Relevance of blockchain for the financial industry

Many studies and surveys have shown that the financial industry is the sector dealing with blockchain technology the most intensively (Beck & Müller-Bloch, 2017; Nofer, Gomber, Hinz, & Schiereck, 2017; PricewaterhouseCoopers, 2018; Prinz & Schulte, 2017). There are various fields of application for blockchain in the financial industry, where it could not only replace but also complement traditional processes and increase their efficiency. The range of potential applications is growing rapidly (Peters & Panayi, 2015). Most commonly, the application of blockchain in the area of capital markets, trade finance, identity management and payments is discussed.

Collaborating to build know-how

To obtain comprehensive knowledge about blockchain technology, financial institutions can either deploy their own resources or collaborate with similar players (Korschinowski, Forster, & Luca, 2017). The advantage of deploying internal resources is the ability to define the direction of the development and to align the research to one’s own business model. However, this option is cost intensive, as all the know-how must be gathered independently (Korschinowski et al., 2017).

Forms of strategic alliances

Collaborations between corporations can take many forms. However, with his definition, Gulati (1998) covers a broad spectrum of inter-firm collaboration. He defines strategic alliances as “voluntary arrangements between firms involving exchange, sharing, or co-development of products, technologies, or services. They can […] take a variety of forms, and occur across vertical and horizontal boundaries” (Gulati, 1998, p. 293). All forms of strategic alliances involve two or more companies and are “a hybrid form between the market and the hierarchy” (Hagedoorn et al., 2000) in which organizations bundle or exchange their resources (Gulati, 1998). However, embodying several hierarchical elements, joint ventures come closest to the hierarchy form, while alliances in which the organizations do not share any equity are more market oriented (Gulati, 1998).

Structuring R&D to foster innovation in organizations

Research & development (R&D) can be integrated in organizations in various ways and with different structures. Existing research mainly distinguishes between centralized and decentralized R&D structures.

According to Ahuja (2000), a central position within a network has the following three advantages. First, centrality yields the ability to gather large amounts of information and know-how (Ahuja, 2000), which enables a significant learning effect (Kale & Singh, 2009; Mazzola et al., 2015). Second, a central setup supports the conversion of gathered information and knowledge into further innovations (Ahuja, 2000; Cohen & Levinthal, 1990). Third, larger projects generate more knowledge than smaller projects and thus, enable scale economies in research (Ahuja, 2000). Furthermore, centrality reduces the costs to find external resources (Mazzola et al., 2015) and lowers the expenses to coordinate internal R&D activities (Argyres & Silverman, 2004,). It also strengthens a company’s ability to innovate and increases the impact of innovation on the future development of processes (Argyres & Silverman, 2004; Mazzola et al., 2015). Zhang, Baden-Fuller, & Mangematin (2007) have additionally reported that firms with centralized R&D competence are more likely to form strategic alliances.

Concerning decentralized R&D structures, Mazzola et al. (2015) have stressed the lack of consensus regarding the effect of a bank’s divisions on performance and innovation. Those divisions work independently with their own information flows in the same company, a setup that results in structural holes (Burt, 1992). Ahuja (2000) found a negative effect of such structural holes on companies’ innovation activity, and Argyres & Silverman (2004) have likewise stated that a decentralized R&D structure yields less innovation than a centralized R&D structure. This outcome occurs as R&D is dispersed and connected to individual divisions. Thus, it does not allow for economies of scale and “incurs greater transaction costs of interdivisional coordination” (Argyres & Silverman, 2004, p. 930). However, those structural issues can be bridged by teams having different professional know-how and introducing new ideas. They enhance a company’s awareness of emerging trends from another point of view and increase its innovation activity (Padula, 2008; Zaheer & Bell, 2005).

Composition of teams dealing with innovative topics

Several studies have pointed to a positive effect of interdisciplinary teams on innovativeness (Henneke & Lüthje, 2007). For example Bantel & Jackson (1989) have demonstrated that educated teams uniting diverse professional backgrounds lead to more innovative banks. To foster innovation, a multidisciplinary team with members from different departments and backgrounds needs to be established. Such a team should include product experts, technologists, and innovation process experts, among others (Krasadakis, 2017). For an innovative project to succeed, team members must be fully committed to it and not “have their attention split across multiple responsibilities” (Fudge & Roca, 2012, p. 10). However, the size and composition of such a team is dependent on the corporation’s industry, its field of expertise and size (Krasadakis, 2017). Optimally, such a team should have one leader to steer it in the most efficient way. Nevertheless, any member of the team should be able to lead the team when he or she holds the relevant know-how at that point in time (Fudge & Roca, 2012).

Overview of the blockchain projects of German banks

The investigated German banks provide a well-balanced overview of the projects and fields of application targeted by German banks. However, the development status of the banks’ blockchain projects has varied substantially. It can be distinguished between an initial phase and a later development phase. In the initial phase, proofs of concepts (PoCs) are created and prototypes are built to demonstrate a business case behind a project. Compared to that, in the later development phase, first pilot transactions with real customers are conducted or the product is implemented and ready for the market introduction.

Applications in capital markets

There are different kinds of blockchain products in development in the area of capital markets, including the more short-term money markets. Six of the surveyed banks are currently working on simplifying the documentation and coordination of commercial papers, bonds, and promissory notes [i] by embedding their settlement process onto a blockchain. Compared to bonds, commercial papers are characterized by their short duration and plainer structure. To not lose their competitive positions, the banks are developing these products either alone or in small private consortia with only a few fellow banks. Furthermore, three banks are implementing over-the-counter (OTC) derivatives in a blockchain. More specifically, they are embedding the settlement process of swaps [ii]. While one bank has already discarded the idea, two banks are still working on it. As swaps are bilateral products, the development of a blockchain solution is also happening in small private consortia. In another blockchain project, one bank, in cooperation with corporate clients, is dealing with settling currency futures on a blockchain, including real-time post-trade confirmations and the automatic matching of documents.

With regard to the settlement of such money market and capital market products, the interviewees remarked on the challenge of actually implementing not only the settlement but also the whole process of issuing, trading, and settling those products via a blockchain. To enable the issuance and trade of those products on a blockchain, value would need to be transferred over the blockchain, which would require a digital currency, such as a cryptocurrency. Expert 5 (2018) stressed that such a digital currency needs to fulfill certain risk requirements and should be either backed by a central bank or issued by a trusted clearing house. The mere settlement of this process does not require a transfer of value (Expert 5, 2018; Expert 6, 2018).

Applications in trade finance

In the area of trade finance, a pertinent trend toward joining consortia was observed. This is mainly due to the fact that there are several players involved and a platform displaying the trade finance process would need to be rolled out largely by most major players to gain traction (Expert 3, 2018). With two large consortia playing a significant role for German banks in the area of trade finance, namely Marco Polo and we.trade, individual banks would not stand to gain from independently developing a blockchain infrastructure. This is because convincing other market participants to join a newly developed platform without the support of a variety of other banks and market participants would require substantial effort. Consequently, three banks are part of either the Marco Polo or we.trade consortium. Two of these joined in the early stages, and one joined at a later stage. A few other banks, belonging to a group representing similar interests, are considering collectively joining one of the two consortia.

Applications in identity management

Two banks are also developing blockchain projects in the area of identity management. This domain includes, for example, Know-Your-Customer (KYC) and Know-Your-Business (KYB) processes, which are used in several departments throughout a bank. There are central teams in charge of making those processes more convenient, more secure, less costly, and, above all, more efficient. On the one hand, these teams are internally experimenting with blockchain technology in these processes. On the other hand, one bank has also partnered with other banks to conduct research and experiments related to this topic.

Applications in payments

There is no clear trend toward one payment product, but rather a range of different products in development. One bank has successfully conducted cross-currency real-time payments with a foreign bank focusing on blockchain-based international payments. Another bank has partnered with an established market player enabling secure national and international financial transactions to increase the speed of such secure international payments. Furthermore, one of these banks has realized the potential of blockchain technology not only with regard to cross-currency payments, but also with regard to embedding a pay-per-use blockchain system utilizing smart contracts to finance investments. Another bank is a member of a large international consortium that is developing a coin which will be backed by central bank money in the currency of the respective payment and that primarily aims at enabling secure real-time interbank transfers of funds.

Applications in other areas

In particular, the interviewed development bank has several projects not related to the previously mentioned fields of application, such as utilizing the blockchain to track the use of funds in developing countries to prevent the incorrect usage and redirection of those funds. Additionally, the development bank initiated a blockchain project to increase the efficiency of promotional activities. For those, the development bank provides funding through a bank which is intermediating between the development bank and the final customer or project. However, this project was abandoned since blockchains are based on distributed trust, while for the promotional activities, the development bank needs to remain the central player.

Further blockchain projects have dealt with embedding the processes involved in syndicating loans, managing properties, and settling processes with subsidiaries via a blockchain. While the first two projects are still in their PoC phase, the latter one has already been terminated due to the unreadiness of other market players.

Organizational forms of blockchain projects

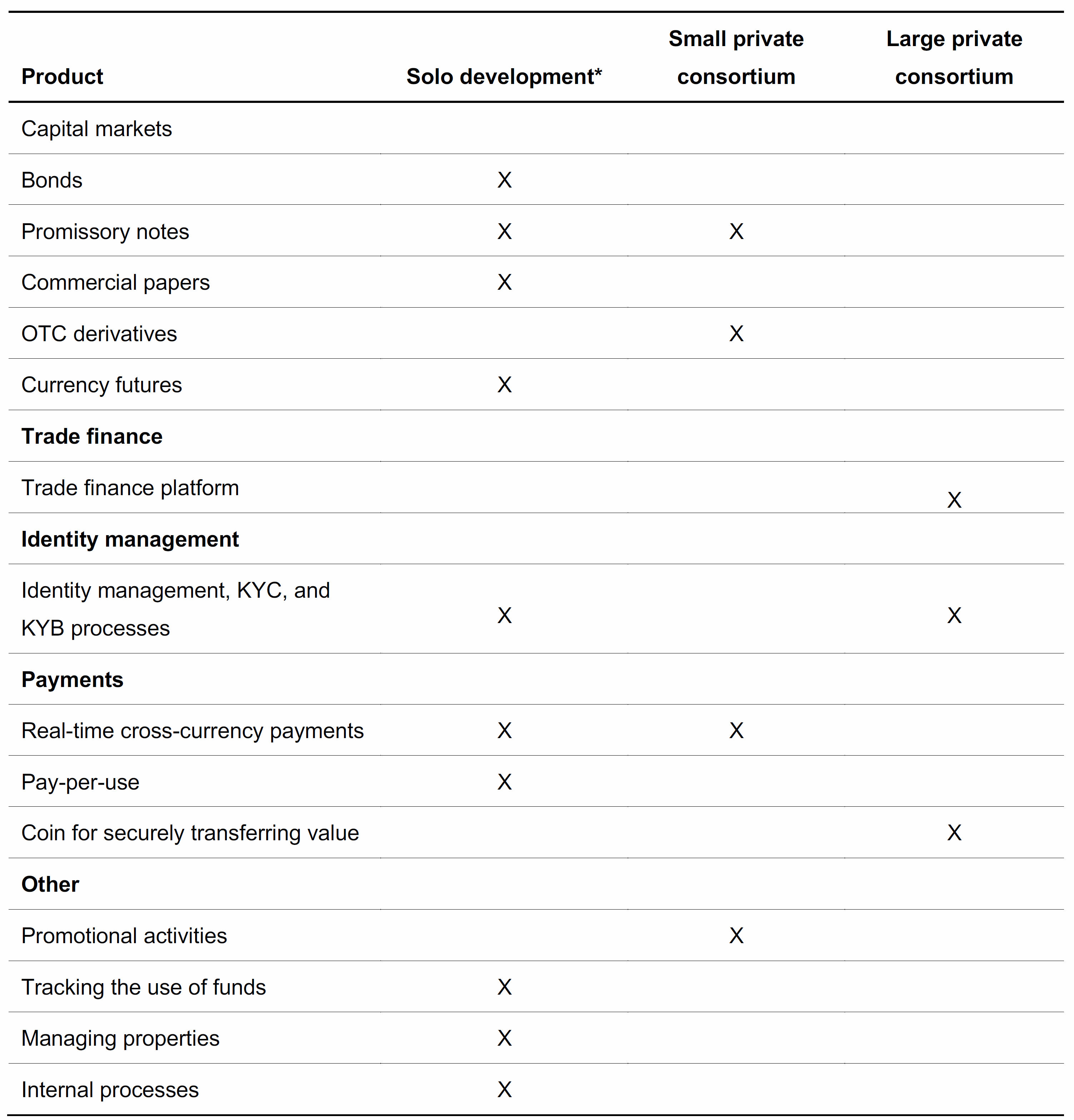

With respect to the organizational forms of the blockchain projects of German banks, no consistency across the different fields of application can be observed. An overview of the different development forms is given in Table 1.

Partnering with fellow banks via non-equity arrangements is a common way for banks to increase their blockchain know-how and approach blockchain projects.

Existing consortia are categorized into small private consortia and large private consortia.

Table 1: Blockchain projects of German banks and their organizational form — Note: *Solo development refers to only one bank being involved in the blockchain development process. However, subsidiaries, cross-industry partners, and service providers can be involved.

Small private consortia involve between two and five banks and are often private. This means that both no further banks can join without meeting certain conditions and that the project itself is sometimes not communicated to the public. There are different reasons that the banks 9 choose to develop blockchain projects in small private consortia. First of all, the banks are able to share their R&D resources and the respective costs. Furthermore, they retain the gained knowledge in a small circle, and entering a market with a new product as a consortium yields a fundamental customer starting base, which is especially vital if the product is expected to dominate the market in the long-term (Expert 2, 2018). Additionally, partnering can be necessary if the underlying product is related to two banks’ interactions with each other (Expert 5, 2018).

Large private consortia have five or more members and are not openly accessible to all potential members. They are mainly founded in areas where substantial market power is needed to drive a project to succeed. For example, in trade finance due to reasons related to scalability and the existing, well-developed blockchain infrastructure, joining a large private consortium is the only feasible option to apply blockchain in the field of trade finance (Expert 5, 2018). Moreover, the consortium founded with the aim of creating a securitized coin for the transfer of value needs a significant amount of market power, as one common coin would result in better market penetration than numerous coins associated with individual banks. Additionally, the interviews made clear that the words of a consortium carry more weight than those of an individual actor when it comes to introducing innovations and pushing regulators to take action.

Banks include their clients in the independent development process, as the actual transactions must be conducted with conventional business partners.

There are also a range of blockchain projects being developed independently by banks without partner banks. In this context, “independent/solo development” only means that one bank, rather than multiple banks, is developing the blockchain project. However, solo development initiatives 10 include projects undertaken within a corporate group or in collaboration with service providers or cross-industry partners. Banks often work together with external blockchain developers, as internal blockchain know-how is still often non-existent. Furthermore, banks include their clients in the independent development process, as the actual transactions must be conducted with conventional business partners, including investors and corporations in need of financing. Expert 1 (2018) mentioned that internal development makes particular sense when a project covers bank- or groupinternal processes and when exposure of one’s know-how is not necessary. Additionally, the interviews demonstrated that developing projects independently or in a small private consortium helps a bank to maintain its market position and protects against an excessive number of parties participating in project development, which would make the coordination of parties’ interests more complex.

Initiators of blockchain projects

The qualitative interviews revealed that various departments in a bank had initially brought up the topic of blockchain. While in some banks an innovation team puts the topic on the agenda, in other banks the IT department, corporate strategy department, management team, or customer requests has driven the process. In most cases, the banks first started considering the topic when blockchain started receiving significant attention around 2015. However, some banks joined the movement at a later stage when the first solutions were already on the market and the first consortia had been formed.

While bringing up the topic is the first step, actually initiating projects concerning blockchain technology is another important step. There are three initiators of blockchain projects in banks. First, product departments themselves initiate blockchain projects. Either they put forward products and processes for which they see potential for improvement via the application of blockchain technology, or a central innovation team raises awareness regarding blockchain and encourages the product departments to look for potential blockchain use cases. Second, some innovation teams not only draw product departments’ attention to blockchain but also search for use cases in the banking environment and start blockchain projects on their own. A third, rather rare, case is a customer approaching a product department and encouraging it to develop a blockchain project.

Level of centralization of blockchain competence

There are different ways to embed blockchain competence within an organization. One central team could be responsible for developing all projects on its own, or all departments could be in charge of developing their own blockchain projects. However, the qualitative interviews pointed out that hybrid versions of these two extremes are particularly common in German banks. In this context, a hybrid form signifies that blockchain competence is neither fully integrated in a central department nor integrated in all product departments in a decentralized manner. Rather, the term refers to an interconnection between a central department, referred to as an innovation team, and the decentralized product departments. There are different potential levels of centralization of blockchain competence in organizations. Figure 1 provides an overview about the level of centralization. Over the course of a blockchain project’s development, its integration in the bank sometimes changes, and thus, the integration of the respective blockchain competence also shifts

Figure 1: Level of centralization of competence in an organization — Source: Own Illustration.

Centralized blockchain technology competence

One interviewee’s bank centrally embeds all blockchain projects and the respective know-how in its innovation team. However, this team does not develop those projects on its own, but collaborates with the respective product departments. Thus, this approach is not fully centralized. Only in one specific case the innovation team develops the project alone, as it concerns a general topic that is not product-specific. However, the interviewee from this specific bank mentioned that it is normally essential for a blockchain project to have support from a product department to gain professional know-how about the product in question and to make the project a success (Expert 1, 2018). Also, this innovation team occasionally develops blockchain prototypes on its own and tests those in terms of viability. Thus, it is also considered an R&D center.

Two other banks follow a similar approach with their innovation teams. However, the innovation teams only provide a central platform connecting developers and product departments so they can jointly work on blockchain projects proposed by the product departments. In this case, the innovation teams do not have the human resources to develop projects themselves. Thus, they rely on external developers. The surrounding infrastructure is only provided for initial development, such as testing ideas and designing the first prototypes. During this initial phase, the innovation team also participates in order to contribute know-how gained from previous projects and to obtain learning effects for itself. Hence, in this initial phase, the provided platform serves as an accelerator that keeps the organization’s blockchain competence at a central location. During later project stages, these innovation teams reduce their involvement and provide fewer resources. Responsibility for the project then shifts to the product departments as the innovation team concentrates on bringing new projects to its platform. However, the innovation team still mediates between all ongoing blockchain projects and functions as a platform for the exchange of experiences.

Decentralized blockchain technology competence

With blockchain projects carried out in the banks’ product departments and no longer centrally developed within the innovation team, blockchain competence becomes decentralized. At some banks, this decentralized model is used from the outset. Three of the interviewees’ banks have a central innovation team that does not provide a platform and other resources, and that only mediates between different blockchain projects, supporting exchanges and raising awareness of blockchain technology. The blockchain projects themselves belong to, and are developed in, the respective product departments.

Another bank relies on a mixed approach. Its innovation team serves as a bridge for blockchain projects developed in a decentralized manner in the respective product departments. However, members of the innovation team also play an active role in the development of some projects. While most innovation teams also initially support projects, members of this bank’s innovation team are part of projects for their entire duration. Consequently, their involvement is much higher, and their blockchain know-how is more profound. This know-how is an advantage when it comes to the innovation team’s other tasks, namely, scouting the market for interesting startups seeking to provide solutions for the financial industry and providing them with a platform to accelerate their ideas.

Assessment of the banks’ approaches to integrate blockchain competence

While the centralization of blockchain competence differs, at least slightly, in all the banks examined in this study, all the interviewees perceived their approach as the right one. The interviewees shared a common understanding of how banks should approach blockchain projects. Interviewees from banks with one to three ongoing blockchain projects mentioned that their setup, with blockchain development taking place in the product departments in a decentralized manner, successfully integrates the innovation team as an intermediary. Furthermore, they stated that it would only make sense to pool all blockchain competencies within a central platform. This would yield blockchain technology to become highly popular and more projects to be initiated. Additionally, the interviewee from the service bank, which had one ongoing project and was the only bank without an innovation team, emphasized that a blockchain competence center would be useful if the current project were to succeed and demand for other projects increase. In comparison, interviewees from banks with more ongoing blockchain projects perceived their approach to pool blockchain competencies in a central team or platform as successful. This is because that strategy allows them to provide departments the opportunity to test their ideas to boost the application of blockchain technology in their organization.

However, the interviewees stressed that they have not had enough long-term experience to properly judge their projects’ success and, thus, to properly evaluate their banks’ approach to integrate blockchain competencies.

Internal setup of blockchain projects

The teams working on blockchain projects bring together staff from different departments, depending on various factors. Those include the underlying product, the integration of blockchain competence within the bank, the project’s development phase, the bank’s available resources, and, especially, the number of project partners (i.e., solo development or development in a consortium with other banks). Due to the different variables playing a role in the composition of blockchain teams, the team makeup varies from project to project. Additionally, the interviewees’ banks have not yet finalized and implemented many blockchain projects. This complicates efforts to determine how many and which resources must be considered throughout a blockchain project’s development phase. This section describes a general blockchain team setup based on the most common approaches used by the banks. Table 2 provides an overview with approximate numbers.

For the initial development phase, blockchain developers and some product know-how are necessary. The blockchain developers are members of the innovation team itself, specialized blockchain developers from the bank’s internal IT department, or external blockchain developers hired for the project. The product know-how is contributed by experts from the respective product departments, which often also manage the project. However, as previously mentioned, one bank’s innovation team also functions as a R&D center and thus partly tests use cases on its own. In some banks, the internal IT department is also involved in the initial phase to examine potential implementation challenges that could arise at a later stage.

Table 2: Overview of departments involved over the course of a blockchain project — Note: The numbers only give an approximate indication of how many and which kinds of resources are employed in the development phases of blockchain projects.

As a project evolves, departments that are involved up to a specific point increase the amount of resources allocated to the project. Moreover, the participation of other overarching departments is also required. In particular, more detailed product know-how and blockchain developer resources are brought in, as the blockchain infrastructure must operate faultlessly when it is about to be implemented (Expert 4, 2018). Additionally, more employees from the bank’s internal IT department join the project. This is because they are now charged with not only examining implementation hurdles but also guaranteeing that new requirements for the bank’s internal IT systems are met. Furthermore, IT developers implement the blockchain infrastructure in the existing IT environment and design an appropriate front-end. However, the increase in IT developers is highly dependent on the underlying product and its interaction with the existing IT environment. These additional developers can be external to the organization and sometimes even replace members of the innovation team, who then have more resources to dedicate to other innovation efforts.

Nonetheless, the innovation team always remains involved in the project to gain knowledge and mediate between projects. Other overarching departments that become involved are, for example, the legal, compliance, and settlement departments. However, this involvement can be in part-time.

There are various internal and external tasks assigned to different departments. While external tasks refer to the actual development of the blockchain-based product or the consideration of regulatory requirements, internal tasks concern internal requirements and integration barriers. Different departments are responsible for these internal tasks, such as, for example, the IT, compliance, or legal department. If a blockchain project is developed in a consortium with other banks, those external tasks are carried out with joint resources. However, each bank individually determines the internal requirements of the new project.

Remarkably, all interviewees underlined that the level of hierarchy within their blockchain project structure is minimal. In the blockchain projects, all participating parties collectively work on equal terms. Furthermore, the organizations use an agile approach to help team members learn from each other and to encourage active exchanges among participants. As in nonblockchain projects, project managers control the project development. They are from either the product or IT department and are in charge of reporting to the next level in the hierarchy. In some cases, however, any team member can report to the next authority, depending on the content of the information.

However, the interviews revealed that jointly developed projects entail more hierarchical levels. While there is still a project manager and a flat hierarchy as regards the development itself, there are additional steering committees consisting of members of the participating banks.

Conclusion

The findings of this paper indicate that the main fields of application for blockchain technology in the financial industry, as presented by the literature, are also covered by German banks. These fields are trade finance, capital markets, payments, and identity management. Going hand in hand with the literature, the results of this paper suggest that innovation competence can be embedded in an organization via a centralized structure, decentralized structure, or hybrid structure combining properties of both. The findings indicate that there is a trend among the interviewees’ banks according to which banks with several ongoing blockchain projects feature a central innovation team that is, at least partly, involved in the development process of blockchain projects, which are, at least partly, developed on a centrally provided platform. Banks with only a few blockchain projects also possess a central innovation team, but that team only mediates between the different blockchain projects, which are developed in the respective product departments in a decentralized manner. Furthermore, this paper has outlined the benefits of different organizational forms of blockchain projects. Banks mainly join small or large private consortia in order to share costs, R&D resources and attain a substantial market power. While small consortia keep the gained knowledge in a small circle and still receive a sound customer base, large consortia are especially beneficial in terms of scalability. Independently developed projects are mainly initiated for bankor group-internal projects and have the advantage of not exposing any internal know-how. Additionally, this paper has elaborated on the internal professional composition of those blockchain projects and reported that an interdisciplinary team with blockchain developers, product and IT department representatives, and an innovation team member undertakes the initial development phase of blockchain projects.

Remarks

The presented paper is an extract of Dominik Lauf’s bachelor thesis “Implementing Blockchain Projects in Banks: An Examination of Blockchain Projects and Organizational Structures” written at Frankfurt School of Finance & Management in January 2019. If you are interested in reading the complete thesis, you can request it via mail.

Co-Author

Dominik Laufs is research associate at the Frankfurt School Blockchain Center.

Endnotes

[i] Promissory notes, known as “Schuldscheine” in German, are similar to bonds, but are less expensive, more individual, not listed on an exchange, and, as a typical German financial product, of high relevance for some German banks.

[ii] A swap bases on the exchange of cashflows from two different financial instruments, which two parties have agreed upon (Chen, 2018).