Introduction

The World Bank describes that “the number of poor worldwide remains unacceptably high, and it is increasingly clear that the benefits of economic growth have been shared unevenly across regions and countries” (World Bank Group, 2018, p. 23). Along with these incidents of economic chaos, civil war and governmental collapse plague developing regions (Prahalad & Hammond, 2002). Besides, poverty is mainly driven by economic factors, which include limited access to financial services (Beck & Demirguc-Kunt, 2006) and high inflation rates (Aisen & Veiga, 2006). Moreover, studies have argued that a low level of trust (Barham, Boadway, Marchand, & Pestieau, 1995) and corrupt government institutions harm the economic development (Olken, 2006).

Crypto currencies could provide a significant benefit by overcoming the lack of social trust and by increasing the access to financial services (Nakamoto, 2008) as they can be considered as a medium to support the growth process in developing countries by increasing financial inclusion, providing a better traceability of funds and to help people to escape poverty (Ammous, 2015).

Introduction to crypto currencies

To provide a comprehensive overview of the opportunities of crypto currencies in developing countries, it is necessary to understand the general advantages and disadvantages crypto currencies provide for users compared to central bank-issued fiat currencies, like the Euro or the US dollar, and to discuss how they emerge from the underlying technology. For this purpose, the example of two crypto currencies is used in this paper. The underlying technology of most crypto currencies is blockchain technology. A blockchain is a decentralized database that is distributed in the network on a variety of computers. It is characterized by the fact that its entries are summarized and stored in blocks.

The first crypto currency discussed in this paper as an example is Bitcoin which is technically, “an algorithm that records an ongoing chain of transactions between members of a decentralized peer-to-peer network and broadcasts these records to all members of the network” (Ammous, 2015, p. 19). Bitcoin is the world’s biggest crypto currency with a market capitalization of more than $189 billion[i]. It was invented by Satoshi Nakamoto in 2008 when he has published his white paper “Bitcoin: A Peer-to-Peer Electronic Cash System” (Nakamoto, 2008).

Secondly, Ethereum is used as an example which is a blockchain-based, public, open-source, computing platform and operating system for smart contracts. This platform supports a modified version of Nakamoto’s consensus mechanism and was proposed in 2014 by Vitalik Buterin (Buterin Vitalik, 2014; Rizzo et al., 2016). The underlying crypto currency is called “Ether”. It is the second biggest crypto currency in the market with a capitalization of over $18 billion[ii].

General advantages and disadvantages of crypto currencies

This section presents the main advantages and disadvantages of crypto currencies compared to central bank-issued fiat currencies and discusses how they emerge from the underlying technology. Furthermore, a comparison with existing solutions is provided to show the practical relevance of crypto currencies.

The first advantage is that crypto currencies combine important properties to foster trust, such as accountability and transparency, which allows trust free interactions between counterparties. The underlying blockchain technology uses consensus mechanisms, hash functions and public and private key encryption to control transactions, which leads to the fact that the user does not have to trust the counterparty. However, the user must trust the network and the underlying blockchain. Thus, it is essential to secure the blockchain against fraud and attacks.

For central bank-issued currencies, trust is established by third parties like intermediaries, and in almost every digital transaction in a fiat currency, an agent is employed to oversee the exchange. Transactions conducted by intermediaries do not only take time, but they also result in a risk premium for the user due to higher transaction costs (Pilkington, 2016).

Another benefit of the decentralization of crypto currencies is that governments cannot manage them. Hence, crypto currencies are not restricted to a specific geographic area and can be traded around the world. Therefore, Bitcoin can be used to provide low-cost money transfers, particularly for those seeking to transfer small amounts of money internationally, such as remittance payments (Scott, 2016). This money can often be transferred cheaper than with central bank-issued currencies, because using crypto currencies allows worldwide financial transfer without the need of an intermediary institution. In addition, the speed of money transfer is increased by eliminating intermediaries.

Nevertheless, these border independent payments also have some negative aspects, which need to be considered. One characteristic is that it makes it easy to transfer money from illegal activities or to finance terror activities without the possibility of government intervention (Fernholz, 2015). In contrast, to traditional money transfers, the user in the Bitcoin system is pseudonymous. Contrary to a bank account user, they do not have to get through a “Know Your Customer” (KYC) process, where the user must identify himself, to have access to the Bitcoin market.

Moreover, the decentralization and “the lack of flexibility in the Bitcoin supply schedule results in high price volatility” (Iwamura, Kitamura, Matsumoto, & Saito, 2014, p. 1). This high price volatility does not only holds for Bitcoin but for most of the crypto currencies, which makes it hard to store money and to make contracts in crypto currencies (Lo, 2014).

The lack of flexibility in the Bitcoin supply schedule results in high price volatility.

Another aspect of crypto currencies is that they support financial inclusion because they do not require high technological standards besides having access to the internet and a digital device (for example a smartphone) to engage in transactions (Dow Jones Institutional News, 2018).

Furthermore, no government or central bank can influence the supply of crypto currencies, because the supply is defined in the underlying protocol of the crypto currency (Nakamoto, 2008). Therefore, no state can influence the flow of money, which limits governmental power.

Due to the loss of power for the government and the risk of terror financing some countries have prohibited the use of crypto currencies, for example, Indonesia. The Indonesian central bank has published a press release at the 13th of January 2018 that “forbids all payment system operator […] in Indonesia […] to process transactions using virtual currency” (Bank Indonesia, 2018, p. 1). This action shows that some states see crypto currencies as a real threat, which outweighs the advantages crypto currencies provide for those countries.

Developing countries and poverty

The following section provides a definition of „developing countries“. Moreover, it also gives an overview about which countries are classified as developing countries and are therefore in the focus of this study.

A developing country is a country with a low Human Development Index and a less developed industrial base relative to other countries (O’Sullivan & Sheffrin, 2003). There is no agreement which countries are categorized as developing countries. However, most of the countries which are declared commonly as “developing countries” have various aspects in common, which can therefore be seen as criteria for developing countries. These similarities are inadequate supply of food for large groups of the population, low per capita income and poverty, a lack of educational opportunities, a lack of access to quality health care which goes along with a high infant mortality rate and low life expectancy. All these aspects lead then to higher unemployment in developing countries, and an overall lower standard of living. Furthermore, the existing assets in developing countries are often extremely unevenly distributed (Bundesministerium für wirtschaftliche Zusammenarbeit und Entwicklung, 2018).

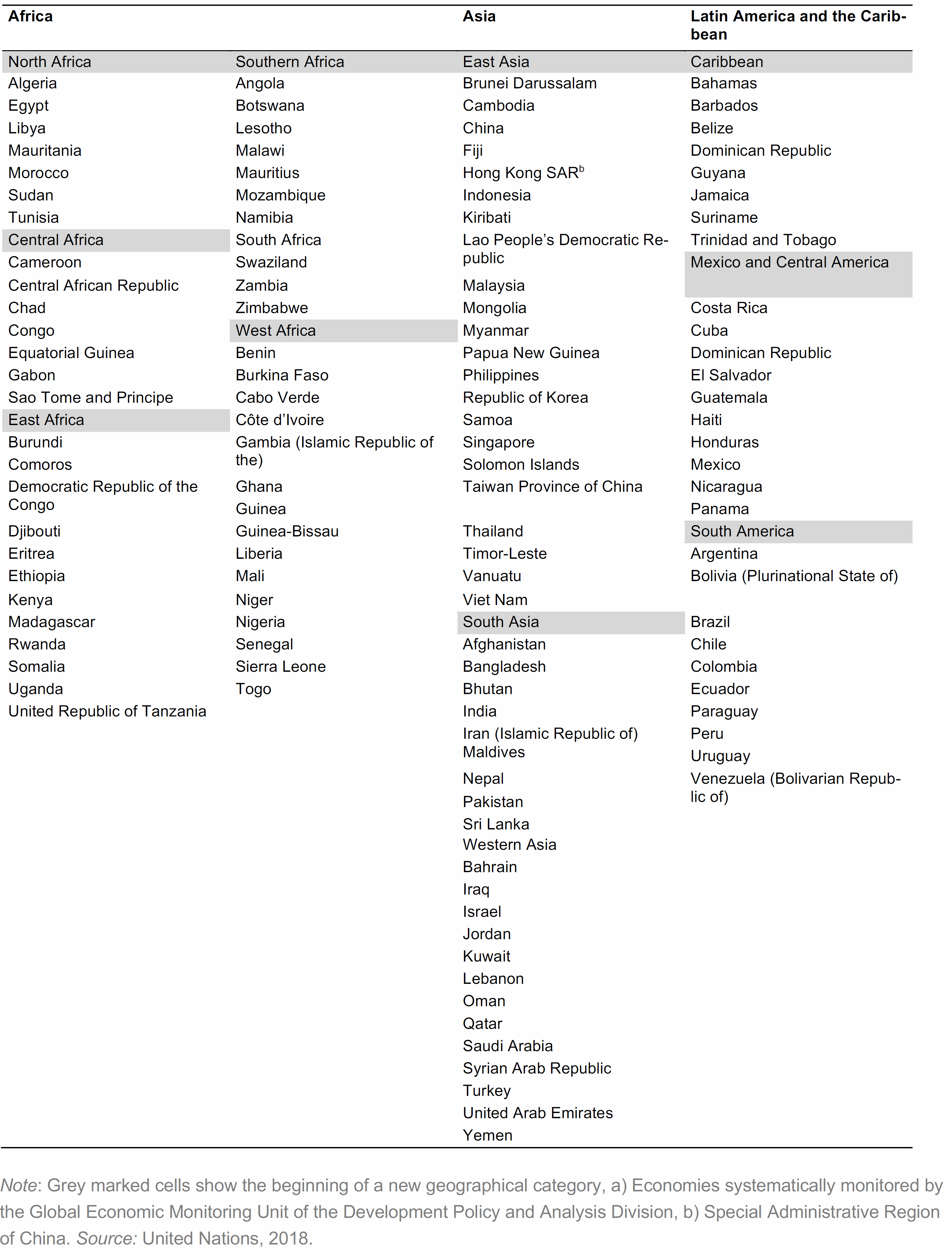

In the study “World Economic Situation and Prospects” from 2018, the UN delineate trends to show various dimensions of the world economy. The study classifies all countries in the world into one of three broad categories: developed economies, economies in transition and developing economies. The composition of these groupings is intended to reflect the economic conditions in these countries (United Nations, 2018). However, many countries cannot be placed entirely in one single category, because they often have characteristics that could place them in various categories. Anyhow, the UN has created the groups mutually exclusive. A complete list of all countries the UN and this study considers as developing countries alongside with their geographical classification can be found in Appendix A.

In the following, the main economic issues of developing countries will be explained. Note that they are not exhaustive, and there are also other problems like a low educational level and inadequate medical care, which can be considered in addition. One reason for poverty is the limited access to financial services (Beck& Demirguc-Kunt, 2006). Many studies have proven that financial inclusion is essential for the development of a country. For example, Honohan (2018) observed in his study, that poverty is linked to access to financial services, and that limited access to financial services is a significant problem itself. Financial services can help because they provide people with the opportunity to protect themselves against situations of financial shortage (Honohan, 2008).

Financial intermediaries are not only crucial for individuals but also for companies (Gorodnichenko & Schnitzer, 2013), because they provide jobs and can grant loans. Furthermore, firms could be forced to a suboptimal behavior, if financial frictions are severe (Gorodnichenko & Schnitzer, 2013). Due to the detrimental situation of the companies, when they do not have access to financial intermediaries, they cannot get funding for innovation leading to competitive disadvantages compared to companies abroad. Additionally, they cannot exploit potential complementarities between innovation and export activities, which further increases the productivity gap (Gorodnichenko & Schnitzer, 2013). Thus, firms in developing countries are not able to generate as much revenue and profit as desired and therefore, support the local economy less through fewer jobs, lower salaries and an overall lower tax volume.

Another problem of the limited access to financial services for companies and individuals is that they cannot participate in worldwide trade. This is because a bank account, with an international transaction identification, for example SWIFT identification, is required. Firms without bank accounts are excluded from a wide range of international services and are hindered in selling products outside their region (Scott, 2016).

Another problem in developing countries is a low level of social trust, because social trust tends to improve economic growth and the standard of living (Barham, 1995). As social trust is highly correlated with equality, economic equality and equality of opportunities, social trust is inferior in most of the developing countries. It would be helpful for these countries to increase the level of social trust, but many countries with low social trust are stuck in a so-called social trust trap. The logic of such a situation is that social trust will not increase as long as there is high social inequality. However, public policies that could remedy this situation cannot be defined because there is a lack of trust (Rothstein & Uslaner, 2005).

The next problem in developing countries is the issue of corrupt government institutions. Corruption tends to lead to a welfare loss as only a small group of people benefits from bribes, and many people suffer from the consequences of lower government income. In some cases, corruption can even outweigh the benefits of redistribution programs, such as Olken (2006) has shown for Indonesia.

Opportunities through crypto currencies in developing countries

Based on the analysis of the economic problems in developing countries, crypto currencies can accelerate the development process potentially in various fields. In general, new technologies and innovations are key solutions for the catch-up process of developing countries as Chudnovsky and Lopez (2006) have pointed out.

People need access to the internet to benefit from crypto currency-based enhancements, as only people with internet access can trade crypto currencies. For this reason, it is good and necessary that the usage of the internet in developing countries has increased dramatically over the past decade (Aker & Mbiti, 2010; Tapscott & Tapscott, 2016).

In Figure 1 the internet user penetration rate of the total population is shown by region. It compares the current status, with an estimated future status to see the development over the years from 2017 to 2025.

It can be seen, that the share of internet user of the total population is expected to increase significantly in the whole world. The growth rate is especially high in areas with more developing countries like in the Sub-Saharan Africa region with a growth rate of over 90%. This shows that developing countries have a rapidly growing interest in the internet and the related innovations.

Figure 1: Internet user penetration rate of population in 2017 and 2025, by region

Without crypto currencies the local fiat currency must often be exchanged to more wide-spread fiat currencies like the US dollar or the Euro and then must be converted again into the target currency, since there is often no liquid market for the exchange of the fiat currency to the target fiat currency. This process could be optimized through crypto currencies, which could make it faster and cheaper (Ammous, 2015).

For example, a Chicago-based Indian worker could use a local service provider that transfers US dollars to Bitcoins to transfer money to a family member in India, where the family can then deduct Rupees at a local service provider, which changes Bitcoins to Rupees. This would make companies as Western Union reluctant. However, it is essential to have a liquid market for the exchange of Bitcoin to US dollar and to Rupee to increase efficiency. To create a liquid market for Bitcoins some start-ups have been founded, such as BitPesa in Kenya, which provide liquid markets for some specific currency corridors, e.g. for the direct exchange of Kenyan Shilling to US dollar.

Crypto currencies could furthermore solve the problem of the participation in international trade without having a bank account. Crypto currencies like Bitcoin could help individuals and businesses to facilitate small-scale international trade. Using Bitcoins enables these parties to sell products in exchange for Bitcoin and thereby avoiding traditional e-commerce systems (Scott, 2016), which often involve having to set up a merchant account with a formal bank.

Another way of how crypto currencies could help to increase financial inclusion in developing countries is by serving as a quasi-bank account, since everybody with internet access can download a Bitcoin wallet (Honohan, 2008). This wallet then can be used as a quasi-bank account, where people can conduct savings, and daily transactions (Scott, 2016).

The decrease in transaction costs could also increase the possibility for microcredits because currently, money transactions face high costs. The elimination of these costs would open immense possibilities for international financing. Using crypto currencies enables individuals in more developed countries to make small money transfers to people in developing countries. This transaction might be for a small amount of money but could be life changing for an individual in a developing country.

Such microfinance transactions are currently expensive because the borrowing and the repaying transactions, face transaction fees that are almost as high as the payment itself. However, when transaction costs are massively reduced or are even eliminated, such loans could become more widespread (Ammous, 2015).

In addition, crypto currencies, predominantly in combination with smart contracts, can contribute to strengthening social trust and fighting corruption through a more transparent contract system. Citizens can use the publicly available record data of the crypto currencies in the blockchain to monitor the way in which the state funds are used. It would also allow governments to track their spending better and to improve their budget allocation (Schmidt Kai Uwe, 2017).

Discussion

Based on a literature analysis, the following part of this paper consists of a qualitative analysis based on expert interviews. The interview partners have been selected via the social networks Xing and LinkedIn. The participating experts vary widely with respect to their background knowledge from a Fintech start-up representative, a lecturer, to a consultancy ambassador. The experts also differ significantly with regard to the region they live and work in, from Argentina, Kenya, Switzerland to Singapore. An overview of the involved experts can be found in Appendix B.

Crypto currencies and local fiat currencies

Regardless of the form, money must fulfil three main functions. Firstly, it has to be accepted as a medium of exchange for the trade of goods and services. Secondly, it must be suitable as a medium to store value for saving wealth. Thirdly, it must act as a unit of account, to measure and compare the value of goods (Ammous, 2018). In Figure 2, crypto currencies are compared with with gold, the oldest form of money, and with central bank-issued fiat currencies with regard to different traits of money.

In Figure 2, it can be seen, that the traditional types of money, gold and fiat money, fulfil all traits of money to a high or medium level. The fact, that crypto currencies are highly divisible and globally transferable leads to the conclusion that crypto currencies are highly suitable for the role as a medium of exchange (Ammous, 2018).

The advantage of gold is that it is the best collateralized form of money because the exchange medium already carries value in contrast to banknotes or digital money. The most significant difference between fiat currencies and crypto currencies is that fiat money is controlled by the central bank and therefore fully centralized, contrary to the decentralized organization of crypto currencies.

For crypto currencies the decentralization and the lack of collateral leads to the high level of price volatility. Therefore, the store of value function and the unit of account function are harmed (Expert 4, 2018).

Figure 2: Comparison of different types of money, Source: Own illustration

The price volatility can be seen as the main problem of most crypto currencies (Expert 4, 2018; Expert 6, 2018), since the value of money has to be stable enough, that there are no huge financial fluctuations, during the value transfer (Expert 1, 2018). To achieve a more stable price level and lower fluctuations, many crypto currencies progress in the direction of a more formally regulated currency (Expert 5, 2018). Moreover, there is a trend of many crypto currencies to change from a total decentralized system to a more centralized system, in which some actors have the decision power to increase the development possibilities (Expert 5, 2018). Many crypto currencies change from a decentralized system to a centralized system, even if this change results in the decline of the main benefit, the complete uncontrolled financial freedom of crypto currencies (Expert 7, 2018). The price volatility can be reduced due to the fact that only through centralization and support by economic policy decisions crypto currencies can grow substantially (Aisen & Veiga, 2006).

To get political support, crypto currencies need to be limited by national boundaries, so that the governments can control the economic parameters to keep monetary sovereignty (Expert 6, 2018). This would result in a centralized system with governmental control, which diminishes many advantages of crypto currencies.

Based on the interviews, it can be assumed that crypto currencies are currently no complete substitution for fiat currencies and add only a few additions to fiat currencies. Furthermore, this has led some national authorities to characterize crypto currencies as a digital asset rather than a currency. In this sense, it has similarities with gold, where it is also unclear as it should be perceived as an asset or as a form of money. It can be said, “that (i) Bitcoin is a digital token that can be moved between parties, and (ii) the token has market value in terms of major national currencies (the token can be exchanged for [US] dollars, pounds and other currencies) and (iii) it is sporadically used — albeit often in small amounts — in exchange for real-world goods and services” (Scott, 2016, p. 3).

Crypto currencies in developing counties

As Expert 2 (2018) mentioned in the interview the impact of crypto currencies on the improvement of developing countries is not noteworthy yet, because the technology is still at its infant stage. In addition, Expert 2 stated, that there is currently only limited adoption of crypto currencies and the positive effects of crypto currencies will only occur if there is mass adoption (Expert 2, 2018). Similar to this view, Expert 1 (2018) argues that currently the support for the improvement process in developing countries with the help of crypto currencies is not given, mainly due to the small adoption.

Expert 1 stated, that the regulation of crypto currencies is crucial for its future development and adoption because it determines which degrees of freedom and benefits crypto currencies can keep. The regulation of crypto currencies must be well balanced. They should not be too strict that all benefits are mitigated, but the regulation must be strict enough that crypto currencies are politically supported, because only with political support it can come to a massive adoption of crypto currencies (Jaag & Bach, 2015).

Currently, crypto currencies are generally not politically supported, because of the fear of fraud and of losing control over economic policies such as monetary policy (Expert 6, 2018). This result in the consequence that “the usage of crypto currencies has been prevented by different countries” (Expert 6, 2018). The fear of losing control stems from the fact, that national governments cannot regulate crypto currencies and therefore, its money supply. This leads to the loss of their financial sovereignty. A solution to keep the financial sovereignty alongside with crypto currencies is to issue a central bank-issued digital currency (Lagarde, 2018).

The usage of crypto currencies has been prevented by different countries.

There is great potential to further strengthen the development of developing countries with the help of crypto currencies for example, by reducing corruption through enforcing social trust or by increasing financial inclusion of the population (Rothstein & Uslaner, 2005). Moreover, crypto currencies can allow people and firms to utilize technologies and increase the speed of development (Expert 3, 2018). However, it must be noted that realizing this potential is often significantly harder than it seems due to various limitations. Examples of such limitations are illiteracy, financial illiteracy, unstable political situations, unstable job markets and price volatility (Expert 7, 2018).

Improvement of financial inclusion in developing countries

The improvement of financial inclusion is the most significant and most developed benefit of crypto currencies for the population in developing countries (Darlington, 2014). As previously shown, crypto currencies can lower the transaction time and costs significantly and can act as a type of bank account that allows people to make savings and conduct daily transactions (Honohan, 2008; Scott, 2016).

However, the realization of the benefits of the financial inclusion is associated with various issues. One difficulty is that crypto currencies are not widely accepted and therefore have to be exchanged to the local fiat currencies, that their value can be used to purchase real-world items (Expert 5, 2018; Expert 1, 2018). For the exchange procedure, it is often necessary to have a traditional bank account. This requirement limits its impact because those without a bank account cannot use the stored value in crypto currencies. Consequently, “crypto currencies face the same problems, which traditional banks are facing” (Expert 5, 2018). Crypto currency themselves can be used without a KYC process. However, the exchange of crypto currencies into the local fiat currency requires a KYC process, for which the applicant needs a document of identification. People without identity papers are therefore excluded (Expert 5, 2018).

In addition, crypto currencies can help to execute transactions much faster and cheaper than traditional bank transfers, such as the SWIFT process (World Bank, 2018). By eliminating some intermediaries, mobile payment operators and crypto currency transactions can reduce the costs and increase the speed of the transactions (Tapscott & Tapscott, 2016).

Crypto currencies can be very promising for remittance payments. The lower transaction costs for using crypto currencies will also leverage microcredits since only a smaller amount of each transaction will be deducted for banking and the conversion fees (Expert 5, 2018; Expert 6, 2018; Scott, 2016). However, the lending process is currently restricted to small amounts, particularly for individuals in the low-income segment, due to the fact, that the items they own are typically difficult to efficiently collateralize with traditional financial tools. For example, it is difficult for banks to grant loans with life stock as collateral (Expert 7, 2018).

Furthermore, crypto currencies help to create access to the world market for businesses particularly when they want to expand (Expert 1, 2018). Their customers can then pay companies from other countries in crypto currencies even if the firms do not have a bank account with an international identification. For example, a website developer in a developing country can get hired by customers outside of his country and can get paid in crypto currencies such as Bitcoin (Ast, 2018).

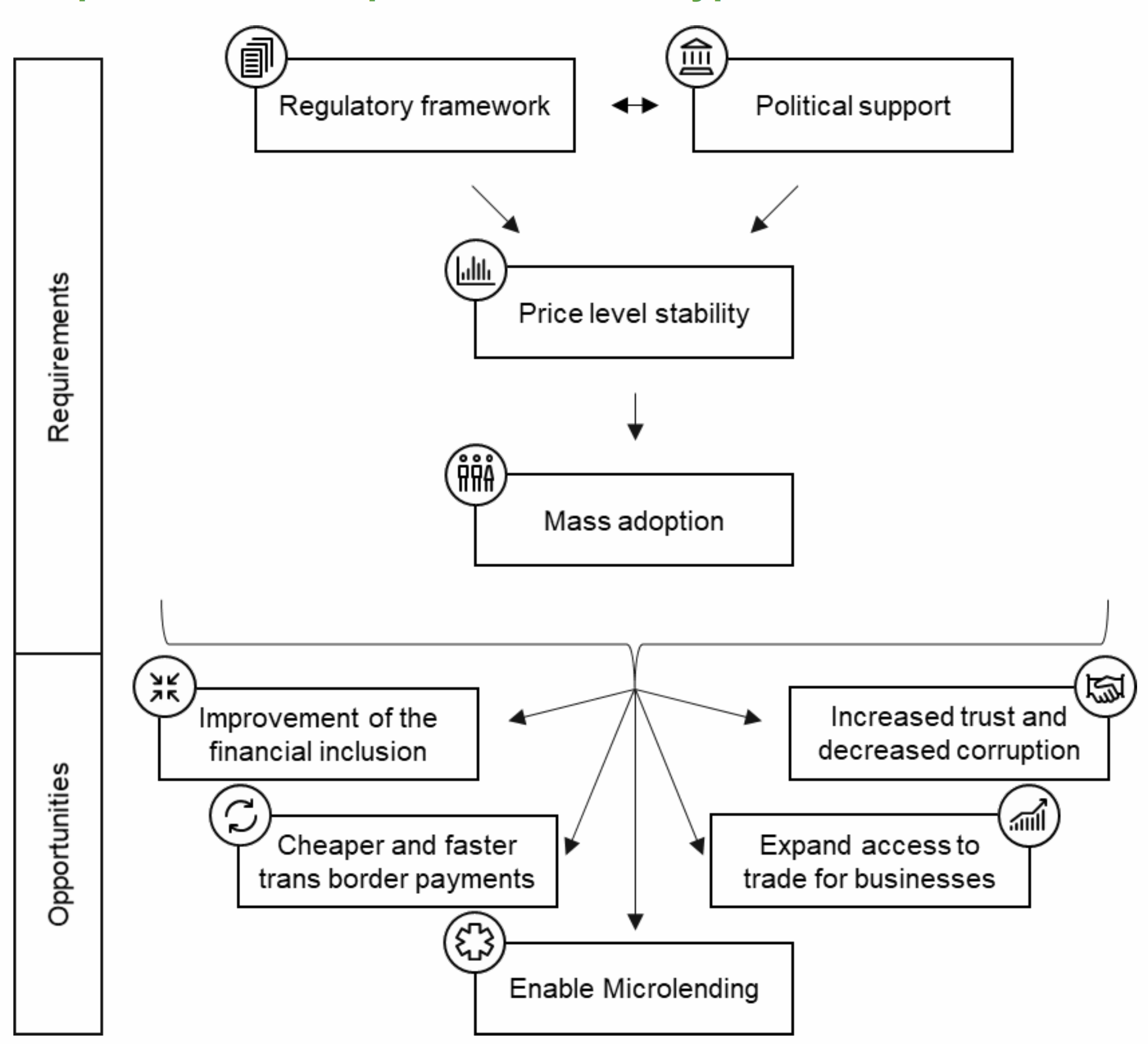

Figure 3: Requirements and possibilities of crypto currencies, Source: Own illustration

Figure 3 shows the summarized requirements and the opportunities of crypto currencies in developing countries. In the upper part, it can be seen that a sound regulatory framework and political support are required to achieve a stable price level. A stable price level is then a prerequisite for the mass adoption of crypto currencies (Jaag & Bach, 2015; Scott, 2016).

Only when all of these requirements are fulfilled crypto currencies can unfold their full potential and improve the financial inclusion, make cross-border payments cheaper and faster, enable micro-lending, expand the access to trade for businesses, increase the social trust and decrease corruption (Darlington, 2014).

Limitations and further potential areas of crypto currencies

Cross-border payments are currently the most significant use case for crypto currencies, due to the reduced transaction time and costs. Also, the Libra project, initiated by Facebook, aims to significantly decrease fees of cross-border payments by using blockchain technology (see Groß, Herz, Schiller, 2019). Currently crypto currencies are mostly used for cross-border payments. However, the importance for cross-border payments could in the future be overtaken by peer-to-peer lending through an even broader market since peer-to-peer lending helps to solve liquidity problems, specifically in developing countries. Furthermore, the collateralization issue could be solved partly by community trust as Expert 6 (2018) has mentioned.

Another area of interest for crypto currencies could be internal systems in large organizations or governments. It would be an promising application because it would increase the credibility to a level that current tracking systems cannot provide (Expert 4, 2018; Expert 1, 2018).

A specific case where Ethereum could be beneficial is the case of smart contracts, because crypto currencies are necessary to conduct smart contracts, as an incentive model, so that other people can operate the blockchains and the underlying infrastructure (Expert 5, 2018). Currently, the crypto currency Ether is mostly used to pay for these services. Based on the smart contracts, there are many applications, and for this reason, these contracts are an essential factor for the future use of crypto currencies (Wood, 2014).

One other possible application for smart contracts is the social security system. Currently, multiple layers of bureaucracy handle payments like unemployment benefits, to which the society must pay commission fees. With smart contracts, these bureaucracy costs could be eliminated. The social benefit payments could be linked to conditions defined in a smart contract (Expert 6, 2018).

All of these potential areas require low price volatility (Expert 2, 2018; Darlington, 2014), which is currently not given. In addition, the use of crypto currency heavily depend on the regulatory framework. A relatively lax regulatory system would increase price volatility and would make it possible to misuse crypto currencies for illegal transactions, like money laundering. On the other hand, a too strict regulatory framework would diminish the advantages of crypto currencies (Expert 7, 2018).

Conclusion

Overall, crypto currencies can have a considerable impact on developing countries, by increasing financial inclusion of individuals and companies. In particular, by reducing the transaction fees and time, cross-border payments can be improved (Scott, 2016). This is beneficial for remittance payments, peer-to-peer lending and international trade. The underlying technology also supports the fight against corruption by having a more transparent tracking system for the use of funds (Darlington, 2014).

However, all these benefits heavily depend on the mass adoption of crypto currencies and the fulfillment of all three functions of money, and this is currently not given because of excessive price volatility. The lack of back-up and centralization does not support a stable price level (Ammous, 2018). A stable price level could be reached by stronger regulation and more political support for crypto currencies. However, crypto currencies can only get political support, if government or central banks have control over the money supply (Jaag & Bach, 2015). Nonetheless, this would reduce many benefits crypto currencies have.

Currently, crypto currencies support the growth process of the developing countries in very limited ways. The future development heavily depends on the regulations that will be introduced, the resulting price stability and adoption of crypto currencies.

Appendixes

Appendix A: List of developing countries by region

Appendix B: List of interviewees

Endnotes

[i] Data from Coinmarketcap.com, Accessed at 5th of September 2019: https://coinmarketcap.com

[ii] Data from Coinmarketcap.com, Accessed at 5th of September 2019: https://coinmarketcap.com.

Co-Author: Moritz Holtmeier, a graduate of the Frankfurt School of Finance & Management.