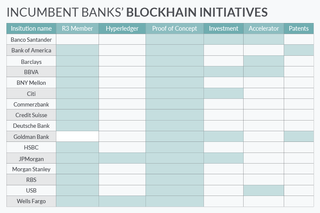

Banks have shown interest in the technology, with nearly one-third of surveyed institutions noting that they have started developing strategies to integrate blockchain into their financial operations. Banks collaborate with blockchain startups, invest in the blockchain research, and set up accelerators.

Source: Outlier Ventures

Goldman Sachs is setting up a cryptocurrency trading desk in New York that will be up and running by the end of June 2018.

Across the ocean, a Swiss bank UBS is leading a pilot that aims to automate regulatory requirements for the MiFID II/MiFIR rules that take effect in 2018.

Tech giants are not lagging behind as well. According to CBInsights, Google was the second most active corporate investor in blockchain tech from 2012 to 2017. Now, Google is planning to adopt a blockchain-like ledger system, to differentiate its cloud business from the competition.

As we can see, both financial services incumbents and Big Techs are showing considerable interest in blockchain and, subsequently, luring blockchain talent.

The fight for blockchain talent

There is an astounding shortage of blockchain talent across the world, and the competition for it is incredibly fierce.

The scarcity of blockchain specialists has its impact on the global market and companies that want to implement blockchain solutions. According to the findings of the poll conducted by Synechron and TABB Group, about 40 per cent of firms do not have enough qualified blockchain engineers.

The shortage of available talent for blockchain was mentioned as a critical topic at the DTCC’s Fintech Symposium, held at the Grand Hyatt in New York City.

According to LinkedIn data, there are just around 75,000 blockchain and distributed ledger specialists in the US and about 16,000 in the UK. Eastern Europe offers an additional pool of roughly 7,500 blockchain engineers, a lucrative source of talent for Western companies that struggle finding relevant skills in their local markets.