People are experiencing actual or anticipated financial hardship during COVID-19 — people losing their jobs, work dries up, retirement and other investments lose a large proportion of their value, or people are concerned about being made redundant.

With so many people out of jobs or work during this crisis around the world, many are now thinking about alternative ways of gaining an income after they have registered for unemployment benefits in their own countries if they qualify. Some are even looking at starting online businesses or freelancing to earn some money.

If you already have lost your job, here are some things you could do now

- Talk to family and friends so that you can vent and let go of these emotions. Allocate some days to vent and then move it. It is not your fault. Don’t beat yourself up for not having a job right now.

- Pursue your hobbies and doing what you love is one of many ways to relax.

- Exercise daily so that you can release your emotions such as guilt, anger and disappointments.

- Sleep and eat will keep your body and mind healthy.

- Keep yourself entertained.

- Perform a job that is different from what you usually do like — i.e. be an Uber driver or volunteering your time in the local community centre.

- Upskill yourself with online training or with organisations offering free training.

- Maybe it is a good time to self-assess, pivot to another industry or career by looking at other opportunities — something you have always wanted to do.

- Talk through your options with professionals who are not your family and friends to gain an outside or independent perspective.

Possible sources of job

If you do not have a job, turn to the following industries or sectors that may be hiring:

- Shipping and delivery/transportation companies

- Online learning companies

- Grocery, food and convenience stores

- Shipping, delivery and warehousing services

- Telecommunications and remote meeting companies

- Child care/nannying for working parents

- Internet and tech support

- Computer software and hardware

- Cleaning

- Tutoring and homeschooling

- Home improvement and gardening

- Interior design

- Baking and craft

- Pets

- Exercise equipment and personal coaching

- Healthcare, health-related and medical supplies

- Relationship advice

- Career for aged care facilities

- Call takers or customer service.

COVID-19 has caused the worst economic downturn since the Great Depression

The International Monetary Fund’s April World Economic Outlook projects that the global growth in 2020 to fall to negative (-ve) 3 percent, as shown in the graph below. This is a downgrade of 6.3 percentage points from January 2020, a major revision over a very short period.

“COVID-19 has caused the worst economic downturn since the Great Depression”

This makes the Great Lockdown (of COVID-19) the worst recession since the Great Depression and far worse than the Global Financial Crisis

Pre-COVID-19 economies were week anyway

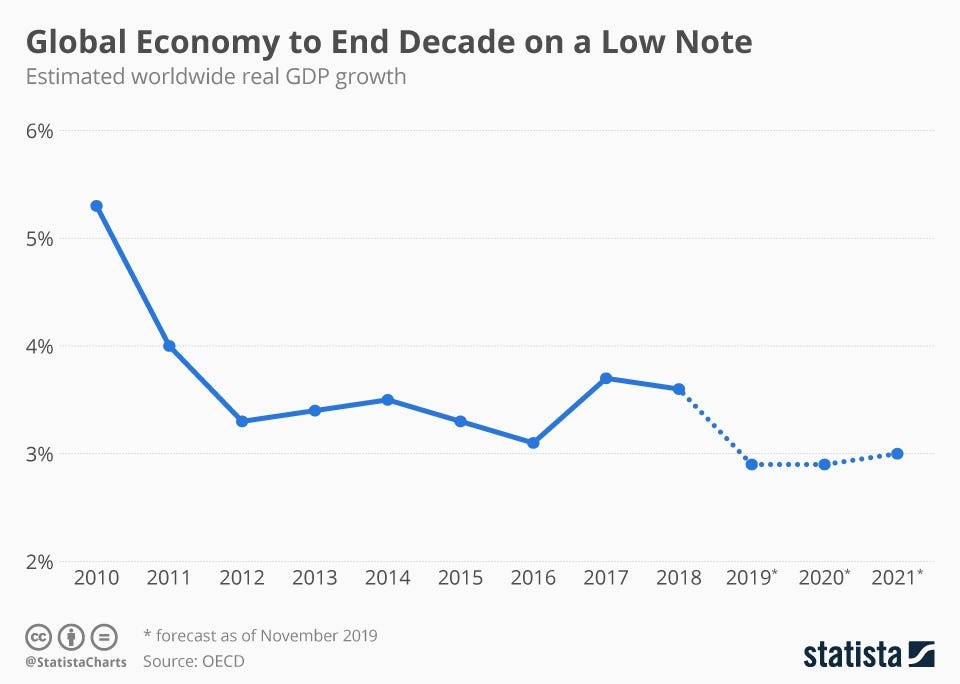

According to the OECD’s latest Economic Outlook, the global economy was to grow only 2.9 percent in 2019, the lowest rate of growth since 2009.

Despite starting off on a positive note, with more than 5 percent growth in 2010 in the aftermath of the financial crisis, it’s been a decade of meagre growth for the world economy.

Declining GDP

Inhibited by political uncertainties, trade tensions and lacklustre demand in some major economies, global GDP growth hovered between 3 and 4 percent for most the decade before (expectedly) dropping below 3 percent for the first time in 2019.

The OECD was cautious in its outlook for the coming years as well, expecting 2.9 percent growth for 2020 and a minimal improvement to 3.0 percent for 2021, as shown in the graph below.

Declining potential growth

Potential growth in the advanced economies has declined steadily since the mid-1980s. The decline was interrupted in the late 1990s and early 2000s, as shown in the graph below.

This decline had accelerated during the global financial crisis because that crisis had long-lasting economic effects. Although potential growth has picked up a little since 2013, it is currently only around half its rate in the mid-1980s.

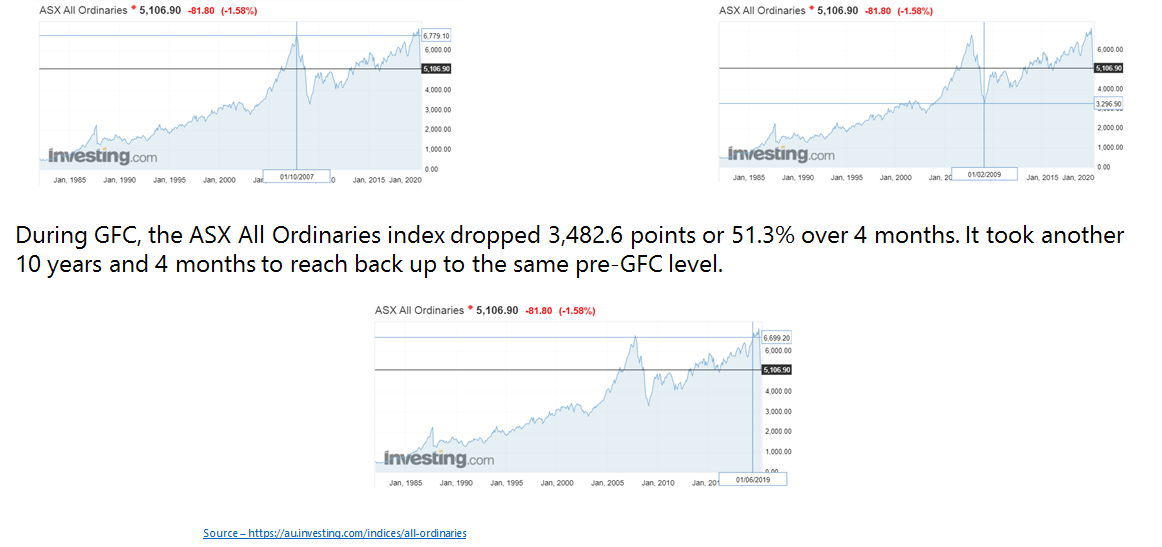

Countries like Australia took 10 years to recover from the GFC, as represented by the ASX All Ordinary Index, as shown in the graphs below.

Declining average hours worked by workers

There is also a decline in the average number of hours, as shown in the graph below. This is because females and older workers, whose participation has increased, are more likely to be in part-time employment.

Lower wage growth

The increase in the number of jobseekers due to population growth in a number of countries has led to a decrease in the average hours worked, as shown in the graph below.

This has also subdued wage growth across many advanced countries below an average of 3.12 percent.

Where to from here … the future of work post-COVID-19 will be bleak for many people

This pandemic crisis will invariably prompt deep and unexpected shifts in economies and lives where there will be greater acceptance of government interventions in all areas of life.

Attitudes towards globalism, borders, retailing and immigration have changed or will be transformed.

Those who are anticipating a return to pre-pandemic normality may be shocked to find that many of the previous systems, structures, norms and jobs will disappear and will not return.

The ‘new’ normal will be very different from the ‘old’ normal.

“The mother of ALL crisis”

The world recession triggered by COVID-19 will very likely be much worse than the financial crisis and the two depressions put together — perhaps this will be “the mother of all crisis”.

It will not be a ‘normal’ recession (or depression) where there is the death of many businesses with millions of people becoming unemployed at the stroke of a pen.

This is the tipping point for an already weak global economy that has been struggling for a very long time leading up to COVID-19.

Customers are not spending

The global retail industry is experiencing an unprecedented crisis in the wake of COVID-19. Consumers are staying home and tightening their spending as they face uncertainties related to their health, wealth, and jobs.

Consumer spending drives the economy. When spending stops or decreases, so too will the economic activity. The unintended consequences will be dire.

Even if we are allowed to leave our homes tomorrow, customers will be not be spending their money immediately or anytime soon. They will be waiting to see what happens.

Economies will not be immediately bouncing back to pre-COVID-19 levels. It will take months to restart the economy, enhanced by the recession that is to come.

Governments doing whatever it takes

Governments have promised to “do whatever it takes” to keep their economies from collapsing. This means that new approaches and tools are being considered. It includes Universal Basic Income or a universal income floor.

Debt levels will significantly increase on top of the already high debt level pre-COVID-19. Governments have no other choice but to borrow larger amounts of money to support businesses and the unemployed.

The cynic may ask, “Are we throwing good money after the bad?”

Some governments are being urged to fast-track infrastructure projects to create jobs and support their ailing economy. But economists have cautioned policymakers against approving new projects that offer little value to the community besides a short-term lift in employment.

Forget about productivity and wage growth

Government economic priorities and language will likely shift away from productivity and surpluses towards employment and ensuring a basic safety net for all.

With productivity growth already declining pre-COVID-19, we can only see a further free-fall in productivity and GDP growth. This will inevitably lead to the lowering of wages and average working hours for many workers.

Future generations will have to pay for the enormous “do whatever it takes” price tag

Younger generations will, unfortunately, have to bear much of the cost of the crisis in future years.

But we must remind ourselves that debt is essentially using tomorrow’s money today or spending tomorrow’s income today. We are borrowing to sustain our lifestyle today.

It will take more than 2 to 3 generations to pay down the already record levels of government debt pre-COVID-19, in addition to this “do whatever it takes” price tag.

The downward spiral has already begun

Lower wages and productivity, and higher taxes and cost of living will only accelerate significantly. This will significantly impact all future workers and the future of work.

Our children and grandchildren will have less discretionary money to spend, suppressing consumer demand even more.

When this occurs, more businesses will close down and fewer people will be employed. This will cause higher unemployment requiring more government intervention and financial support. This will only lead to higher debt incurred.

Income inequality increase

The crisis may exacerbate income inequality even more.

Warren Buffett’s famous saying is repeating now — “Be fearful when others are greedy, and be greedy only when others are fearful.”

When everyone around you is in a panic, acting on this means that people with financial resources will now buy or invest when prices drop and sell when prices rise again.

Thanks to the pandemic, investor fear is running rampant. It’s not that investments feel riskier these days, but that things feel more uncertain.

Rise of remote working and the demise of offices and urbanisation

The crisis has presented us with an opportunity to re-evaluate our lives, our priorities, and working practices.

Working remotely at home will become the norm rather than the exception.

This may cause a lesser demand for commercial real estate. Things related to working from home including the value of the residential real estate and interest for at-home telecommunications, fitness and dining will only increase.

People may even move away from cities and into the suburbs and countryside. This can have a win for the environment.

Lifestyles will significantly change

The crisis is accelerating major changes in how we live and interact online or with each other. It will impact our lifestyles significantly.

Organisations that can function effectively with a remote workforce will close offices to save costs. Office workers will be reluctant to resume that commuting lifestyle.

Worklife balance will take more prominence.

Reconfiguration of business models and organisational structures

The economic impact caused by COVID-19 will clearly affect some sectors (e.g. hospitality, tourism) more than others (e.g. logistics, farming, healthcare).

There will be rapid pivoting or changing of business models (e.g. food wholesalers moving from restaurant supply to home delivery) and reconfiguration of service delivery models (e.g. supply chains, manufacturing).

Remote working has also created many distributed organisations and alternate governance and control systems to support it. New services will be required to support these changes.

Acceleration of labour-replacing automation

Organisations will take this opportunity to accelerate their use of labour-replacing automation and artificial intelligence. There will be fewer jobs available in the future due to increased automation.

Businesses can easily do so now when the cost of borrowing money has decreased significantly due to historically low interest rates and increasing minimum wages due to government intervention and labour union lobbying.

‘Acts of God’

Organisations can conveniently use ‘force majeure’ or ‘Acts of God’ as a legal defence for delaying or cancelling projects, which may impact the employment of workers.

Employment contracts, especially for potential hires, may also be put on hold, leaving hopeful candidates without a job.

Changing job markets

Many jobs that disappeared during the pandemic will not return. Existing jobs will likely be transformed or evolved into something different.

Just as water seeks its own level, people will have to transition into new in-demand sectors and jobs. New skills will be required. New ways of training and developing workers will be demanded.

Education institutions and training organisations must pivot and adapt their approach for this transition.

Educational inequality will only increase

Home-schooling and alternative schooling and teaching methods (e.g. AI remote teaching, virtual classroom environments) will persist.

This may increase educational inequality as some students may not receive adequate home-schooling or may fall out of the education system altogether.

Students from disadvantage families and communities will be put at risk.

Impact on wellbeing

The crisis is creating both positive reactions (e.g. closer family connections, stronger friendships, caring communities) and negative (economic impact, strained relationships, divorces, domestic abuse, inactivity).

Millions of workers will suffer more mental health issues due to working from home, feeling isolated and stressed, and being unemployed for long periods of time.

Underfunded health systems will not be able to cope, especially when government funding cuts start again post-COVID-19 to pay down debt. Healthcare workers will suffer and many will leave the profession, leaving a big gap to fill.

Social unrest

There will be a significant impact on the most vulnerable — e.g. those in precarious employment, homeless, single-parent families, people with disabilities.

The crisis will hit the poor much harder than the better off. It exacerbates pre-existing conditions of inequality. Before long, this will cause social turmoil, up to and including uprisings and possible revolutions.

Novel solutions emerging requiring new skill sets

Novel solutions to combating mental illness, boredom and social isolation will emerge. This includes permanent changes in the way we use digital solutions and models of distributed governance.

There will be increases in digital government, online delivery of public services, electronic voting, telemedicine, digital trust and currencies, and mass online learning and teaching.

Workers need to acquire new skills and competencies to adapt to the emergence of new technologies and solutions.

Hopefully, legal and regulatory barriers for adopting new technologies and innovations will also fall.

Cyber-crime increases

Cyber-crime will only increase when immature technologies are being rushed into service or people become complacent. This will expose weaknesses in the technologies used.

People and systems will become more vulnerable.

Exposure of fraud and corruption

Economic booms can help fraudsters cover their cracks — from fictitious investment returns to exaggerated sales. But slowdowns and recessions can rip the covering off.

The crisis will see more fraud and corruption being uncovered, possibly impacting organisations and workers. It may also cause their demise.

A decade before the crisis of 2007–09 the dotcom crash exposed accounting sins at Enron and WorldCom perpetrated in the late 1990s. Both organisations went bust soon after together with many job losses.

Personal privacy impacted

As more people are voluntarily surrendering their personal data for the common good (i.e. contact tracing), issues related to surveillance, censorship and personal data will become more prominent. The use of drones, mobile phone positioning, and facial recognition will be more common.

The rights of workers will be compromised.

In summary … the solutions to future-proof yourself

The emergence of COVID-19 has and will change the world permanently and profoundly.

There will be vast political, economic, social, technological, legal and environmental consequences which will last for many decades impacting many future generations.

What’s your response? What choices are you going to make?

Knowledge is only potential power if you do not take action to mitigate the negative impacts.

If you do not have a job now, get the necessary support and reach out for help. Network rigorously and seek out potential job leads and recommendations. Update your resume and LinkedIn profile.

While seeing news of layoffs can be disheartening, it is important to remember that there are employers out there who are hiring.

If you have a job, try to keep that job by adding more value to your employer. Forget about asking for a pay increase. It is not the time to be complacent — as the saying goes, we do not plan to fail but fail to plan for the inevitable.

Don’t wait until things are dire to take action. Updating your resume and collecting a few recommendations now can save you hours or days in the event that you do need to job search. This can give you a head-start if you’re part of widespread layoffs during an economic downturn.

And don’t act like the recession won’t touch your industry. Being blindsided can be a bad thing to happen to you.

It is now a difficult operating environment for organisations

Organisations are now operating in very difficult and challenging business environments. Increasing operational costs and decreasing profit margins are pushing organisations to the brink of bankruptcy or financial ruin.

Business and service models are continuously pivoting and changing. Organisations must be agile to adapt or they will perish.

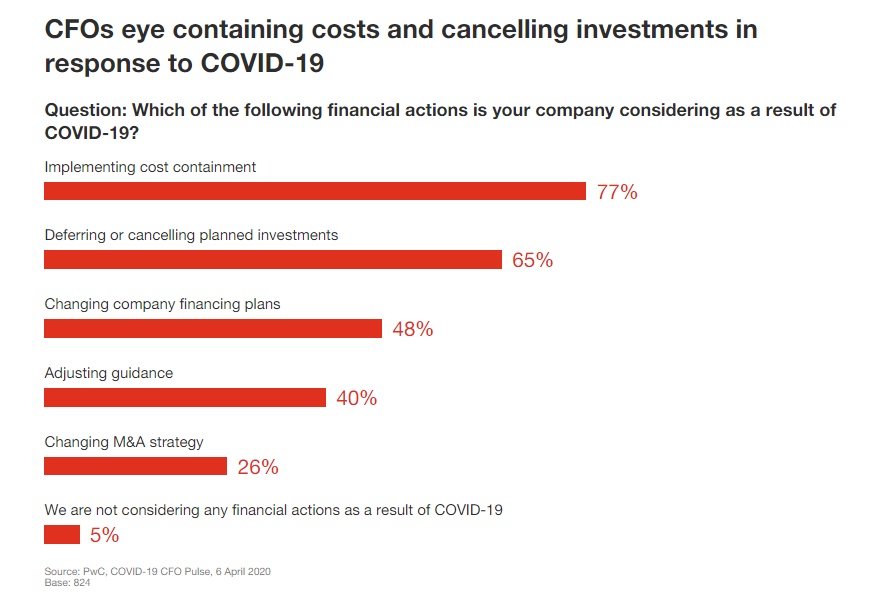

Cost-cutting will be the first item on the ‘to-do list’. When salaries make out a large portion of the cost, many workers will feel vulnerable and very anxious about their job security.

When times are good, ineffective or unproductive workers can still be absorbed as part of the overall payroll cost. But when operating cost must be reduced, the performance of every employee and worker will be put under the termination microscope.

Are you performing in the top 20 percent?

The Pareto principle tells us that only 20 percent of the workforce produces 80 percent of the organisational results. Therefore, organisations will only need to keep 20 percent of their current workforce in order to survive.

The bad news for many workers and job seekers is that most CFOs surveyed internationally by PwC will be considering implementing cost-containment measures (77 percent) and deferring or cancelling planned investments (65 percent), as shown in the graph below.

Employers will only pay for the actual value created

Here is the thing. When you buy an item from a shop, you exchange money or the price paid for the item purchased. Value is what a customer gets in exchange for the price paid. Raising or lowering the price of the item does not change the value of that item.

Rather, it changes the customer’s incentive to purchase that item — i.e., the difference between value and price equals the customer’s incentive to purchase.

In the workplace, the price paid by an employer is the employee’s salary. In return, the work that is performed by an employee is the value that is given in exchange for the salary received.

When the value given or created by the employee for the employer is much greater than the salary received, there is an incentive for that employer to continue keeping that employee on its payroll . There is employment and job security for that employee.

So, are you creating value for your employer?

The key question to ask is, “Are you creating more value for your employer than the salary you are currently receiving?”

If your answer is “No”, then your job is not secure.

Also ask yourself this question, “Are there cheaper alternatives in the form of lower-paying colleagues or new hires who can provide the same value that is the same or similar to you?”

If your answer is “Yes”, then your job is not secure.

The bottom line is that you can be made redundant easily when your employer needs to cut more cost from its operating expenses and save the organisation from financial ruin.

Therefore, to prepare well for post-COVID-19 and to remain continously in employment, workers must be able and willing to create or give tangible value that is well above and beyond the price paid by their employers for their services that is in the form of salaries or wages. Value creation will be the key to your future employability.

Remember the 3Cs — courses, community and coaching

Firstly, you must be pivoting and adapting to your ever-changing circumstances by continuously growing, changing, improving, upskilling and upgrading yourself.

This could be done by attending courses and training programs — offline or online. There are so many free or low-cost MOOCs (Massive Open Online Courses) that you can choose from that will give you new skills and knowledge.

Understanding the gaps in your skills and knowledge will go a long way in positioning and branding yourself for future success, thereby securing your future employment.

The newly acquired skills and knowledge will enable you to continuously provide value to your employer. That value created must be well above the salary you receive.

Secondly, jobs of the future will increasingly be found and secured through networking. It will be through the job recommendations of people who you know rather than through job advertisements that will open up doors for future job interviews.

Let’s face it, it is easier for hiring managers to get personal recommendations for potential new hires than spending their time going through hundreds of resumes that look the same. Networking will be your key to your future employment. So, brush up your social skills and get networking in various communities!

Studies have consistently shown that upwards of 80% of jobs are things people find on the so-called hidden job market. Jobs aren’t posted or advertised online. That means that people who find these jobs are being referred by people they know and hear about them in professional networks and communities.

You also need to intentionally give value to the people who may be able to recommend you for future jobs. Having a servant (giving) attitude will go a long way. For example, send them useful research papers via LinkedIn.

Finally, finding or keeping a job is hard work. It is also getting complex and sophisticated. As such, you must have a focused strategy and practical tactics to be successful.

Whether you are at the beginning, middle, or nearing the end of your career, working with a coach or mentor can be beneficial for your short- and long-term career success.

Coaches can help you navigate through the complexities and technicalities of searching, networking and interviewing for a potential job. They can help you with branding and communication through your resume, cover letter and interaction styles. They can significantly enhance your value and short-cutting your job search process.

Success is a choice, survival is a choice

It’s really your choice if you’re going to be happy, healthy, or financially successful.

When you take daily steps toward your goals, your confidence will increase. The belief that you will succeed will grow.

You will change.

And you will succeed.