Ready to learn Internet of Things? Browse courses like Internet of Things (IoT) Training developed by industry thought leaders and Experfy in Harvard Innovation Lab.

How to rethink your go-to-market (GTM) strategy for a connected world.

We can build the best camel there is.

But can we transport the camel to the right buyer? Do you have the right pallet for it? The right go-to-market (GTM) strategy is needed to ensure you have product-pallet fit to reach your buyers.

Beyond Product-Market Fit: Product-Pallet Fit

How your GTM adapts for a connected world is as important as reimagining your product strategy, as I covered in Part 1 of this series on IoT=IT+OT.

In this Part II, we’ll look at how these IoT offerings are sold and bought. We will start by looking at channel partner structure in IT and OT worlds and then show them side-by-side to see the almost bewildering impact on GTM strategy when IT meets OT.

GTM Partner Types

Regardless of whether your company plays in IT or OT, it’s important to take a look at the players in any GTM partner ecosystem before we complicate the discussion with IT+OT combo issues in GTM.

While the cloud has challenged traditional models for GTM, knowing the basic taxonomy and partner types is essential before you adapt them for IoT-Cloud. So, let’s look at that first. (If you are a purist, note that I’ll be using the words channel and partner interchangeably in this article to refer to GTM partners.)

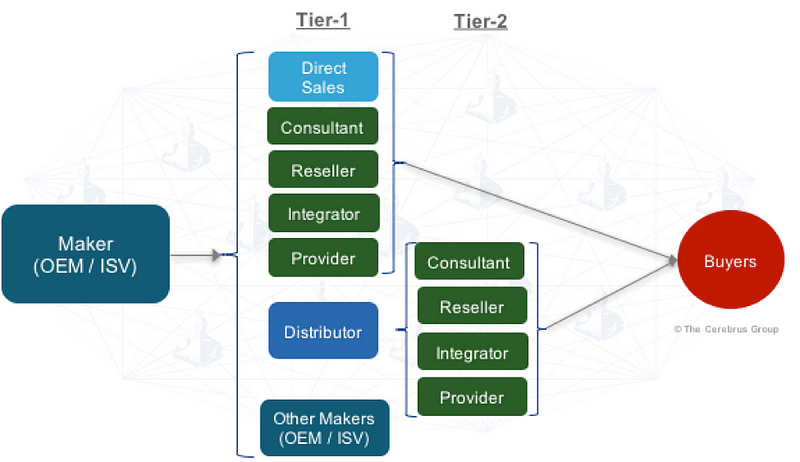

For any product maker, whether IT or OT, the GTM ecosystem looks like this:

Key points to note from this value chain view:

- Maker to Buyer: Left to right is the commercial and operational pathway for products to get to the right customers.

- Direct, Indirect, Tier-1, Tier-2: GTM channel is split into direct vs. indirect and tier-1 vs. tier-2; Indirect splits into tier 1 or tier 2 if an intermediary like a distributor is involved.

- Other Makers: Makers may sell to other makers. This is an OEM/ISV channel (also referred to as technology partner). Know that each OEM/ISV has its own GTM ecosystem facing buyers and it mimics the original maker’s GTM channel structure.

- ISVs: As your offer becomes cloud-delivered and accessible programmatically (via APIs), you will need to foster a software vendor ecosystem that needs to either run on your products or use your products to integrate with other solutions.

- Service Partners: The players in green are service partners who provide consulting (business and technology), resale, integration, and operational support and management (e.g. Managed Service Providers, MSPs). A given player might have multiple services practices that comprise their overall business (e.g. integration and managed service).

You will see different firms use different ways to describe and categorize these partner types. For example, Amazon Web Services simply clubs all the service partners under “consulting partners” umbrella. Some others might call them solution providers and so on.

So be sure-footed when you develop your strategy and normalize the taxonomy for your business’s needs.

GTM for IT + OT

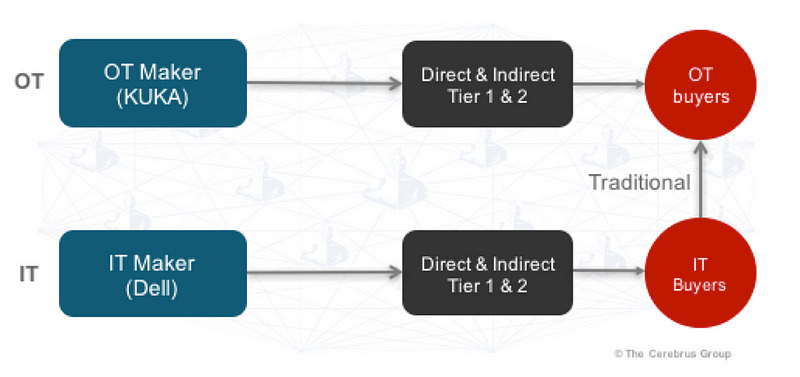

Having mapped out the generic ecosystem layout, let us now simply put the ecosystems for IT and OT makers side-by-side, for example, by pitting KUKA, the robot maker and Dell, the IT maker together.

For simplicity, I have collapsed the different GTM players inside the grey boxes rather than show every role from the prior graphic.

The picture suggests that IT Maker sells to IT buyer and OT Maker sells to OT buyer and the twain meets when IT and OT collides inside an organization to make the IT+OT solution work!

Intuitive? Perhaps. Sounds like a terrible idea? Of course, it is.

Such an approach will never get adopted or scaled for many reason:

- It’s inefficient with so many B2B hand-off’s in the value-chain.

- The onus to get the solution right falls on customer’s OT ops and IT ops.

- Will you find enough KUKA-Dell talented people to make it all work?

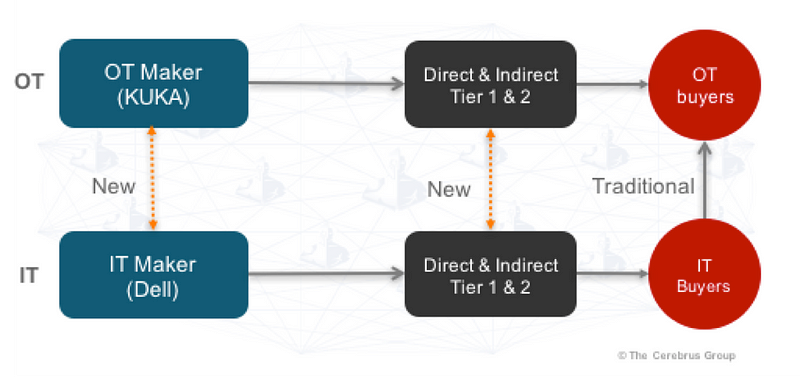

Here lies the entire reason to rethink GTM strategy. You have to foster solution-thinking further upstream in the value chain. Not at the staging site of the customer. AND you have to foster collaboration across the value chain.

Selling scalable IoT solutions require collaboration across the value chain as well as up-front integration of the solution, long before it reaches the buyer.

The resulting picture looks like this:

It shows industry-level collaboration to create the right IoT solutions and take it to market.

Let’s be realistic too. It isn’t going to be all harmony all the way. While collaboration is essential, it will be forced on players in the value chain who are currently competitors, causing the dynamic that I call Frenemies and Knotted Value Chains. But eventually customer success will drive the right behavior.

Summary

I have barely scratched the surface of GTM strategy in the IoT world. We saw the complexity involved.

As we saw in Part I of this series, the product is changing to become consumption-centric. The offer evolution is pulling traditional channel deliverables like support, management, and integration to the cloud, towards the maker, as part of the consumption-friendly delivery of the product.

Consumption-centric offer evolution creates a horizontal pull of deliverables towards the maker and necessitates vertical skill integration between OT and IT partners.

We can see why most organizations struggle to navigate this transition to consumption-friendly IoT and orchestrating the IT+OT ecosystem. It requires changes on multiple fronts at the same time:

- Consumption-centric offer

- Subscription financial models

- Channel orchestration

- And direct and indirect channel incentives, just to name the top challenges.

Who said life is easy when IT meets OT? It’s simply is exciting.

In Part III of this series, we’ll look at how M&A and venture investing strategies change in a connected world.

Originally published at iotforall.com