Ready to learn Blockchain? Browse courses like Blockchain for Finance Professionals developed by industry thought leaders and Experfy in Harvard Innovation Lab.

Why is consent the key to the future of cryptocurrency

The Origin of Cryptocurrency

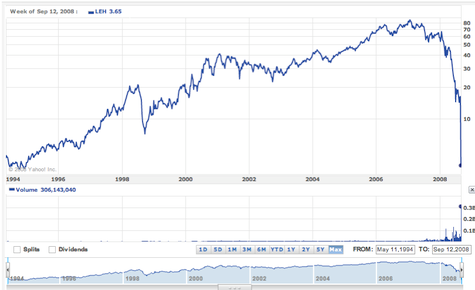

An important date in the history of cryptocurrency is September 15th 2008. This is the date that Lehman Brothers collapsed, the largest bankruptcy of all time at over $600B USD in balance sheet.

Notably, October 31st 2008 was the date of the publication of the Satoshi Nakamoto Bitcoin White Paper.

The <title> tag on the bitcoin.org web site is “Open Source P2P Money”

Consensus and Consent

At the heart of the Bitcoin Blockchain is the Nakamoto Consensus algorithm. This is the heart of everything revolutionary in cryptocurrency — a mechanism that makes it thermodynamically impossible and economically impractical to lie. According to the rules of Bitcoin, every single ledger entry contains the truth.

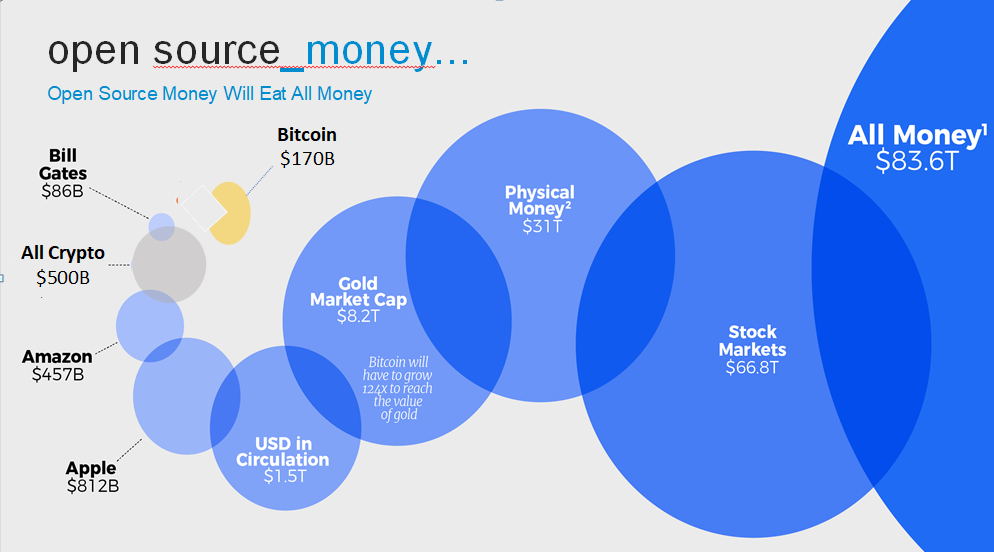

Open Source Money

The implications of an open source money go far beyond just software developers. Over the past 25 years open source software has become the platform for the entire software industry.

Software is eating the world. — Marc Andreesen

We know that Software is eating the world. But what we have observed is that open source software eats software.

How Open Source Software Eats Software

Open Source Software eats all other software by competing for consent. There is over a trillion dollars of licensed software value sitting in GitHub that anyone can use for free. Open Source software doesn’t mean free software. It means you can read the source. So how did free open source software dominate? One word: consent.

The entirety of open source can be viewed as an evolutionary matrix that feeds on one source of energy — consent. If there are two software packages that are functionally identical, the one that costs nothing will beat the one that has a cost.

Externalities

Financial costs are not the only form of cost. Economics defines the term “Externality” as a cost that is paid without consent. Unfortunately, the global economy is full of externalities. The reason why I cited the collapse of Lehman Bros as an important date in the history of cryptocurrency is not merely the chronological coincidence that the Bitcoin White Paper was release a month later — rather that the collapse of Lehman marked the day that the rules that underpin our centralized financial infrastructure were irrevocably broken. We live in a post Lehman world, a world where all the king’s horses and men cant put Humpty Dumpty back together.

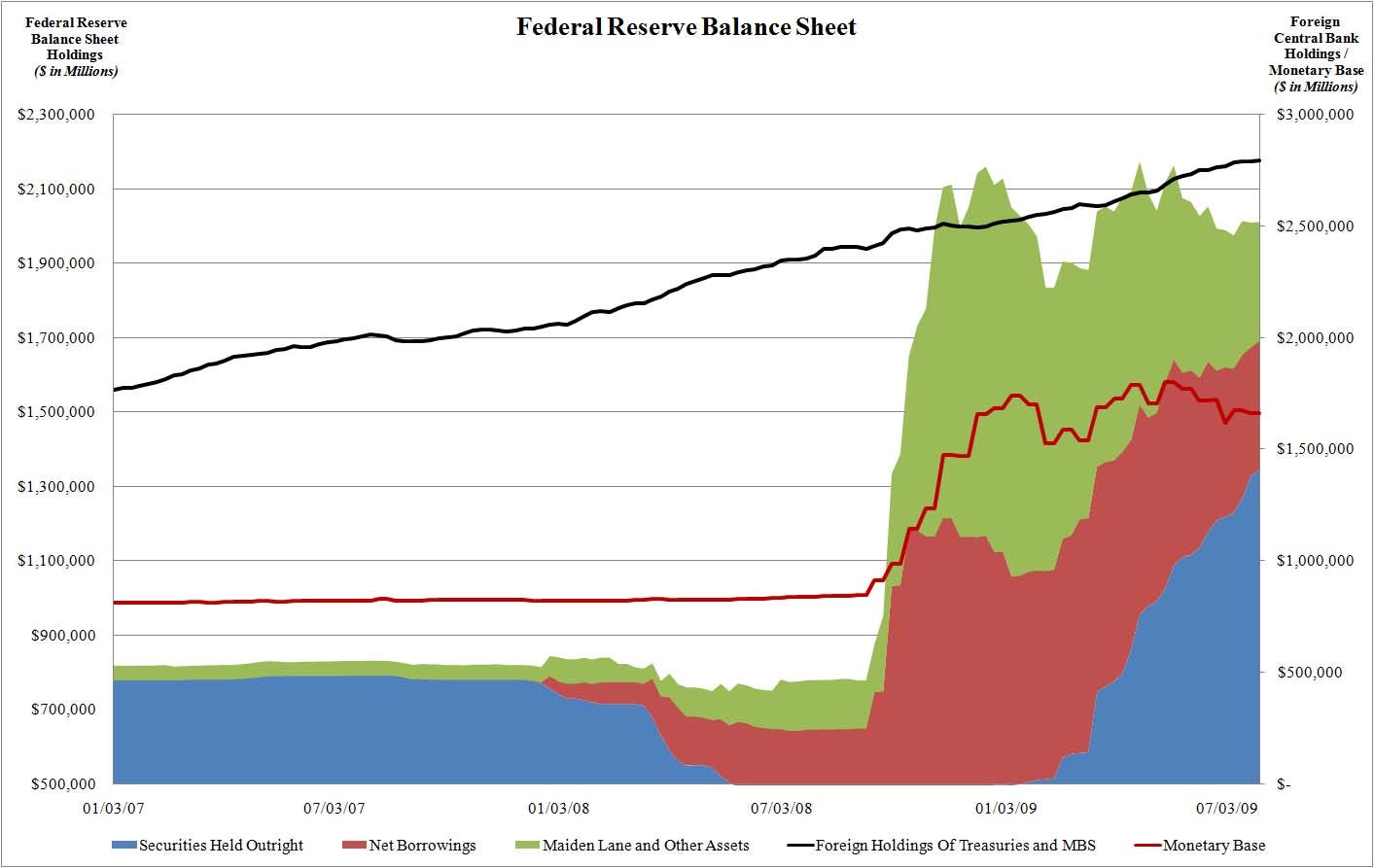

Can you see September 2008 on the Federal Reserve balance sheet chart below?

Too Big to Fail and Consent

What does this have to do with consent? The big banks and the government have set up a system that some call “privatized profits, socialized losses.” What happens is that banks take exorbitant risks with toxic assets like credit derivatives and the resulting collapse is paid for by taxpayers in the form of inflation (money printing), negative yielding bond sales, Toxic Asset purchasing and the printing of trillions of dollars of fake money IOUs. We didn’t consent to buy these toxic assets, we were forced into an unwinnable situation. Now we have an ever-expanding debt load that places thousands of dollars of debt and a ruined global ecosystem on the next generation. These are very large externalities.

How Open Source Money Will Eat All Money

Open Source Money will eat proprietary money automatically. How can I assert this? Simply because it competes by its nature for user and developer consent. If there are any externalities, developers will eliminate those externalities and users will vote with their feet. They will move towards the systems that serve and benefit them.

So What’s Stopping Us?

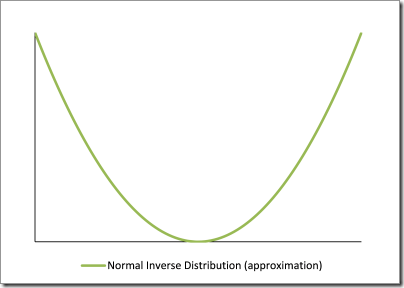

One of the biggest things I’ve noticed in cryptocurrency is that it seems to attract an inverse normal distribution of people.

On the lower end of the graph are people willing to break consent.

When Consent Breaks

I mentioned that Nakamoto Consensus creates a situation where according to the rules of bitcoin, every single ledger entry is true.

The problem is that people can manipulate the rules of Bitcoin to break consent.

According to the rules of Bitcoin, the transactions are immutable and irreversible. This means that people can be tricked into sending bitcoins to the wrong place. This rule is easily exploited through mechanics like phishing, spear-phishing and other tricks that replace legitimate addresses with those of hackers.

Another rule of bitcoin that helps hackers breach consent is that the owner of the private key is the owner of the wallet. This rule is exploited where private keys are stolen or users are tricked into handing over their private keys.

One insane thing people continue doing is handing their private keys over to custodial exchanges. Almost all of the most popular exchanges in the world for cryptocurrencies are custodial exchanges. According to the rules of bitcoin (and every major cryptocurrency also) that means that if you put cryptos on a custodial exchange, you no longer own those cryptos. Shocking how few users understand this, and this is the root cause for the biggest hack events in the history of cryptocurrency, and in fact the largest thefts in human history. I write more about custodial exchanges here.

A Culture of Consent

One of the things that strongly distinguishes people in the cryptocurrency movement is how they deal with consent.

If you care about consent, the safest thing to do is to ask every time.

I see a lot of bad actors in cryptocurrency playing with consent. This is not even restricted to the extreme cases like kidnapping or the use of physical threats or force, or use of hacking or phishing.

Fake Speakers at Events

One place where I see bad actors playing with consent is crypto events putting the faces and names of speakers on their website to promote their event without confirming that those speakers are actually on board.

Simply put, this is lying.

To protect the community from this kind of behavior, one way anyone can help is simply to confirm directly with the speaker and ask them “are you speaking at this event?”. If you are going to an event to meet or to see a specific speaker, please reach out directly to them. The problem with letting events get away with this kind of behavior is that you end up putting money in the pockets of people who play with consent. This is not ok.

Fake Advisors

Another area where I see bad actors playing with consent is Fake Advisors. I have at least 10 incidents where my image, name and title were placed on a website claiming me as an advisor.

My personal policy is that I won’t allow my likeness, name and any organization I am affiliated to be used on a web site without a signed agreement. In limited cases I am willing to permit this activity ahead of a signed agreement, but in all cases I require consent.

Perfectly Nice Guys (PNGs)

One of the things I’ve seen that I feel bad about are clean-cut, business-like folks who are playing with consent. One person who had put me on their web site without my consent was defended by someone as “I met with them and they seemed human to me.”

Seeming human isn’t enough.

In multiple cases people who I had actually met with jumped the gun and put me on their materials including press releases, web sites and slide decks without my explicit consent. They were often “Perfectly Nice Guys” (PNGs). I use the term “Guys” because in every single case where my consent has been abused, it has been by a male. Maybe women have a better understanding of consent given that some of the most important consent work comes from movements like #MeToo where there are primarily women leaders.

What can I do?

What I suggest people do is ask every time. And not just people running events and ICOs, but investors. If you are planning to invest in an ICO and you see an “advisor” you should directly reach out to that person and ask “are you really advising this ICO?” If the answer is “no” then you should withdraw support for the fraudulent ICO and you should warn everyone about this violation.

Building the Culture of Consent

One of the most exciting things about cryptocurrency is that the future hasn’t been written yet. We are all creating this movement together. Ƀrock Pierce said at Block Con in Santa Monica that there are no competitors in Cryptocurrency, only our friends who work on other “forks”. But he amended this statement by saying that people without integrity were competing with everyone. Let’s all do our best to build the culture of consent. The future of cryptocurrency, the future of open source money, and therefore the future of our financial infrastructure depends on it.

How NOT to behave if asked to remove a speaker from your web site

Here’s how not to behave after you put someone’s image, name and title on your web site without their consent:

Blockconf Australia

Hi Miko,

Please read the website carefully and thoroughly, there is a placeholder below the speaker list explaining that attendance of speakers are not guaranteed, we only claimed that we are negotiating with these speakers, (redacted) is also aware of this conference, please stop emailing us, we already removed your name from the website, next time and think first and then send threatening email.

Thanks,

Ines

And then:

Blockconf Australia

2:14 PM (1 hour ago)

Get a life man, if you have time to waste I don’t, I said we removed you, if you have any other problem email my manager, I am not owner of this conference.