Modern markets in almost any domain are highly-competitive and it takes a lot to stand out from the competition, especially for small businesses and startups. SMEs and entrepreneurs require funds to develop their marketing strategies and introduce new operations on a constant basis.

Ironically enough, despite being a vital part of the global economy, those businesses are often overlooked by banks when it comes to business loans. For them, the process of raising funds turns into a real headache. For instance, Canadian banks require 32 pieces of information from SMEs to apply for credit, and still, a whopping 78% of loan applications are denied. Is that the financial inclusion big banks keep talking about so often? Surely not. Besides, even if applicants are lucky enough to pass the requirements, the process of obtaining funds turns into a burdensome and time-consuming issue. And it’s not solely about businesses. Individuals whose credit score doesn’t look good through the lens of traditional scoring methods experience the same difficulties as well.

The problem is especially acute in light of the global pandemic. According to the recent research by Facebook, a third of small and medium-sized businesses in the US will not operate when the pandemic is over. The majority (34%) of these companies indicated the lack of funds to pay bills and rent as the main reason for shutting down.

Hopefully, a sacred place is never empty, and the expansion of alternative lending has changed the lending scenery for good. Such a new approach in loans as P2P (peer-to-peer) lending bridges the financial gap, and now it is one of the most popular trends in the domain of lending.

The Essence of P2P lending

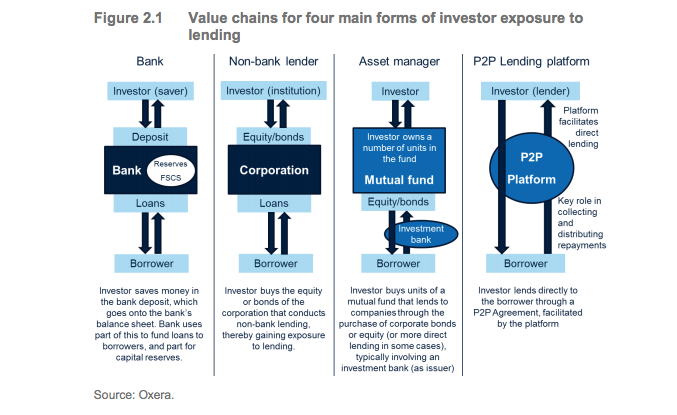

P2P lending is the provision of funds to individuals or legal entities through specialized online loan sites (P2P platforms) without direct mediation from the bank or other traditional financial institutions. Such type of lending contains two main sorts of deals: secured and unsecured loans, with the majority of them being unsecured personal loans.

For each case, the majority of platforms determine the interest rate for creditors based on the risk profile of the loan (or investors may participate in an auction indicating the minimum rate they’d be willing to start the project with). The investor selects a project and sends an application on participation to the organizers of the P2P platform. The next step is the drawing of a contract between a borrower, a lender, and the online platform. In most cases, the contract is certified either by electronic signature or in its traditional form sent by a courier. Finally, the borrower gets the aforementioned credit funds, the lender receives his percentage upon the projects’ completion while the platform charges a fee (usually, up to 5% of the loan amount from the borrower and up to 1% per annum from the creditor) for its services.

On the global scale, one of the most popular P2P lending market leaders is Lending Club, an American company that started its journey back in 2007, and received a valuation of $ 5.4 billion following its IPO in 2014.

Advantages of Peer-to-Peer Lending

Let’s outline the main advantages of peer to peer approach for investors, shall we?

- High risk-adjusted returns. Principally, lenders receive higher returns on invested funds. This happens partly due to competitive rates of P2P platforms compared to traditional banks as administrative and invoice expenses (personnel costs, office rental and etc.) to create a P2P business are relatively low.

- Loans for a wide range of borrowers. P2P lending provides wider access to credit. Following the global financial crisis of 2008, banks and traditional credit organizations have become more selective in choosing borrowers. As a result, both individuals and small/medium-sized businesses that do not satisfy modern credit criteria cannot access credit. Peer-to-peer platforms aren’t that strict, and investors may reach a wider range of borrowers.

- Low default rates. Loan losses for platforms for business and consumer loans are usually around 2-3%.

- Positive public image. There’s an opinion that P2P lending is more responsible and has a higher social value compared to bank lending, as often traditional financial intermediaries use their dominant market position to receive profits without due attention to the interests of their customers.

Disadvantages of P2P Lending

Naturally, peer-to-peer lending (just like any type of lending) contains some drawbacks, therefore, it is vital to realize the following risks when starting out a business.

- No guarantees. Despite low default rates, there’s no governmental insurance nor any way of retrieving money back if a borrower goes default.

- The risk of large-scale cyber attacks. As P2P activities happen online, there is a risk associated with cybersecurity — starting from platform server overloads and ending with identity theft.

- Taxes. May not be a direct disadvantage, but interest gains are subject to taxation to declare in the tax return.

- Overregulation. There’s a possible increase in regulatory restrictions and the formation of additional rules and requirements for risk operations. This may result in slower development of the sector.

How to Choose a P2P Lending Platform

The success of a peer-to-peer business depends on three main cornerstones. Therefore, when choosing a platform, it’s worth asking a potential vendor about the following features.

Flexibility

First of all, the solution must be flexible. There’s no way I can stress this aspect more. A modern P2P platform should allow customizations according to various business requirements or changing regulatory frameworks to launch and run a P2P platform.

Automation

A decent solution is the one with a holistic modular architecture able to automate the P2P lending process in its integrity, starting from the origination of a loan to risk assessment and collateral management.

Integration

Integrations with 3rd party services for KYC & AML compliance, identity checks, credit bureaus, digital signatures are also important.

To Sum Up

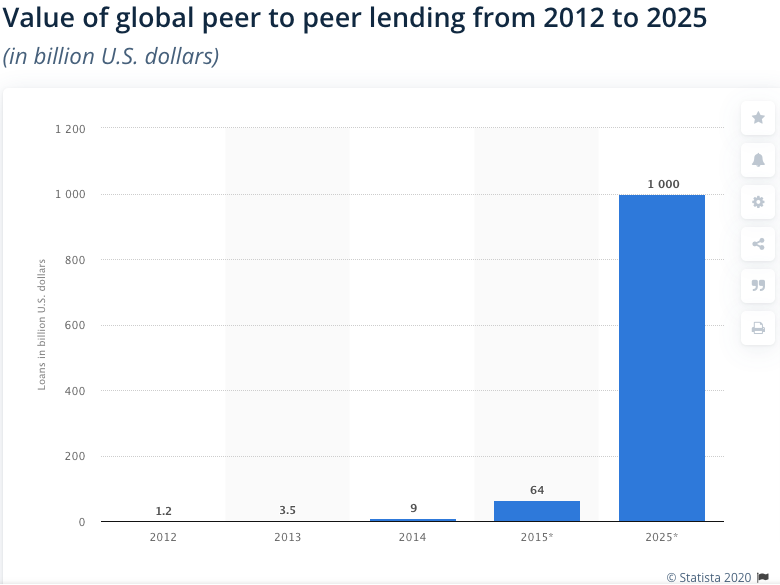

The picture above says it all. P2P loan platforms have become a large part of the financial market offering attractive investing tools to private individuals and seasoned investors. As stated in the first paragraph, one of the reasons for such growth is credit deficit. Crisis, pandemic, or whatever it might be, population and businesses still need to get small loans, while traditional institutions still decline them as (in banks’ eyes) they do not provide high returns and contain high risks. This new reality provides good prospects for companies in the field of P2P lending, both established and startups.

Source: https://hesfintech.com/blog/the-pros-and-cons-of-peer-to-peer-lending-business