General Motors Corporation officially originated the first-ever car loan in 1919. Since then, leasing has become an essential part of the automotive industry in regions like North America, Western Europe, and Japan. By the beginning of the 21st century, markets in China and Eastern Europe adopted automotive finance as part of their financial strategy as well.

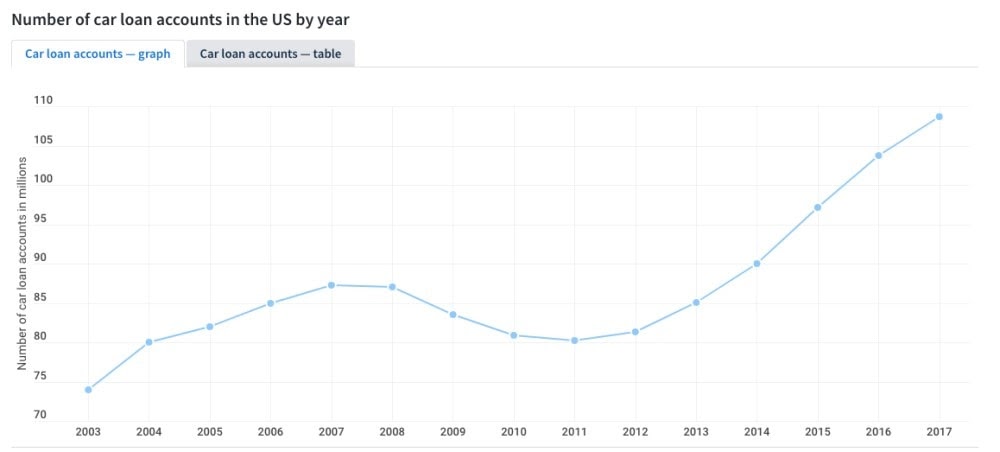

According to Experian, modern automotive finance is growing exponentially. Americans alone owe more than $ 1,18 trillion in auto loans. In 2019, the total volume of car loan originations climbed to a record of $ 584 billion, while automotive assets (i.e. passenger cars and commercial vehicles) accounted for € 267,8 in 2018.

New Approaches in Auto Loans Business

The WEF Global Future Council Financial Monetary Systems report 2018 claims that “digital transformation in the financial sector is well underway and moving fast. With the right policy choices, we can turn these technological advances to the benefit of the whole society. To build flourishing ecosystems, it calls for cooperation between small and large, old and new players.” An AI-powered lending platform could bring such cooperation to an unprecedented level. In this scenario, banks will create new products and distribute them according to the growing demand from customers worldwide.

For example, the domain of modern automotive finance is projected to see a transfer from a classic “bank (OEM) — client” approach to a new “bank (OEM) (classical financial institution) — P2P — the client” one. The model takes root in the wave of digitization that reduces both transaction and information costs while connecting clients with businesses. What’s more, this technological trend opened the market to players who couldn’t previously enter this sector due to high entrance costs.

So what’s the deal? With the help of automation, a variety of processes are no longer processed manually leaving any place for human error. In monetary terms, the use of automated credit scoring results in reduced salary expenditures and operational costs such as the rent of big office space.

On the other side of the fence, clients gain access to credit resources online and they don’t have to spend a lot of time on the search. Hannah Keshishian, an automotive analyst at Mintel, explains that “consumers currently view the car purchasing process as a necessary evil they must be subjected to in order to get a vehicle. They tolerate the current process because they feel they have no other options in terms of where to purchase from; however, as younger generations grow into their purchasing power, they might look to startups and other disruptors that will give them the experience they seek.”

According to the HES Fintech survey, $ 250,000 — 300,000 are needed to start a lending business based on a P2P platform. This figure includes the development of the lending platform itself and variable costs.

Business Opportunities That the P2P Approach Offers to Lessees and Lessors

According to statistics, SMEs worldwide usually face lack of resources to teach staff and develop business processes. Besides, many of them still suffer from outdated technologies with slow processes.

Lending platform solutions can solve any of the problems mentioned above:

- Using such software, SMEs do not need to hire a large staff team because most of the business processes are automatized by developers;

- Common business processes of the lending industry are already installed on a platform. Developers just need to adapt them to a particular SME request. What’s more, scoring algorithms of such solutions improve all the time, and potential customers get access to a relatively inexpensive, flexible, rapid, and more client-oriented alternative to classical services proposed by high street banks.

Auto Loan Industry Trends, and the Corresponding Role of the P2P Model

The global digital lending platform market size is expected to grow from USD 5.1 billion in 2018 to USD 12,1 billion by 2023, at a Compound Annual Growth Rate (CAGR) of 18.7% for the forecast period.

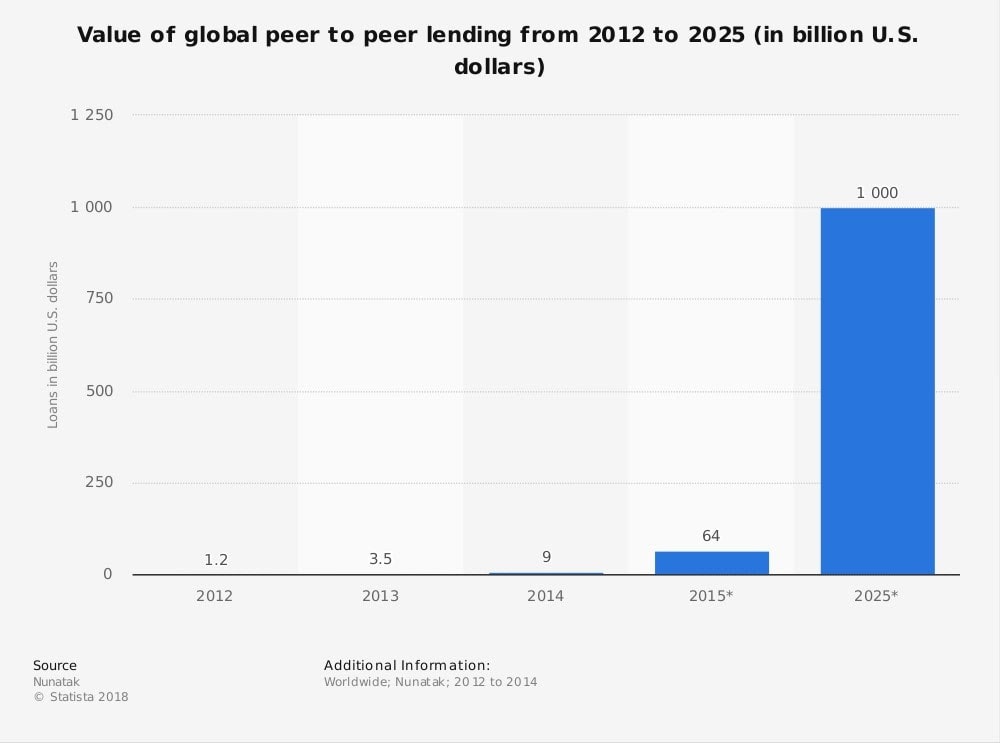

That means that more companies will likely switch to automation to improve their business processes with P2P solutions. The WEF report indicates that the industry of peer-to-peer lending is forecast to hit $ 1 trillion in global value by 2025. The main advantage of this approach for lenders is its unmatched flexibility paired with new offerings in lending services. With ever-changing market conditions and consumer demands, a robust P2P platform is a universal solution that can be used for different purposes. Now it’s time for all players to re-think what the new industry’s dynamics will mean for them. In tune with modern environmental trends, lenders can switch their product lines from classic automobiles to electric cars equipped with solar panels. From the data above, it’s evident that the LP&P2P industry offers a profitable investment opportunity for the next 10 years.