Ready to learn Internet of Things? Browse courses like Internet of Things (IoT) Training developed by industry thought leaders and Experfy in Harvard Innovation Lab.

YOU'LL BE HEARING A LOT ABOUT ESIM TECHNOLOGY IN THE COMING YEARS. IN FACT, YOU MAY ALREADY BE HEARING A LOT ABOUT IT — AND THERE'S GOOD REASON FOR THAT.

The development of embedded SIM technology — or eSIM, as it's more commonly known — is guided by GSMA specifications that describe the capability to remotely provision a SIM card already in place inside of a connected device. Although the GSMA describes eSIM as being a "vital enabler" of the growth of the machine-to-machine (M2M) ecosystem, the applications of this nascent technology are in fact even wider-reaching than pure M2M applications — and that not only opens up broad opportunities for IoT/M2M companies to define and own their category, it also creates a literal, built-in differentiator that will set them apart from competitive solutions and devices that are not eSIM-enabled.

Of course, SIM cards have been in use for years as the means by which GSM mobile network operators and mobile virtual network operators (MNOs and MVNOs) identify to which subscriber a particular GSM device belongs, with the "SIM" of SIM card being an acronym for Subscriber Identity Module. (CDMA networks and devices do not use SIM cards.) There's a huge fly in the GSM ointment, though: Changing networks means physically changing your SIM card. That's a minor inconvenience if you have one device, but an enormous problem if you have thousands of devices in remote field locations and need to change operators — imagine poor old Bob out there, schlepping it through mud and mosquitos, tracking down and individually changing all those SIM cards because his company was changing networks.

Alas, poor Bob!

Imagine, though, if instead of schlepping through the mud Bob was able to sit down with his laptop and send out an over-the-air update to all of his devices that switched the network to which they were connected. Instead of many wasted hours and company dollars, the entire process would take, say, thirty seconds — and suddenly it's beer thirty in the afternoon for Bob. (Or, as my ex-Wyless friends might say, "Bob's your uncle.")

That kind of remote provisioning/re-provisioning of SIM cards, as mentioned earlier, is exactly what the eSIM specification is designed to address — but aside from the large static deployments already discussed, there are other readily accessible use-cases that we can consider.

For example, OEMs that adopt eSIM technology will immediately be able to simplify their manufacturing processes, since assembling and shipping different lots of devices bearing differently-provisioned SIM cards can be ditched in favor of all devices, despite intended market, having the same eSIM card.

Likewise, solution providers can purchase the right devices for a given application without having to worry whether they will arrive with appropriately provisioned SIM cards. Instead, eSIM-enabled devices can be installed where needed, and then the best available network chosen once the devices are activated. Another case, one more directed at uses where the device itself is mobile, involves the capability for OTA selection of the best available network as the device translates from location to location — and the benefits of on-the-fly choice of best or lowest-cost connectivity are obvious. And to ice the cake, owing to its OTA addessability, is something of a "future-proof" technology that can upgraded in place to match concomitant advances in network technology and availability.

Sounds great, right? The problem, as KORE Wireless CEO Alex Brisbourne points out in "eSIM Matures, but how will Carriers Respond," is that developing a true eSIM ecosystem requires cooperation on the part of the MNOs — and MNOs, at least superficially, have a built-in disincentive to allow users (or the devices themselves) to select a network other than their own.

But Brisbourne, with an assist from AsiaInfo's Dr. Andy Tiller in "The embedded SIM: Operator opportunity, or operator threat," also points out that any MNO that disregards eSIM technology in favor of maintaining its walled-garden business mentality is hobbling its own potential in a high-growth environment where the business of connectivity is fundamentally changing away from what it's been for the past decades. Tiller sees huge opportunity for MNOs and MVNOS in being facilitative and collaborative solution providers, and not just connectivity portals or providers. In this way, he writes, "operators can embed themselves in the solution and claim a pivotal position in this developing marketplace."

Brisbourne picks up this theme, and echos Tiller's assertion that “[eSIM] provides a real opportunity to build new markets around devices and partnerships that would create even greater rewards and turn the operator into a provider of digital services,” but seems slightly more bearish than Tiller as to whether network providers are going to embrace the paradigm shift required to make this move — because such a shift is going to require the vision to see the path ahead, as well as the courage to walk it.

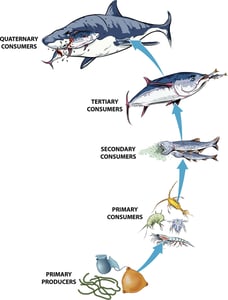

To some solution providers and OEMs slightly lower down in the ecosystem, though, how many options are available to a given device right now might not be as important as the future-proofing that eSIM affords them. Those folks are the early adopters of eSIM that will in all likelihood show the vast potential of the new paradigm, and help to drive increasing adoption both up and down the food chain.

There's risks, of course — specifications can be changed, or abandoned — but early adopters of eSIM technology have a built in differentiator they can push in their marketing efforts. It's important, though, for these early adopters to move quickly in defining their categories and owning their space before everyone else piles onto the bandwagon. Once that happens differentiation and competitive advantage are lost, and with that comes the very real potential to lose first-to-mind brand positioning.

I've written before on how to own and market your IoT vertical, and the opportunities in eSIM are essentially just a special case of those opportunities. For those with the vision to see that path, the potential rewards are huge — and even more so for those willing to be among the first to walk it.

Originally published at Threetwelve