Ready to learn Blockchain? Browse courses like Blockchain for Finance Professionals developed by industry thought leaders and Experfy in Harvard Innovation Lab.

Authors: Manuela M. Schöner, Dimitris Kourouklis, Philipp Sandner, Erick Gonzalez, Jonas Förster.Download the article as PDF file. More information about the Frankfurt School Blockchain Center on the Internet, on Twitter or on Facebook.

With this paper, we present a blockchain-based solution to increase supply chain security for the pharmaceutical industry. Supply chain security is one aspect that has recently won attention, when the Drug Supply Chain Security Act (DSCSA) has been implemented in the U.S. to, amongst others, fight the counterfeit drug problem. During the second “{Life Science} meets IT” hackathon in Heidelberg a team of enthusiastic young professionals and students developed a prototype solution that is able to guard people’s life with a patient-empowering blockchain solution and won the first price with their prototype LifeCrypter.

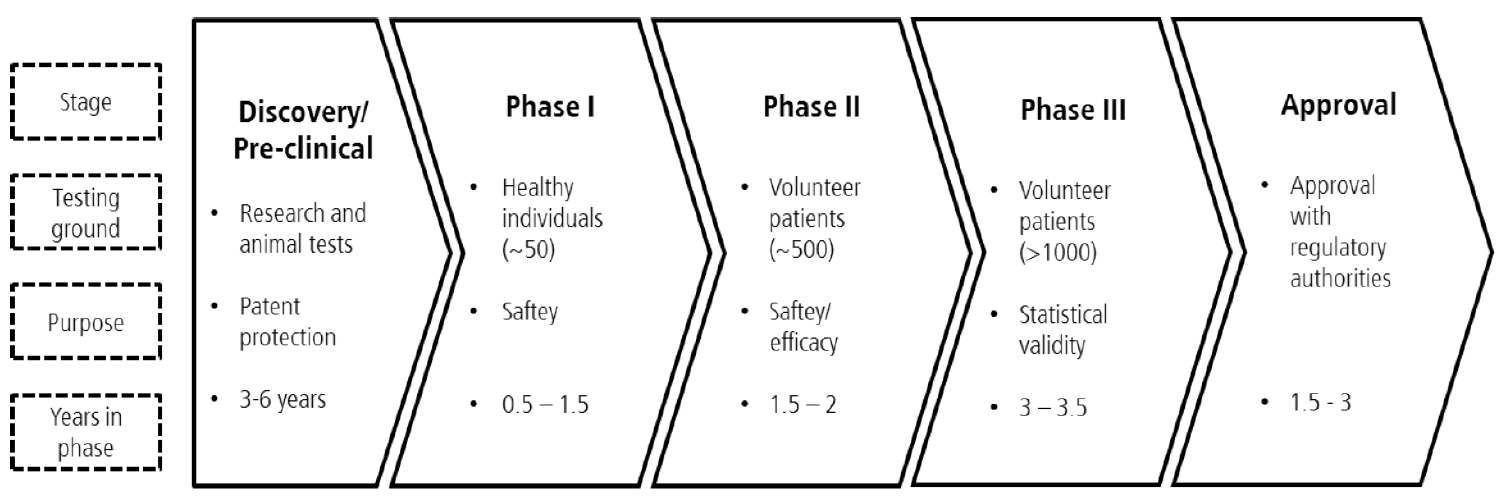

The pharmaceutical value chain starts with the drug development process. We know that the pharmaceutical Research & Development process (R&D) is a complex development process that on average takes about fifteen years from drug discovery to regulatory approval (Ding, 2014).

It is structured into different phases, from the first phase, where the company decides to invest into a certain project to several test phases and a final stage where market access is granted. The research part starts with the discovery phase followed by pre-clinical testing phase after which companies usually file for patent protection.

Figure 1: The drug development process (Based on Himmelmann, 2009)

Clinical trials start with initial human testing on healthy volunteers followed by testing in a larger group of patients to establish safety and efficacy. The trials consist of three consecutive phases: phase I, phase II and phase III, in which safety, effectiveness, and efficacy are tested. The transition to the next phase is conditional on a positive outcome from the one preceding. Each phase of the clinical trials could end up with a decision to proceed, suspend or terminate the testing. The firm may decide to halt or withdraw its application on financial or commercial grounds, or choose to stop the trials in the light of adverse new information. The regulator can mandate that the trials be terminated at any time if problems arise (Petrova, 2014).

After clinical trials have been completed successfully, firms can file for marketing approval. The critical decision to go to market is essentially outside of the control of pharmaceutical companies. In many countries, market approval for a new drug ultimately is regulated by a government agency entrusted to exercise regulatory control over the pharmaceutical industry (Petrova, 2014).

After successful market authorization, pharmaceutical firms negotiate pricing often with other stakeholders such as payers. In Germany, a new drug needs proof of a benefit to any existing drug on the market, before it is allowed to enter the market. The added value is proposed by the pharmaceutical innovator and reviewed by the Institute for Quality and Efficiency in the Healthcare Sector (IQWIG). These reviews play a critical role in the price negotiations of the drug. In the first 12 months, the pharmaceutical firm can freely set prices. Beginning with month 13, the negotiated price discount is binding.

During the phase when the drug is up-scaled for manufacturing and distribution, quality issues and consumers’ safety are priority issues. Supply chain security is one aspect that has recently won attention when the Drug Supply Chain Security Act has been implemented in the US under Obamacare to ensure the traceability of the medicinal product along the supply chain. After successful implementation, the Act enables verification of the legitimacy of a drug, enhance detection of illegal drugs and facilitate recalls of a drug.

Arbitrage opportunities, such as parallel trading, are another aspect often discussed in the pharmaceutical arena. Parallel trading emerges from differences in the price of pharmaceuticals across countries (Danzon, 1998; Kanavos et al., 2005). By repackaging the product in a country with a lower price and reselling it to a country where the price is higher, arbitrage opportunities occur. Pharmaceutical manufacturers lose on profitability, dis-incentivizing future innovation.

Use case: pharmaceutical supply chain and the counterfeit drug problem

Supply chain security is one aspect that has recently won attention, when the Drug Supply Chain Security Act (DSCSA) has been implemented in the U.S. The Act has been implemented amongst other things to fight the counterfeit drug problem. Counterfeit drugs are drugs that do not contain the active ingredients they are supposed to and consequently can harm patients. The World Health Organization (WHO, 2010) estimates worldwide sales of counterfeit medicines to $75 billion in 2010, a 90% rise in five years. According to the WHO, in more than 50% of cases, medicines purchased over the Internet from illegal sites concealing their physical address are counterfeit drugs. Even lifesaving prescription medicines for cancer and serious cardiovascular diseases are being sold to consumers (WHO, 2010). Counterfeit drugs are motivated by the potentially huge profits and especially developing countries are targets because the cost of legitimate drugs IS often beyond the reach of much of the population (WHO, 2010). The overall death toll attributable to counterfeit medicines, like the scale of the business, is unknown, but the costs to public health are huge, since apart from death counterfeits can cause resistance to medicines (WHO, 2010).

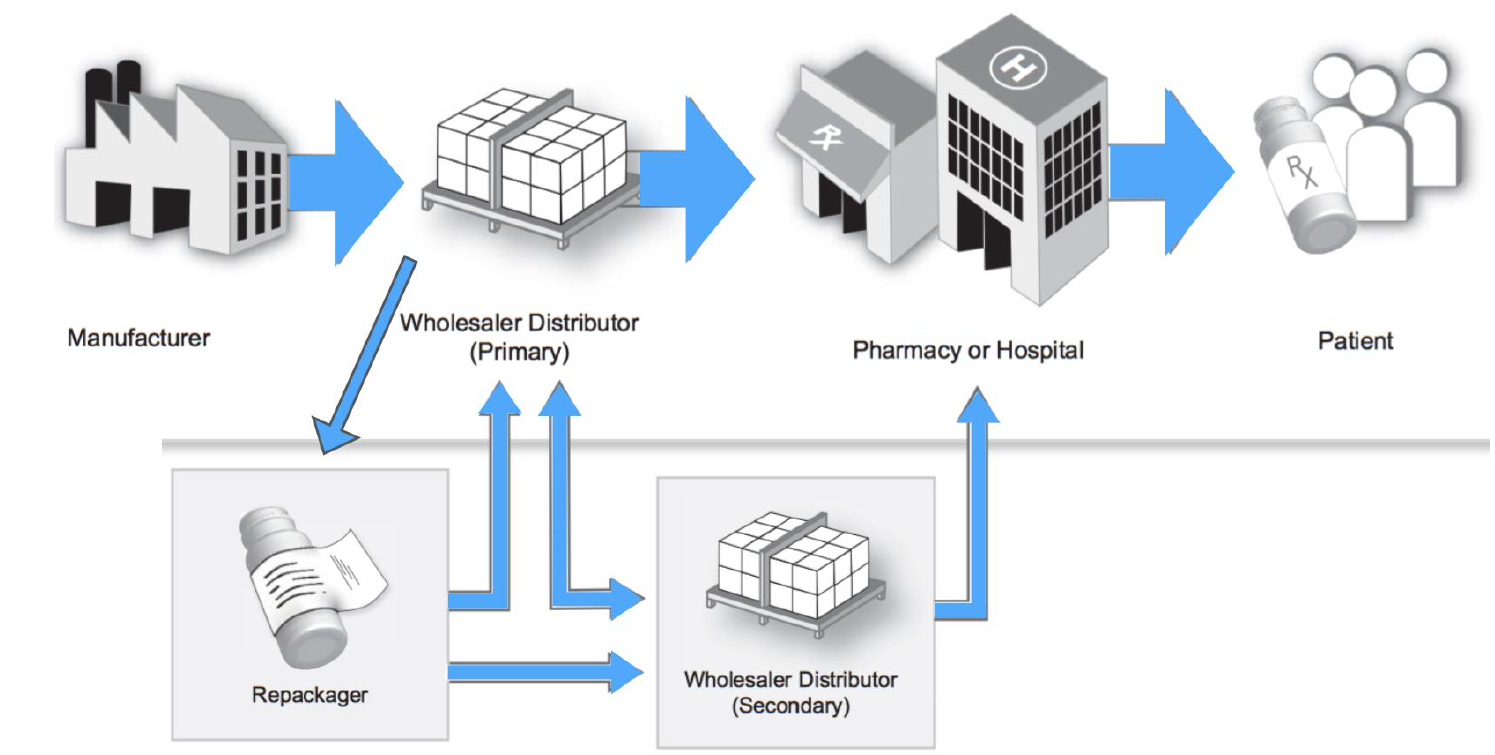

The supply chain in the pharmaceutical industry is complex, with drugs changing ownership from manufacturers to distributors, repackagers, and wholesalers before reaching the customer. There is little to no visibility for manufacturers throughout the supply chain to track authenticity. Consequences include the counterfeit drug problem and inefficient processes for conducting recalls and returns processing. These inefficiencies result in financial losses and loss of trust with consumers.

The blockchain could be an opportunity platform to increase trust and transparency, with customers being able to track pharmaceutical products throughout the supply chain. The packaging of a drug could be scanned by a bar code anytime, the drug changes ownership. Only trusted parties are granted access to write on the blockchain. The record is delivered on the blockchain in real time. Manufacturers and end customer can scan the bar code and see the history. Optimally, the platform ensures drug identification, tracing, verification and notification in case an illegitimate drug is found.

Implementing the prototype: LifeCrypter

LifeCrypter is the prototype we developed. The goal was to show the benefit of the blockchain technology and to illustrate how this prototype can guard patient lives with a patient-empowering blockchain solution.

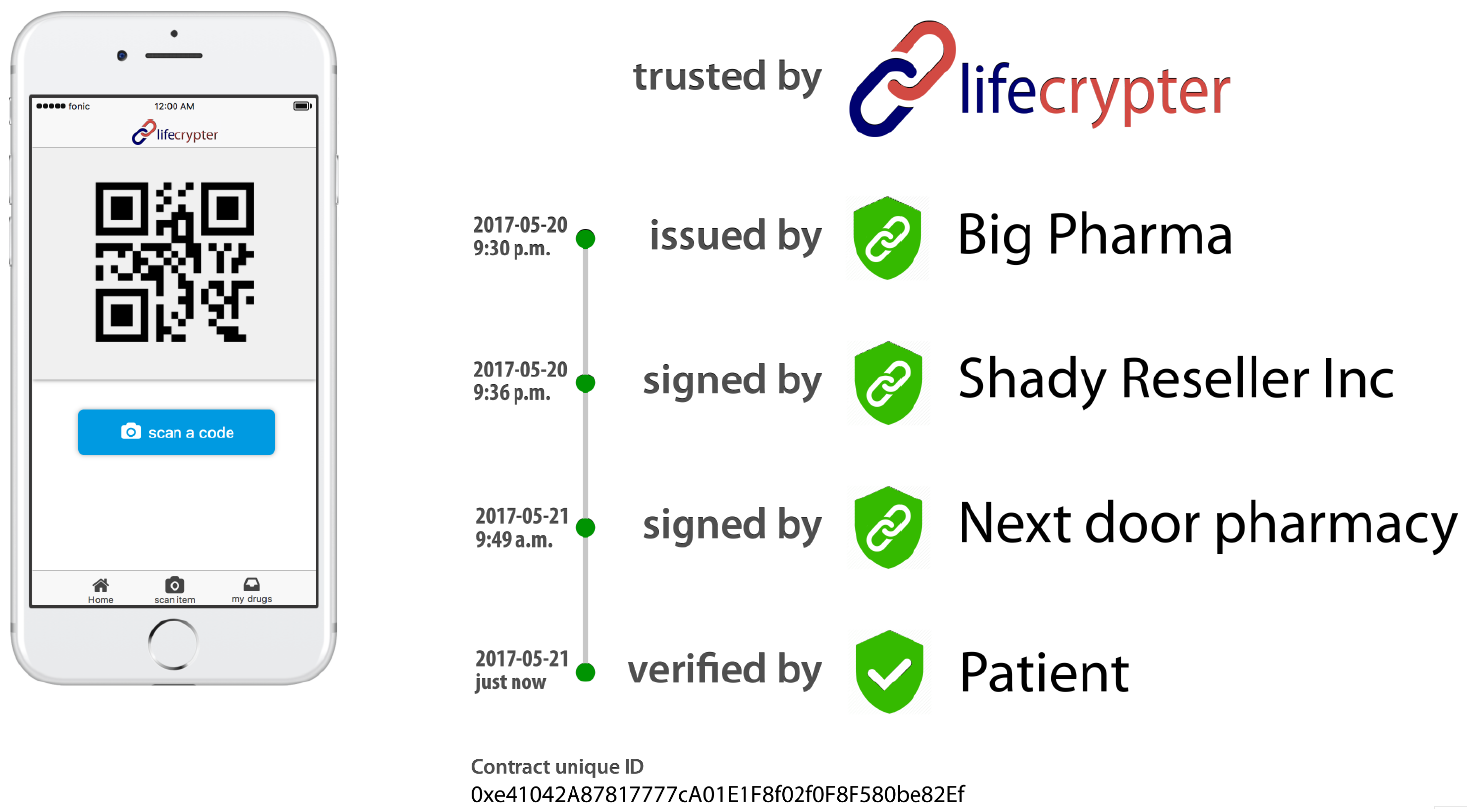

Figure 2: Smart contracts provide integrity, traceability and transparency (Based on U.S. Department of Health and Human Services, 2017, A Drug Supply Chain Example)

With LifeCrypter, we envision an elegant blockchain solution that brings integrity, traceability, and transparency to the global drug supply chain.

Our product empowers patients around the world with an easy-to-use app that traces each item of medicine throughout its trade history to largely “disincentivize” the distribution of counterfeit drugs.

In our solution, each item of medicine is attached with an unambiguous identification tag, which allows for virtual and physical ownerships to be transferred from the upstream suppliers to the downstream consumers, in parallel, through a trusted network verified by smart contracts on a blockchain and the global drug supply chain at the same time. The smart contract enables free and trustless trade for all parties involved, with the capability to introduce rules for trades that are at all stages transparent and self-enforcing.

Figure 3: Tracking the supply chain of a drug

In fact, worldwide over 100.000 lives are lost annually due to the effects of counterfeit drugs. They account for about 10% of the global pharmaceutical market share, that is, over $200 billion loss each fiscal year in the pharmaceutical industry.

By implementing our solution under the support of the blockchain technology, pharmaceutical supply chain stakeholders are enabled to considerably increase their efficiency during the process of distributing verifiable drugs all over the world; whereas patients stand to profit by being enabled to independently verify products via the end-point solution — our easy-to-use app.

Another use case: information asymmetry and abnormal returns in pharmaceutical R&D

The Blockchain technology offers further fields for application along the pharmaceutical value chain. Pharmaceutical R&D is a major source of information asymmetry between firms and investors and among investors themselves. Information asymmetry captures the problem that firms internally know more about their strengths and values than outside investors on the capital markets.

The R&D progress is a complex procedure, making it difficult for investors to derive information: First, the absence of reliable information creates uncertainty with investors and asymmetric information, which complicates valuation (Himmelmann, 2009; Aboody et al., 2000; Oriani et al., 2003). Second, many R&D projects are unique to the developing firm with little comparability across companies for the investor (Aboody et al., 2000). Third, there are no tradable markets for R&D (Aboody et al., 2000). Fourth, reporting rules treat R&D differently from other investments (Aboody et al., 2000). R&D expenditures are usually expensed immediately, even under international accounting standards (Leibfried et al., 2004). IAS 38 allows for a capitalization of intangibles if there is a substantial probability of future benefits. The drug development process is characterized by a high degree of uncertainty and, thus, pharmaceutical companies often are unlikely to qualify for that regulation (Himmelmann, 2009).

Other investments are capitalized and impaired in subsequent periods. Hence, investors obtain beliefs of the management about any value change of the asset, which they in turn can incorporate into their valuation. An immediate expense of R&D deprives that information from the investors. Consequently, information asymmetry between managers and outside investors likely arises (Aboody et al., 2000). Information asymmetry is apparent in various industries, but it is arguably strongest in companies in the pharmaceutical sector and a potential driver of abnormal returns of up to 4–6% annually (Schöner, 2017).

In the early research phase, funding from investors is critical for successful drug development. Abnormal returns may adversely affect funding opportunities. One potential opportunity to increase information access to investors in the early research phase, while at the same time keeping track of ownership of proprietary information, could be the management of the early innovation process via the blockchain. Trust and integrity between several stakeholders, such as research companies and investors, is established through active collaboration and clever coding (Tapscott et al., 2016). Blockchain technology can increase effectiveness and transparency in the early research phase (Zhong et al., 2007). The blockchain ensures information exchange and flow across different processes of the innovation stage. Transaction costs occurred by contractual issues related to confidentiality (Tapscott, 2016) can be minimized. In real time, information is visible to the regulator and funding parties, reducing information asymmetry and potentially reducing abnormal returns.